Taka keeps falling, forex reserves slip below $31b

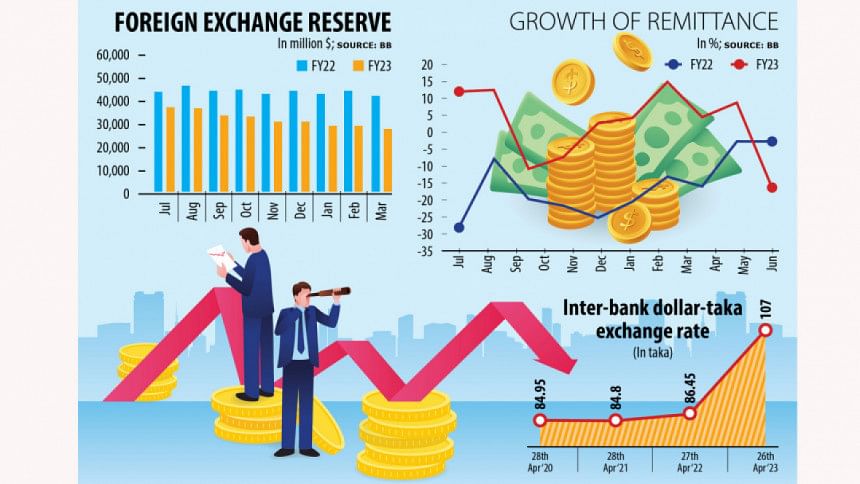

The taka has lost its value further against the US dollar after the Bangladesh Bank sold the greenback at Tk 104.5 as the foreign exchange reserves keep falling.

The reserves stood at $30.92 billion yesterday, down 29.7 per cent year-on-year, central bank data showed.

The taka has been under pressure for nearly a year after the Russia-Ukraine war-induced fallout deepened the volatility in the global commodity and energy markets as import-dependent nations such as Bangladesh were forced to pay more to clear import bills, which took a toll on the international currency reserve level.

The central bank began selling US dollars at Tk 103 in the first week of April from Tk 102 previously as it is working to allow the exchange rate to be determined in line with demand and supply.

At a meeting on April 30, banks decided to pay Tk 110.70 per USD to migrant workers and non-resident Bangladeshis from May in order to encourage them to send money through formal channels.

Banks also decided to raise the buying rate to Tk 106 from Tk 105 for exporters to arrive at a single exchange rate gradually in place of the present multiple exchange rates.

As per the reform actions attached to the $4.7 billion loan programme, the International Monetary Fund also suggested the government put in place a market-based interest rate mechanism by July this year.

A lower-than-expected flow of export and remittance receipts also did not give the country much-needed breathing space when it comes to boosting the reserves and bringing stability to the exchange rate regime.

Remittances, the cheapest source of US dollars for Bangladesh, declined 16.27 per cent year-on-year to $1.68 billion in April. The flow, however, was up 2.36 per cent to $17.71 billion in the first 10 months of 2022-23.

Export earnings dipped 16.52 per cent to $3.95 billion in April, data from the Export Promotion Bureau showed yesterday. But it was up 5.38 per cent to $45.67 billion during the 10-month period.

Although import bills fell 10.27 per cent to $48.79 billion in the first eight months of 2022-23, it was not enough to stop the depletion of the forex reserves. Import data for March and April have not been published yet.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh says: "The central bank's initiative aimed at depreciating the local currency is good. But it is not good enough given the ongoing market situation."

He urged the central bank to implement a single exchange rate instead of multiple ones. "And it should allow the floating exchange rate."

"In addition, the interest rates of loans and deposits should be market-based as well. Otherwise, the stability in the foreign exchange market can't be restored."

The BB has decided to implement a market-based interest rate from July, moving away from the 9 per cent interest rate cap on loans.

In January, the central bank removed the deposit floor rate.

Monzur Hossain, research director of the Bangladesh Institute of Development Studies, said the reserve is still at a satisfactory level.

"But we should implement a single exchange rate immediately to bring back discipline to the foreign exchange market."

Fahmida Khatun, executive director of the Centre for Policy Dialogue, says that the central bank has taken a number of initiatives in recent months, but the erosion of the reserves can't be stopped.

"So, we must be careful about the ongoing instability in the foreign exchange market."

Mohammad Ali, managing director of Pubali Bank, says remittance flow should be increased to give a boost to the reserves.

"The authorities should gear up its monitoring to curb hundi operations," Ali said.

Hundi cartels, which operate illegal cross-boundary operations, accounted for half of the remittances that flowed to Bangladesh even before the coronavirus pandemic.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments