S Alam took out 86pc of Global Islami Bank’s loans

S Alam Group and its linked companies account for more than 86 percent of the disbursed loans of Global Islami Bank (GIB), one of the six Shariah-based lenders that were controlled by the Chattogram-based business giant.

As of June, Global Islami's total loans stood at Tk 13,880 crore, with S Alam and its linked companies accounting for 86.45 percent of the sum, according to the Shariah-based lender's records.

The loans were taken between 2013 and 2018 from the bank's branches in Chattogram through more than 50 trading companies linked with the S Alam Group, The Daily Star has learnt from officials of the bank who are involved with identifying the bank's exposure to the conglomerate.

Established in 2013 as NRB Global Bank, the bank soon came under the grip of S Alam Group, whose chairman Mohammed Saiful Alam is a close collaborator of the deposed prime minister Sheikh Hasina. After the fall of her government last month, the Bangladesh Bank reconstituted the board.

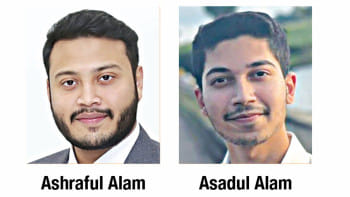

From the preliminary investigation, it has been identified that 85 percent of GIB's loans were taken by S Alam and its affiliates companies, said Mohammad Nurul Amin, the new chairman of GIB.

More information will be available after the independent audit.

No new loans were disbursed to the group or its affiliate companies after 2018 but the tenure of the previous loans were extended, he said.

"We are trying to reach them to recover the funds."

On paper, GIB's defaulted loans stood at Tk 327.12 crore, which is 2.36 percent of the total outstanding credit as of June. But the actual amount of bad loans is higher, Amin added.

Meanwhile, a central bank inspection report found that more than 80 percent of the bank's loans were disbursed from the Chattogram division. The majority of the funds were disbursed through Chattogram's Khatungonj branch, BB report showed.

The Khatungonj branch lent Tk 1,250.16 crore to eight trading companies linked with S Alam Group: Tk 151.87 crore to Green Expose Traders; Tk 163.23 crore to Epic Able Traders; Tk 160.94 crore to Momentum BG: Centre; Tk 136.68 crore to Monir Trade International; Tk 168.50 crore to Masum Trading House; Tk 161.58 crore to Hossain Traders; Tk 163.82 crore to Dominion Karpa; Tk 143.54 crore to Chowdhury and Hossain Trade, said a senior official of the bank seeking anonymity.

The bank, however, became mired in irregularities within years of its operation. In 2015, it appointed Prashanta Kumar Halder, popularly known as PK Halder, as its managing director.

Halder, said to be a close associate of Alam, amassed hundreds of crore from several non-bank financial institutions (NBFIs), which he laundered abroad.

The Daily Star could not reach Mohammed Saiful Alam, the chairman of S Alam Group, at the time of filing the report.

Contacted, Subrata Kumar Bhowmik, executive director of the business group, told the newspaper that he is not in the position and does not have such information as well.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments