Three risks ahead

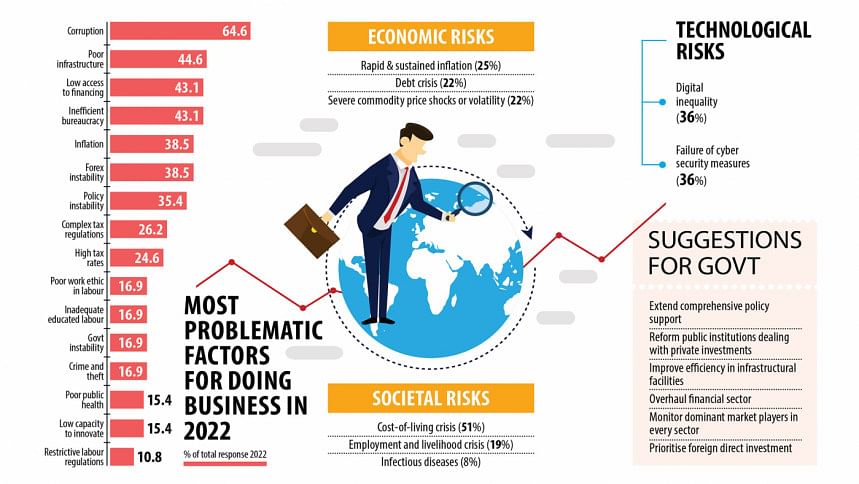

Higher inflation, debt crisis and severe commodity price shocks are some of the major economic risks Bangladesh may face in the upcoming years, a new survey of executives warned.

Other challenges include asset bubble burst and proliferation of illicit economic activity, said the "Executive Opinion Survey" of the World Economic Forum (WEF).

The study was as part a global survey carried out by the WEF on 11,800 respondents from 121 economies from April to July of 2022. In Bangladesh, the Centre for Policy Dialogue (CPD) conducted the survey and the number of respondents was 74.

The respondents represented private companies in the agriculture, manufacturing and services sectors and they are based in Dhaka, Chattogram, Narayanganj and Gazipur.

The top three societal risks for the upcoming years for Bangladesh are the cost-of-living crisis, employment and livelihood crisis, and infectious diseases, said the report.

According to the survey, most of the indicators in the financial sector showed lower scores in 2022 compared to 2021.

"Overall, the level of performance of the financial sector remained negative, indicating a struggling situation as in previous years."

"A negative perception was observed in the case of the soundness of banks, accessing start-up capital, and financial and auditing reporting standards."

"The financial sector needs major overhauling," said CPD Research Director Khondaker Golam Moazzem while making a presentation on the findings of the survey at an event at the CPD office in Dhaka yesterday.

The overhauling could be initiated as part of meeting the loan conditionality of the International Monetary Fund and amending to the Bank Company Act and by way of lifting the cap on lending rates and ensuring an effective oversight role of the central bank, the Bangladesh Securities and Exchange Commission, and the Insurance Development and Regulatory Authority.

The country's business environment deteriorated in 2022 compared to the previous year mainly due to corruption, said the report.

Corruption was one of the major barriers to doing business in Bangladesh as 64.6 per cent of the respondents complained about the high level of corruption.

Weak institutions are the most challenging components for doing business in Bangladesh, said the report.

Improvement of institutions is sluggish and most importantly, their performance deteriorated in 2022. Public entities dealing with taxes, licences, public utilities, judicial system, export, and import performed poorly last year.

The performance of the majority of infrastructure-related facilities is perceived to be below the average level despite major public investments in key infrastructures.

The respondents cited the poor quality of road infrastructure, less efficiency in train services, inefficient seaport services, and poor public transport services.

According to the businessmen, the major lessons for Bangladesh from the Sri Lanka debt crisis were to avoid undertaking unnecessary large projects, promote export diversification, avoid taking up bulk loans from a single lender, and attract private investment.

The Russia-Ukraine war has had a number of adverse impacts on the economy, namely the rising cost of production, uncertainty in the import of final goods, the higher cost of imported raw materials, and the difficulty in international transactions.

Businessmen's perception regarding safety and security significantly deteriorated in 2022 compared to that in 2021.

More than 57 per cent of respondents observed that climate changes pushed up the cost of doing business and are causing the rise in higher demand for jobs in cities, pressure on urban services and a spike in informal economic activities.

Despite various initiatives, foreign direct investment inflow remains at a low level, cited the report.

"A lack of proper infrastructure, the limited functionality of one-stop service facilities and weak financial reporting of local companies are considered as drawbacks for attracting FDI."

There was further deterioration in the competitiveness of the business environment in 2022 and entrepreneurs still considered that the corporate businesses are dominated by a few groups of companies like in the previous years.

The competitive environment in businesses has further deteriorated due to a lack of proper practices of corporate governance, weak regulatory oversight and a lack of corporate ethics.

This led the respondents to urge the Bangladesh Competition Commission to be proactive in monitoring the activities of dominant market players.

A new set of factors have emerged, according to the report. They include inflation, foreign currency instability and policy instability.

"Given the uncertain business environment, businesses need comprehensive policy support targeting the short-, medium- and long-term challenges."

Small and micro-enterprises are facing the pressure of inflation, instability of foreign currency, and inefficient government bureaucracy, according to the report.

Large enterprises found more problematic issues in the case of inadequate infrastructure, inefficient government bureaucracy and foreign currency instability.

Entrepreneurs said the current education system is still behind in complying with the needs of the competitive economy. And over 67 per cent of respondents perceived that companies are not investing enough in the training and development of the employees.

"The current education and skill development systems are not conducive to creating human capital that can meet the needs of digital technologies, creativity skills and self-management skills," said the report.

Businessmen are worried about the safety and security-related issues concerning organised crime, climate-related business risks, and social and political unrest.

A major reform needs to be ensured in the case of public institutions dealing with private investments through better transparency, accountability, and efficiency.

"Major political parties should commit such reforms in their upcoming national election manifesto," said the report.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments