State enterprises must answer for losses

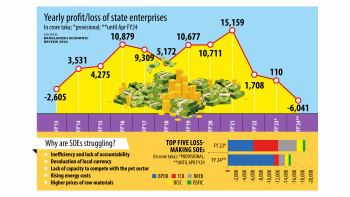

We are alarmed to learn of a projection that state-owned enterprises could end up counting nearly a fivefold increase in losses in FY2024-25 compared to the previous year, as their expenses are likely to far exceed their earnings. This is according to a monitoring cell of the Finance Division that conducted a budgetary analysis of 50 enterprises across seven sectors. Their total loss for FY2025 could be Tk 28,047.97 crore—up from the Tk 5,989.87 crore loss incurred in FY2024—indicating a deeply concerning trend.

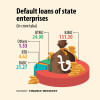

The projection, made by a government body no less, is yet another indictment of the widespread corruption and mismanagement besieging government institutions, including state-owned enterprises. Not too long ago, we had a similar indictment when the Office of the Comptroller and Auditor General (OCAG) revealed massive financial irregularities in many of these institutions. Their spiralling losses, despite many enjoying monopolistic advantages as service providers, raise questions not only about how they would have fared in a competitive market environment, but also regarding the government's austerity measures, which should have stemmed the tide of rising expenses in them. Evidently, things are as bad as depicted in media reports, and they are now set to get worse.

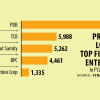

This is not to say that all government enterprises are underperforming. In fact, according to the monitoring cell, most are making a profit. But the overall picture is marred by the staggering losses of 13 of the enterprises—projected to be Tk 36,144.93 crore in total—significantly eating away at the achievements of the rest. Some of them are well-known for their serial underperformance. Top among them is the Bangladesh Power Development Board (BPDB), contributing the largest anticipated loss with Tk 18,103.60 crore, thereby justifying the prediction of two Centre for Policy Dialogue (CPD) experts, made in a column published in this daily last year, that it was turning into a "white elephant." Another familiar contributor of losses is the Bangladesh Petroleum Corporation (BPC), where the level of irregularities is so massive that it even stunned a parliamentary committee.

We, therefore, demand a thorough review of why these 13 entities are floundering. We can no longer ignore their persistent losses, or that of other state institutions regularly flagged for irregularities. Any intervention must aim to rid them not only of corruption, but also the cycle of poor planning and inefficiencies that have long gone unpunished. The present economic crisis will be harder to overcome with these albatrosses hung around our neck.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments