Will BSEC ever learn from its missteps?

The Bangladesh Securities and Exchange Commission (BSEC) has recently stepped in to limit the loss that a company might suffer in a single day, preventing the market from running on its natural course.

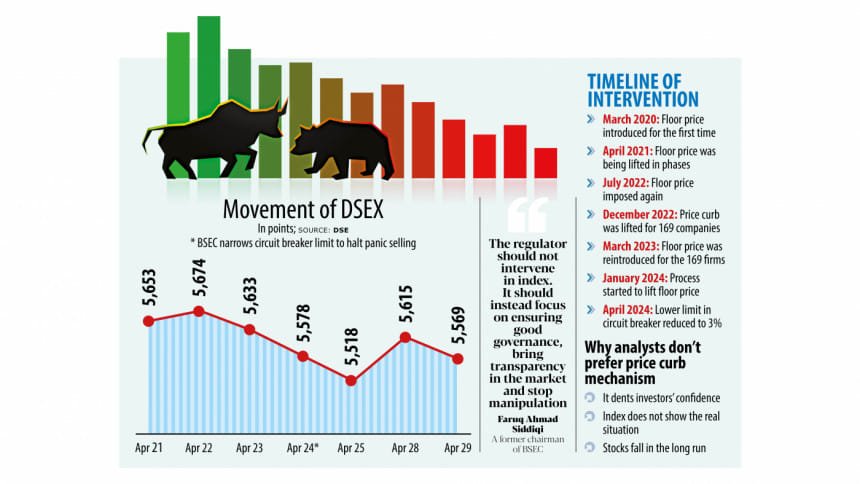

However, the new move did not work because investors have kept selling shares within the new limit, forcing the key indices of the Dhaka Stock Exchange (DSE) to drop in the last two sessions out of three.

On Wednesday, the stock market regulator narrowed the scope of stocks to fall more than 3 percent daily instead of the previous 10 percent since the market shows no sign of improvement.

The latest curb came two months after the withdrawal of the floor price, launched in mid-2022 for the second time in the market's history to stop a major fall amid the unprecedented economic crisis, brought on by the Russia-Ukraine war, higher commodity prices in the global market, and the volatility in the foreign exchange market.

Analysts say the regulator's intervention is denting investors' confidence and it comes at a time when they are still smarting from the wounds caused by the 18-month-long floor price, a period when most of the stocks were untradeable.

Now, foreign investors appear to have gone for sell-offs amid falling corporate profits, lower economic growth projections, persisting higher inflation, a sharp depreciation of the local currency, and the depletion of foreign currency reserves. This means there is no clear signal of when the country will be able to come out of the current phase of uncertainty.

Therefore, the regulator should have carried out a proper analysis and research before implementing any new policy so that no moves do more harm than good, said one analyst.

A top official of the BSEC also confirmed that the decision on the 3 percent decline limit was not taken based on any research. "Even, it was not the outcome of a formal commission meeting."

Foreign and institutional investors are already suffering from a serious confidence crisis due to the floor price. The new mechanism deepened it as they fear that their investment might get stuck again like they faced during the floor price era.

"The regulator should not intervene in the market. Rather, it should allow the market to function as per supply and demand," said Faruq Ahmad Siddiqi, a former chairman of the BSEC.

By launching the floor price, the index was kept at an elevated level for a long time artificially. Following Wednesday's intervention, investors are worried that the market would be illiquid again.

"So, the market has reacted negatively," Siddiqi said.

He led the BSEC from 2006 to 2009 but such an intervention never came to his mind, he said. "Making intervention in the market is not the task of the commission."

Although the market rose on Sunday, a number of intermediaries attributed this to a commission's verbal order, saying some large investors were asked to invest heavily in the market to lift the key index.

A senior official of a brokerage firm questioned whether the regulator could issue such an order without holding a formal commission meeting. "The commission needs to meet to issue an order as per rules."

"The BSEC took the decision suddenly to slow down the fall of the market."

The broker said if the mechanism has not been put in place, the indices might have fallen for several days but they would have made a comeback at some point.

"Now, the intervention can hit the confidence level of investors hard, bringing about a longer-than-usual bear-run. So, the regulator is hurting general investors in the name of protecting their interests."

A top official of an asset management company said pessimism prevailed in the market for a longer period due to the floor price. The latest price mechanism will amplify it.

"It has not been a good decision at all for the market."

The asset manager said the logic behind the decline limit has been that the market is not going to slide 10 percent in a single day.

"However, because of the spooked confidence and the lingering economic uncertainty, the market will definitely fall and it may take three days to shed a total of 10 percent."

Faruq Ahmad Siddiqi recommended the regulator focus on ensuring good governance, ensuring transparency, and stopping manipulation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments