Agent banking sees rise in female participation

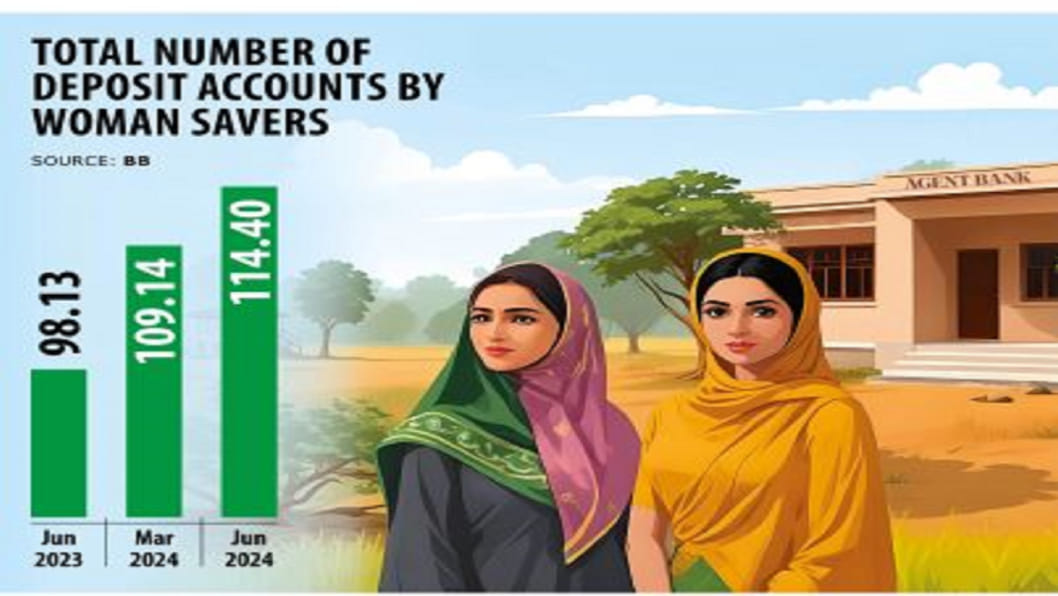

The number of women in Bangladesh using agent banks for deposits and loans saw growths of 16.58 percent and 17.31 percent respectively over the past year, according to a report of Bangladesh Bank.

On a quarterly basis, the number of deposits made by women rose by 4.81 percent in the April-June period, while the number of loans availed edged down by 0.39 percent.

The Bangladesh Bank's Agent Banking Statistics for April-June 2024 also highlighted the crucial role women play in advancing financial inclusion.

It showed that women now account for 49.67 percent of the total deposits made through agent banks while men contribute 48.78 percent, and the remaining 1.55 percent comes from "others".

The rise in female engagement points to a positive trend toward financial empowerment and inclusion within the country's banking sector.

At present, some 31 banks comprising two state-owned banks, 21 private commercial banks and 8 Islamic banks are operating agent banking services across the country.

As of June 2024, there were 21,473 outlets managed by 15,991 agents, indicating a growth of 3.09 percent year-on-year and 0.99 percent from the previous quarter.

However, the number of agent banking outlets registered more modest growth of 0.87 percent year-on-year, while its quarterly performance shrank by 0.65 percent in the April-June period.

The report also mentioned that there has been a significant growth in the overall number of account holders, which has reached 23.03 million, with deposits amounting to about Tk 398,136 million.

These figures indicate an annual growth of 16.24 percent in overall account numbers and 22.34 percent in deposits, while the quarterly growth was 4.62 percent and 11.74 percent respectively, it said.

The number of loans availed and total outstanding loans in agent banking also saw substantial annual growth of 11.53 percent and 14.42 percent respectively.

In rural areas, deposits and loans through agent banking have seen growths of 16.15 percent and 12.54 percent year-on-year while the quarterly growth was 4.82 percent and 0.48 percent respectively in the April-June period, the report said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments