Why stock market was overrun by price manipulations

The way that the stock market has been run over the past 15 years under the Sheikh Hasina-led government can be best summarised as facilitative to the manipulation of stock prices.

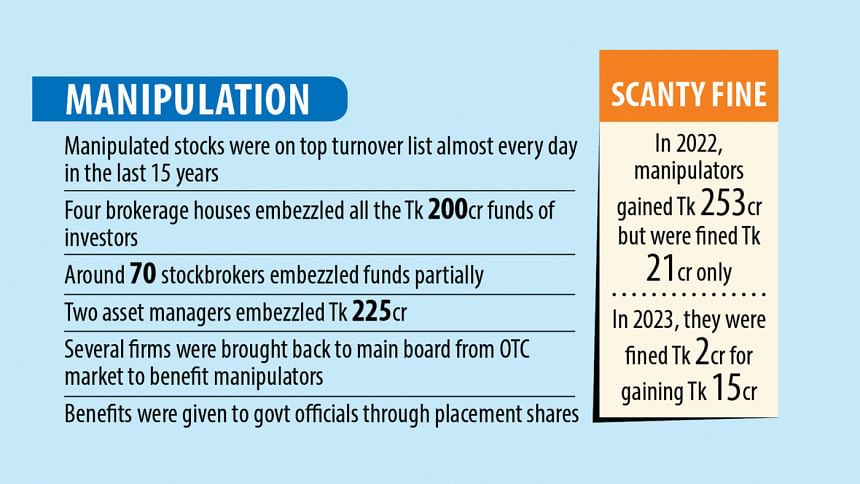

Such manipulation, including through serial trading of shares, was a regular scenario.

Interestingly, a number of businesses, including banks, become engaged in the manipulation malpractices which were previously not that common.

The regulator's loose monitoring and lack of punitive measures led to investors losing their hard-earned money and eventually leaving the market for good.

Even after parking their funds in good stocks, they lost their money as at least four stock brokerage firms embezzled investors' funds in the period.

Around 70 brokerage firms were found to have partly embezzled their funds.

The safest instrument, mutual fund, also betrayed investors as several asset managers, in an unprecedented move, misused peoples' funds even though they were the persons appointed to protect the funds and manage them well.

Stock market analysts blamed a lack of monitoring by the Bangladesh Securities and Exchange Commission (BSEC) and minimal punitive measures against substantial violations of regulations for the prevalence of manipulation.

For instance, after unearthing the price manipulation of quite a few stocks, the BSEC in 2022 had imposed a fine of only Tk 21 crore whereas the wrongdoers gained Tk 253 crore.

In 2023, they gained another Tk 15 crore on being fined Tk 2 crore for price manipulation. The trend was the same almost throughout the last 15 years.

Interestingly, the involvement of listed and non-listed companies in the manipulation of stocks grew over the years, an ominous sign for a market already facing a confidence crisis.

Prior to 2021, one or two firms were found to have been engaged in price manipulation whereas the number crossed 15 in 2022. In 2023, six firms were found to have been engaged in manipulation.

At times, the BSEC ran investigations so slow that manipulators had enough time to pack up and leave.

Take the instance when the stock market regulator received allegations of officials of Universal Financial Solutions (UFS) having misappropriated around Tk 180 crore from mutual funds.

It ran an investigation that took four months, which gave the people involved ample opportunity to flee.

This is not the sole instance when fund managers misappropriated funds of investors.

Due to price manipulation running on a massive scale for a long time, many general investors left the market on losing their funds, said Shahidul Islam, chief executive officer of VIPB Asset Management.

Although the country's economy witnessed a GDP growth of 6 percent on an average, it did not permeate the stock market, he said.

As there was a lack of accountability and the BSEC imposed insignificant amounts as fines on manipulators, the manipulation turned into a regular phenomenon of the market.

"Moreover, investors saw that the BSEC high-ups maintained connections with manipulators as they were invited to several roadshows. So, the BSEC failed to control manipulation," Islam said.

Sometimes, the BSEC approved the listing of many companies that had little intrinsic value. So, essentially, the regulator allowed manipulators to manipulate the stock prices so that they rise and get a justification for the approval of the IPO, Islam added.

Since 2010, at least four brokerage houses -- Banco Securities, Crest Securities, Tamha Securities and Shah Mohammad Sagir and Co -- were shut for allegedly embezzling around Tk 200 crore of general investors.

Some 68 brokerage firms were found to have unethically transferred clients' deposits, worth around Tk 430 crore.

The BSEC allowed several over-the-counter (OTC) market companies to return to the main board of the Dhaka Stock Exchange and Chittagong Stock Exchange even though they had no potential to justify the move.

The companies include Tamijuddin Textile Mills, Bangladesh Monospool Paper Manufacturing Co, Paper Processing and Packaging, Sonali Paper and Board Mills and Monno Fabrics.

These have been traded on the OTC market for the past 10 years for their non-compliance to regulations.

Thanks to the absence of proper enforcement of rules and regulations, manipulation has been fuelled over the last 15 years, said Ali Imam, managing director and CEO of Edge Asset Management.

The regulator's efficacy was highly compromised and there was no political intention either to penalise manipulators. Moreover, the manipulators earned a huge amount of money through manipulation and utilised it to influence the regulator.

The triumph of the manipulation essentially spoiled professionalism, competitiveness and the market environment as a whole, he said.

For instance, manipulators assured investors they would double their money within three months while professional fund managers can offer a yearly gain of around 15 percent to 20 percent, that too after holding onto investments for a long time.

Due to trading aimed at manipulating prices, people ultimately lost their interest in the stock market and now they believe that they will lose money if they invest in the stock market, Imam added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments