Tax returns shoot up 33pc

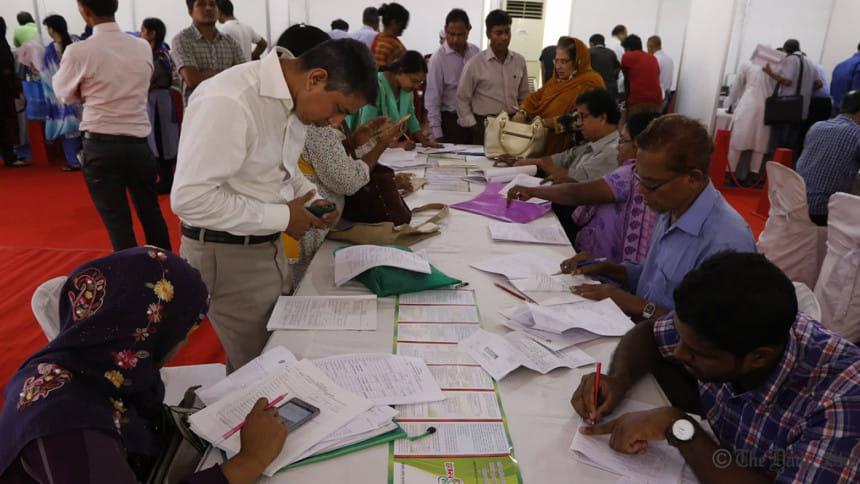

Tax return submissions shot up 33 percent year-on-year to 18 lakh last fiscal year, marking the highest spiral in the last decade, according to data of the National Board of Revenue.

Recent steps taken by the tax authority have ensured that a large number of individuals, particularly public and private employees, have been included in the tax net with higher compliance.

“This is a result of the legal measures we took two years ago to improve compliance,” said a senior NBR official preferring anonymity.

With returns hovering around 10 lakh between fiscals 2012 and 2014, the number of registered taxpayers and tax returns began to increase at a faster rate in the following years.

Today, the NBR has more than 37 lakh registered taxpayers, which is more than 2 percent of the total population of 16 crore. Three years ago, the number of Taxpayer's Identification Numbers (TIN) was just half of today's figure, according to the tax authority.

“The number of registered taxpayers started rising after we made it mandatory for the employees, rather than the workers, to have TINs,” he said.

Rules framed in fiscal 2016-17 state that both public and private sector employees, who earn Tk 16,000 or more a month, will require TINs to receive their salaries.

It also made mandatory for companies to submit a list of employees and their taxpayer identification numbers while showing their salary expenses. Rules were framed that public sector employees with a basic salary of Tk 16,000 and above will have to submit returns.

“Since then, we see a rising rate of compliance,” he said. “Apart from compliance, the rate of disclosure has also increased.”

The tax administration tightened measures further a year later making it obligatory for companies to ensure submission of income tax returns by their administrative employees and managers having taxable income.

Otherwise, companies would require paying taxes on the salaries to be paid to employees who avoid tax return submission.

This fiscal year, the NBR has changed the rule but said private sector employers will have to file a statement about the return of submission of their employees by April 30 each year.

Under the provision, private sector employees will have to submit their TINs, the date for tax return filing and the serial number provided by the income tax administration after the filing for every year by April 15.

Then, the employers will have to send the statements on returns filed by their employees by April 30. Employers will come under auditing taxmen if they fail to submit the statement.

The official said a reason behind tightening the measure was to increase collection of payroll tax, which is around 2 percent of total income tax collected in a year. The ratio is far below the developing country average of 20 percent, according to the official.

“Ours is perhaps the lowest in the world,” he said, adding that 40 percent of taxes come from payroll taxes in the USA.

He expected the number of return submissions would rise to 22 lakh at the end of the current fiscal on June 30, 2019.

“We expect better results this year than the previous year owing to increasing awareness. Now many employers are trying to ensure that their employees are submitting returns. This cooperative compliance is very positive,” he said, adding that the TINs of registered taxpayers would rise to one crore in the next five years if the trend continues.

Ahsan H Mansur, executive director of Policy Research Institute (PRI) of Bangladesh, said many people come into the tax net to keep the tax-free income ceiling unchanged for the last several years.

The NBR hiked the tax-free income threshold to Tk 2.5 lakh in fiscal 2014-15; the ceiling is unchanged since then.

“It has played a big role in increasing the number of return submissions. An increase in the salary of public sector employees after the implementation of a new pay scale also contributed,” he said.

“This needs to be sustained. The NBR should monitor that all employers are collecting payroll taxes from their employees and depositing it with the coffer. The NBR should also examine if the employees are complying. It would not be wise to give all responsibilities to the employers only,” he said.

Analysing Household Income and Expenditure Survey data between 2005 and 2010, the Centre for Policy Dialogue, last week, said the compliance rate remains low, although the size of the income taxpayer's base and income tax collections almost doubled during this period.

It also found through a survey that 68 percent of people did not submit tax returns the previous year despite having taxable income.

The CPD suggested encouraging self assessment by simplifying return submission for lower income groups, providing incentives to lower income people to become tax payers and ensuring efficient use of public money and better public services to encourage people to pay taxes.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments