Time for change, time for reform

Bangladesh is at a crossroads where the past meets the present and the future is forged.

For decades, the economy has struggled under the weight of corruption, nepotism and a lack of political will. The financial sector has been ravaged by loan defaults and the banking sector has been held captive by the rich and powerful.

The government faces a defining moment where it must choose between the status quo of a broken system or a bold new path towards policy reform. Stakeholders have been calling for much-needed reforms since the beginning of this century to make development more sustainable, inclusive and acceptable to the wider population.

Will the authorities have the valour to implement desperately needed reforms? The time has come for change. The time has come for reform.

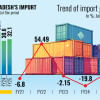

The economic situation in Bangladesh is complex and concerning, with a combination of internal and external factors contributing to its current state. The absence of adequate response over the past decade has resulted in a slow-burning crisis, now coming closer to a sudden crisis.

The government's partial interventions of import controls and exchange rate adjustments and public expenditure controls are okay, yet insufficient in addressing fundamental issues.

Inflation must be addressed as the anchor of any intervention package, and there is no miracle solution to the problem. Rather, there must be a combination of measures, including relaxing interest rates, slowing down credit growth, and continuing social aid programmes for the poor.

The recent International Monetary Fund facility is an opportunity for the government to make necessary changes to help improve the economic conditions of ordinary people and secure a better future for Bangladesh. Previous lack of acknowledgement of the crisis and political will to implement reforms have been significant barriers, but it seems that they can now be overcome, as IMF loan agreements mandate reforms.

One good thing is that economists and even many politicians are now agreeing on the question of reform. However, it is important to ensure that reforms are implemented effectively and sustainably, rather than just to get the loan.

Structural reforms are needed to increase growth potential. For that, it is imperative to create a supportive environment for the growth of trade and foreign direct investment, development of human capital and establishment of good governance.

The government will also need to accelerate its ambitious reform programme to achieve more sustainable and inclusive growth amid global economic headwinds.

Reforms are also needed in both tax policy and revenue administration. Revenue sector reforms will improve government financing, investment and debt management, as well as efficiency and overall governance.

According to the central bank, it is focusing on reducing delinquency in the banking sector, ensuring good governance and improving technology-enabled risk management. The National Board of Revenue is apparently also emphasising expanding the tax-GDP ratio and reducing harassment of taxpayers through increased technological integration in tax collection.

These issues have been long discussed.

However, many debate that the gains of the Loan Reform Commission, the central bank strengthening project and the Banking Reform Commission couldn't be sustained due to undue interference of state and political parties. Bad debt has not been reduced and income tax collection remains low.

Additionally, the implementation of the VAT online project remains incomplete, and harassment reports are frequent at sea and airports. More political will, coupled with competent human resources, is needed to reform the financial and revenue sectors, sustain development and drive overall reforms.

The author is an economic analyst

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments