Stocks fall on poor performance of large companies

Indexes of the stock market in Bangladesh declined yesterday on rising the day before, largely due to the poor performance of Islami Bank Bangladesh along with the large-cap and blue-chip shares amid sales pressures.

Large-cap refers to shares which account for large amounts in market capitalisation, which is the value of a company's outstanding shares.

Blue chip refers to companies which are nationally or internationally recognised, well-established, and financially sound.

The DSEX, the benchmark index of Dhaka Stock Exchange (DSE), went down by 35.06 points, or 0.66 percent, from that on the day prior to close at 5,298.

The DSES, the index that represents Shariah-based companies, edged down by 12.29 points, or 1.03 percent, to 1,183.

The DS30 index of blue-chip firms shed 7.35 points, or 0.37 percent, to reach 1,970.

Islami Bank Bangladesh was alone liable for the loss of 19.90 points on the DSE.

LafargeHolcim Bangladesh, Al-Arafah Islami Bank, Beacon Pharmaceuticals, BRAC Bank, National Bank, Khan Brothers PP Woven Bag Industries, United Commercial Bank, Pubali Bank and Bangladesh Shipping Corporation all suffered losses.

However, Square Pharmaceuticals, Beximco Pharmaceuticals, MJL Bangladesh, BAT Bangladesh, Grameenphone, Olympic Industries, Shahjalal Islami Bank, Meghna Petroleum, Sea Pearl Beach Resort and Spa and BSRM Steels managed to attract investors.

None of the companies witnessed a double-digit growth.

Square and Beximco, the leading two drugmakers of the country, jointly logged a gain of 7 points.

Of the issues that changed hands on the DSE, 136 experienced a price hike, while 216 closed lower, and the remaining 48 did not see any price fluctuation.

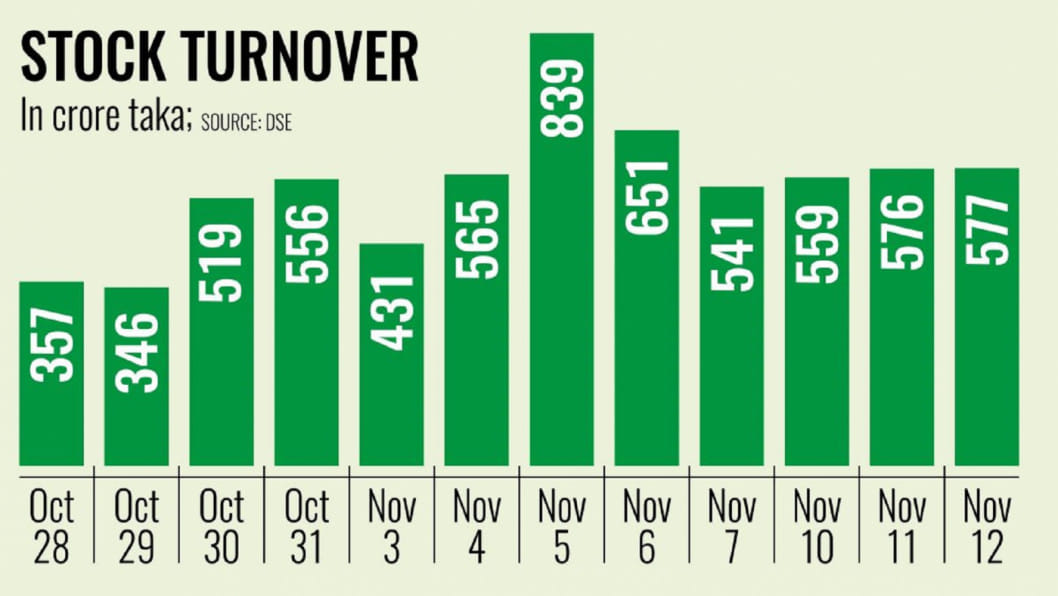

Turnover, which indicates the total value of shares traded, stood at Tk 578 crore on the DSE, an increase of 0.19 percent compared to the previous day's trading session.

The pharmaceuticals sector dominated the chart, accounting for 19.19 percent of the total turnover.

Another 5.6 percent was posted by block trades, which refers to high-volume transactions in securities that are privately negotiated and executed outside the open market, according to the daily market update by BRAC EPL Stock Brokerage.

Meghna Petroleum emerged as the most traded share, with a turnover of Tk 25.6 crore.

Sector-wise, general insurance, life insurance and food and allied sectors became the top three sectors that closed in the positive, UCB Stock Brokerage said in its daily market update.

Jute, cement and engineering sectors were the top three sectors to close in the negative.

Large-cap sectors posted a mixed performance, with food and allied witnessing the highest gain of 0.79 percent.

It was followed by telecommunication (0.52 percent), and fuel & power (0.07 percent).

However, some logged losses such as pharmaceuticals (0.08 percent), banking (1.61 percent), non-bank financial institutions (1.61 percent), and engineering (2.10 percent).

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments