Unearth real data of bad loans

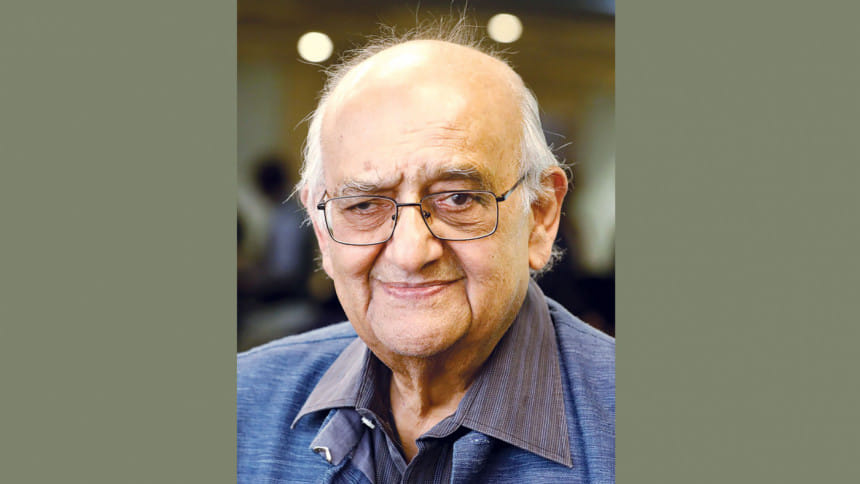

Noted economist Prof Rehman Sobhan yesterday said there is no real data on non-performing loans (NPL) in the banking sector, mentioning that many companies are not repaying their loans and instead rescheduling them year after year and those are excluded from the total default loan amount.

"Unfortunately, we don't know the real amount of NPLs… partly because of policy failure and partly because of the failure of the regulatory institution (central bank)," Prof Sobhan said.

He made the comments at the launching ceremony of a book titled "Is the Bangladesh Paradox Sustainable?" at BRAC Centre Inn yesterday. The event was organised by the South Asian Network on Economic Modeling (Sanem).

The veteran economist said the balance sheets of all the banks as well as their borrowing and repayment should be analysed to unearth the real amount of NPLs in the banking sector.

At the end of December 2023, Bangladesh's banking sector had NPLs worth Tk 145,600 crore, around 9 percent of total outstanding loans, central bank data showed.

Prof Sobhan said that the government had promised to publish a list of the top 100 defaulters in the country, but it did not do so.

He added that the treatment of borrowers varies from person to person as some people that are not repaying loans are getting rescheduling benefits while some loans are being written off. Others are seeing their loans defined as NPLs after non-repayment.

A similar scenario is witnessed in the tax administration. Tax files are not being checked in line with the rules, with some being allowed to slip through the cracks.

Whether someone benefits from that or not depends on if they have political clout or relatives in the institution, the economist said.

He said that, according to a central bank directive, no defaulters would be allowed to contest in the parliamentary elections. However, the government allowed them to contest the polls after making a small down payment against their outstanding loans.

"Shockingly, they stop repaying loans once the election is over," he said, adding that several such discriminatory institutional practices prevail in the country.

The same is also happening in the Anti-Corruption Commission. For instance, many MPs' assets grew manifold in the last several years, which was disclosed before the last parliamentary elections.

"Did the Anti-Corruption Commission or the National Board of Revenue take any steps to see how the asset growth was fueled?" Prof Sobhan questioned.

"We need a fundamental breakdown of institutions that are running deal-based operations. They do not operate according to the laws. We need rule-based institutional frameworks, not person-based institutions."

He added that many people do not believe there are any rules in Bangladesh, adding that central to the institutional failure was a departure from a rule-based system.

"If we want to truly understand why foreign direct investment is lower in Bangladesh compared to Pakistan, despite our higher growth, we should investigate the absence of credible institutions," Prof Sobhan added.

The book was edited by Prof Selim Raihan, executive director of the Sanem, François Bourguignon, emeritus professor of economics of Paris School of Economics, and Umar Salam, principal economist of Oxford Policy Management.

It was published by Cambridge University Press.

The Prime Minister's Economic Affairs Adviser Mashiur Rahman said provisions have become necessary after repeated defaults, which lead to increased toxic assets and reduced lending funds.

Moreover, he observed that entrepreneurs frequently alter enterprise sizes, perpetuating a continuous demand for loans.

"How we build our bureaucracy should be reevaluated," Mashiur said, highlighting the need for a more fair and efficient recruitment process to eradicate corruption.

Selim said Bangladesh's growth occurred despite poor formal institutional quality.

"Bangladesh has established pockets of informal institutions and a political settlement process that facilitates growth drivers."

He added that Bangladesh faces a stable corruption equilibrium, where forces and counter-forces of corruption maintain equilibrium, sustaining a status quo.

"There is a strong anti-reform coalition in the system that prevents breaking this cycle of corruption," he added.

SR Osmani, professor of Development Economics at the University of Ulster, United Kingdom, MM Akash, a former chairman of the economics department of Dhaka University, Zaidi Sattar, chairman of the Policy Research Institute, and Mirza M Hasan, senior research fellow at the BRAC Institute of Governance and Development, also spoke at the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments