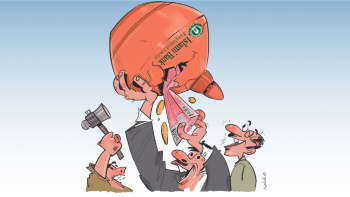

The robbing of Islami Bank

For the first time, we have directly heard from the former managing director of Islami Bank that he was forced to resign from his position at the Shariah-based bank after being taken hostage by members of a security force. Although speculations about such incidents had been circulating previously, this account now confirms those suspicions. Given that even the appointment of a bank MD requires Bangladesh Bank's approval, how could such an event occur? It has now been alleged that S Alam Group—a private conglomerate—used two state machineries: a security agency to hold the former MD at gunpoint to force him to resign, and the Bangladesh Bank to legitimise the takeover of the bank, which is akin to robbery.

According to the former MD, many top officials of Bangladesh Bank stayed in their offices late into the night to accept his resignation. Why did none of them protest this irregularity using our regulatory body? Does the central bank lack an internal evaluation or inquiry mechanism that could have prevented this? How could all our banking laws be ignored, allowing a private individual to effectively rob a bank under the direct supervision of Bangladesh Bank? The same questions should be asked about the relevant security agency. Why didn't it protect itself from such inappropriate and unethical use? The security agency is responsible for national security, so why was it utilised as if it were an agency for hire?

After taking over Islami Bank, the S Alam Group acquired several other banks in the country. Why were none of these takeovers prevented, and were the same or different state mechanisms involved in these acquisitions? These are questions that we need answers to. Moreover, the interim government must create provisions so that this cannot repeat again.

Now is the opportunity for our security agencies to ensure they are never used in this manner again. For the sake of our national interests, we hope they will make the most of it. Provisions must be established to prevent partisan politics from turning our security agencies into instruments of the ruling establishment, and to ensure that their primary function remains the protection of national security.

Systems also need to be in place to ensure that the Bangladesh Bank is not merely used to rubber-stamp such abuses but is instead able to perform its regulatory task of protecting depositors' interests and maintaining the overall health of the financial sector. Therefore, the upcoming banking sector reforms must address the existing loopholes that allowed for partisan politics and cronyism to ruin all central bank independence, rob banks at the barrel of a gun simply at the whim of powerful interest groups, which ultimately has led to tremendous financial irregularities and harm to our overall economy and national interests.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments