Women hold majority of accounts opened thru’ agent banking

The number of women in Bangladesh with bank accounts opened via agent banking far exceeds that of men as the facility offers better accessibility and guidance for various banking services, making it particularly suitable for those living in rural areas.

As per the latest data from the Bangladesh Bank, the total number of savings accounts opened through agents stood at 2.14 crore by the end of December 2023.

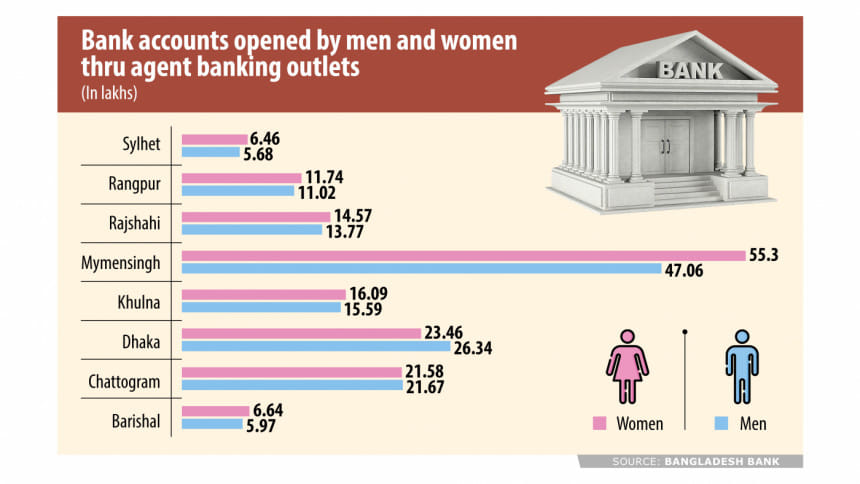

About 1.04 crore of these accountholders were men and 1.06 crore women while the remaining 3.29 lakh fell into the "others" category, including business accounts.

Agent banking is a form of branchless banking that uses local intermediaries to provide financial solutions in their given localities.

The number of female accountholders exceeded the number of males in Barishal, Khulna, Mymensingh, Rajshahi, Rangpur and Sylhet, suggesting that agent banking has increased women's participation in the financial landscape.

Asked why women are opening agent banking accounts more in divisions outside Dhaka, Md Mohibur Rahman, head of agent banking at City Bank PLC, said it was because traditional banking has been serving most customers for a long time in areas like Dhaka and Chattogram.

"So, there is scope, especially for rural women, to come under financial inclusion through agent banking," he added.

Reflecting on the reasons for there being more female accountholders with agent banks, M Khorshed Anowar, deputy managing director and head of retail and SME banking of Eastern Bank PLC, said it was because they got several facilities that make the service more accessible.

"Women mostly feel encouraged to open agent banking accounts for facilities like transactions through fingerprint, easy way to receive remittance, accessible location, speedy and easy service, emphasis on small savings, ability to pay utility bills, along with specialised products," he added.

Anowar also said that EBL's agent banking outlets arrange various community engagement programmes to promote financial inclusion among marginalised and unbanked populations.

In addition, EBL promotes easy and secure financial solutions that encourage everyone, including women, to open accounts, and avail pension schemes and other services.

Thanks to agent banking offering banking services to a wide array of people in both urban and rural settings, women have found new opportunities to save, borrow, remit and pay bills.

City Bank's Mohibur also said one of the reasons women choose agent banking is the security factor.

For example, City Bank agent banking introduced a two-factor authentication system called token management. This required a customer to provide both their fingerprint and the token number generated for any transaction to be processed.

"So, even if someone manages a forged fingerprint, the transaction won't take place without a token number," he added.

Mohibur said raising awareness, especially among rural women to attain financial literacy, is one of their top priorities in spreading agent banking among the people.

The data also showed that there are 15,757 agents and 21,601 agent banking outlets across the country. Of them, 13,243 agents and 18,470 outlets are located in rural areas.

This means the number of rural agents is 5.3 times higher than the number of urban agents while the number of rural outlets was six times higher than the number of urban outlets, indicating that agent banking is popular as an accessible option for rural people.

In terms of transactions, the data showed that the total number and amount of transactions through agent banking outlets in December 2023 was 94.02 lakhs and Tk 44,261 crore respectively.

Both the number and amount of transactions were significantly higher in rural areas than in urban areas, reflecting the high demand and usage of agent banking services among rural and underprivileged people.

The most common types of transactions through agent banking were cash deposits and withdrawals, inward remittance, fund transfers, and utility bill payments.

Agent banking was introduced in Bangladesh in 2013 as a way to extend financial inclusion to the unbanked and underbanked segments of the population, especially in remote and rural areas.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments