State enterprises’ loan rising, so is govt guarantee

The government needs to provide guarantees against an increasing amount of loans of state-owned enterprises every fiscal year, especially for power generation, fertiliser and fuel imports, and aircraft purchases.

The government provides these "sovereign guarantees" against loans negotiated by various state-owned financial and non-financial enterprises, states the finance ministry's Medium-term Macroeconomic Policy Statement for 2024-25 to 2026-27.

Meant to aid the implementation of public policies and programmes, the sovereign guarantees are mostly issued to entities operating in commercial aviation, power and public commodity sectors, and fertiliser plants, according to the statement.

If the entities fail to repay their loans on time, the guarantees could be invoked and the liabilities would be passed on to the government, which inevitably would have future fiscal implications, it added.

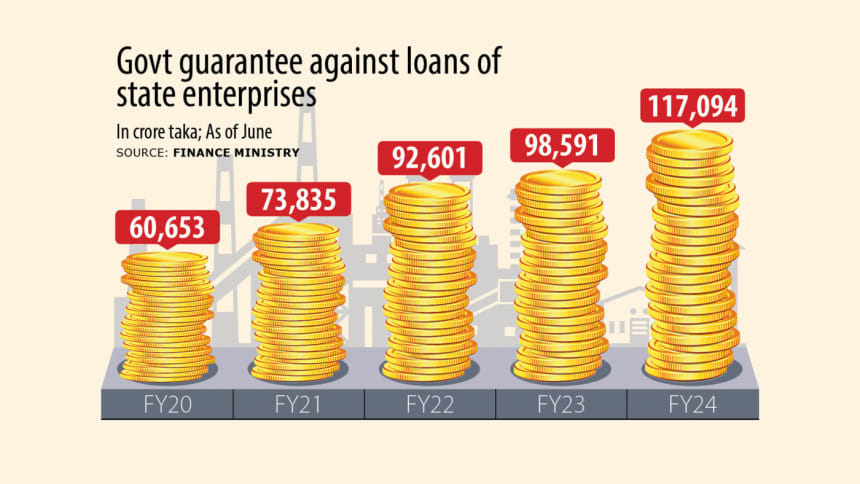

As of the current fiscal year of 2023-24, sovereign guarantees were backing Tk 117,094 crore in loans, according to budget documents of the finance ministry.

In the last fiscal year of 2022-23, it was Tk 98,591 crore whereas it was Tk 92,601 crore in fiscal year 2021-22.

The amount has been increasing by around 19 percent on average every year.

State-owned power agencies now have the highest amount of loans -- Tk 53,596.26 crore.

Bangladesh Agricultural Development Corporation accounted for Tk 18,985.48 crore, all availed for importing fertilisers.

Besides, the loan against Ghorashal-Palash Urea Fertiliser Factory, which was inaugurated in Narsingdi in November last year, stands at Tk 10,113 crore.

Biman Bangladesh Airlines had loans to the tune of Tk 8,543.45 crore, the energy sector Tk 7,660.18 crore and the Trading Corporation of Bangladesh Tk 2,432.11 crore.

One of the ways in which state-owned enterprises were correlated with the government's fiscal position, as per a partial analysis, was that their loans exposed the state to potential financial loss, said the finance ministry statement.

Moreover, the government has had to inject additional capital to keep many of the enterprises afloat, it said.

Economists suggest privatising loss-making entities instead of running them by spending taxpayer money.

As of February, 30 state-owned enterprises had Tk 65,089.48 crore in debt with state-owned commercial banks, read the Bangladesh Economic Review 2024.

Of the amount, Tk 183.62 crore has been classified.

Up until now there has been no default of loans backed by sovereign guarantees, said the finance ministry statement.

However, the government plans to amend the existing guidelines to streamline the process and further strengthen the debt repayment capacity of the state-owned enterprises, it said.

Loan default of state-owned enterprises is a serious issue in terms of preserving the confidence and image of the country as it generally does not happen anywhere in the world, said M Masrur Reaz, chairman of Policy Exchange of Bangladesh.

When state-owned enterprises default on loans, the impact falls on the private sector and raises questions about the capability of the government, he said.

Most public enterprises are incurring losses, but the government does not shut those down on political grounds, said Ahsan H Mansur, executive director of the Policy Research Institute.

Instead, the government continues to run these enterprises by providing subsidies and repaying their loans by spending taxpayer money, he said.

According to him, the ultimate solution is to privatise the state-owned enterprises to avoid the liabilities of debt for years on end.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments