Home loans to soar 67pc in four years

The demand for low- and middle-income housing finance may grow 67 percent to Tk 81,816 crore by 2020, according to a report of the International Finance Corporation.

Of the total demand, Tk 33,640 crore, or 41 percent, will come from rural areas -- district and upazila levels -- over the next four years.

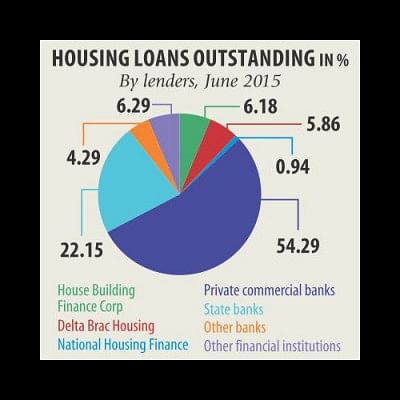

The total housing loans outstanding for the financial sector in 2015 was Tk 48,990 crore, with the rural mortgage portfolio amounting to Tk 4,023 crore.

“There remains a major untapped market for rural low- and middle-income housing finance as the lenders focus on catering to the needs of upper-income segments in major cities,” said the report.

The report, which will be unveiled at a programme on Thursday, has analysed secondary data collected from the central bank, scheduled banks, specialised housing financiers and real estate developers.

The objectives of the study are: assess the current and future demand for low- and middle-income housing finance, make recommendations to address barriers and develop a roadmap for widening access to housing finance.

The study identified the low- and middle income households as those with monthly household income of less than Tk 60,000.

“The rural low- and middle-income housing sector can create a huge opportunity for the banking sector,” said Ananya Wahid Kader, senior financial sector specialist of the IFC. The demand for housing finance will not only grow in rural areas but also in major cities including Dhaka, the report said.

Dhaka City is set to grow from a population of 1.89 crore in 2011 to a projected 2.74 crore by 2030, with an implied growth rate of 4.3 percent. While other cities will also grow, their proportion of the total urban population is expected to decline or remain static, IFC said.

Inadequate basic amenities both in urban and rural areas also create an opportunity for lenders to finance renovations or new construction, the report said.

Presently, over 85 percent of all rural and over 70 percent of urban dwelling units fall in inadequate or deficient categories, which signifies the scale of housing finance needs.

Bangladesh will need to construct about 85 lakh new houses in the next five years to overcome the existing shortage in urban areas, and most of the need is concentrated in the low- and lower middle-income groups, the report said.

Against this demand, about 25,000 units are supplied each year, according to the Real Estate and Housing Association of Bangladesh, the platform for realtors. REHAB members account for around 15,000 units.

However, the IFC report says that private developers cater only to the upper- and upper middle-income groups, while the middle- and low-income segments remain largely untapped. The development of affordable housing is in a very nascent stage, with the volume being barely 2 percent of all newly constructed apartments.

The state-owned House Building Finance Corporation, a traditional housing lender, is in a precarious financial situation and currently relies on loan recoveries to support its lending activity.

HBFC's market share fell from 48 percent in 2001 to 17 percent in 2011, and it is now much below 10 percent, according to IFC.

The government can inject target-based capital to HBFC, Ananya Kader said, adding that the state-owned housing lender must improve its efficiency and risk management to get the funds. The report also identified impediments that are affecting the growth of the housing finance sector.

These include inefficiency of the regulatory regime including foreclosure, land administration frameworks and poor legal infrastructure; deficient financial systems; dearth of long-term funding; and limited avenues for developer finance.

Insufficiently-developed land and inappropriate land planning and urban development policies are driving up real estate prices in Bangladesh. Land and titling procedures, registration procedures and costs, and a poor regulatory framework for real estate stifle the market as does the lack of an organised database and key information on the housing sector.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments