Sovereign guarantee rules to be revised

The government plans to amend the existing sovereign guarantee guidelines to streamline the process and mitigate fiscal risks if public entities fail to make repayments on time, according to a finance ministry report.

The revision is being considered as government guarantees for loans taken by state-owned enterprises (SOEs) are gradually increasing.

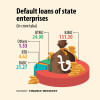

As of June this year, the total guarantees provided by the government against SOE loans will amount to Tk 119,082 crore, up 2 percent year-on-year.

This marks the sixth consecutive year that government guarantees for loans taken by public entities have risen.

At the end of fiscal year 2019–20, the state's pledges against SOE loans stood at Tk 60,653 crore. This means the guaranteed amount has almost doubled since then.

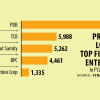

The guarantees were primarily issued to entities operating in various sectors, including commercial aviation, power, fertiliser production plants, and public commodity distribution, said the finance ministry in its Medium-Term Macroeconomic Policy Statement (MTMPS) for FY2025–26, published this month.

On this issue, Ashikur Rahman, principal economist at the Policy Research Institute (PRI) of Bangladesh, said SOEs are becoming a major source of contingent liabilities for the government.

"In fact, one of our recent analyses reveals that Bangladesh's SOEs are creating a dangerously unsustainable fiscal burden," he said.

Despite operating in key infrastructure sectors, the majority of public entities are consistently incurring losses, resulting in Tk 88,100 crore in net fiscal transfers from the government in FY24, equivalent to 1.7 percent of the country's gross domestic product.

"This exceeds the country's total annual public spending on health or social protection," he said.

"The worst offenders, such as the Bangladesh Power Development Board and Petrobangla, suffer from chronic mismanagement, poor pricing policies, and political interference," he said.

"Subsidies and unserviced government loans to SOEs are not just draining public finances—they are crowding out critical investments in education, health, and poverty reduction," said Rahman.

"With rising contingent liabilities and mounting opportunity costs, SOEs risk becoming a systemic threat to Bangladesh's fiscal sustainability," he said.

The MTMPS stated that there has been no incident of sovereign loan default by government enterprises.

However, sovereign loan guarantees expose the government to potential financial losses if SOEs default on their debts, it said.

If public entities fail to repay their loans on time, the guarantees are invoked and the liabilities are passed on to the government, it added.

"Secondly, even without defaults, there are implicit risks associated with SOEs if they incur losses. The government might need to recapitalise them to keep these enterprises afloat," the MTMPS noted.

Thirdly, unrealised returns on investment expectations—meaning when SOEs do not generate the expected returns—can further strain public finances, it said, recommending the prudent use of SOE assets.

It is crucial for the government to monitor and manage its contingent liabilities effectively, as their realisation can have a significant impact on public finances, potentially increasing government debt and budget deficits, said the report.

"Assessing and quantifying these risks is essential for sound fiscal management and sustainability," it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments