Janata sinks into Tk 6,063cr loss

Just two big borrowers have plunged the once-profitable Janata Bank into such a precarious situation that the state-owned lender may need years to get rid of it.

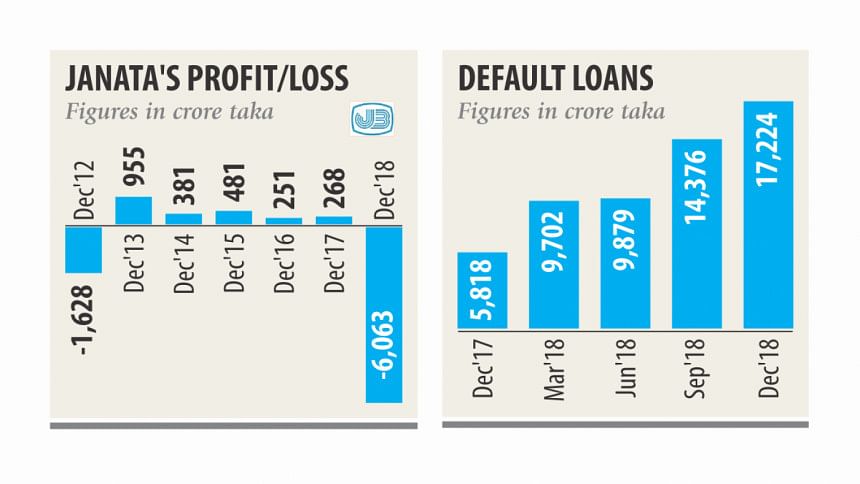

The bank made a net profit of Tk 268 crore in 2017, but a year later its loss skyrocketed to a whopping Tk 6,063 crore, mainly because of the failure of two borrowers -- AnonTex and Crescent -- in repaying the loans that were given without due diligence.

This was the first time a local bank has incurred such a huge amount of net loss in a single year in recent history.

Non-performing loans, a core indicator of a bank's health, surged 196 percent to Tk 17,224 crore last year, the highest among all banks, from Tk 5,818 crore in 2017, Bangladesh Bank data showed.

Large borrowers AnonTex and Crescent that together took loans of Tk 8,300 crore are mostly responsible for the massive deterioration in the bank's health as the loans were given through irregularities. Of the amount, Tk 7,600 crore turned defaulted

in December last year, according to the bank.

The BB unearthed the two scams at the beginning of last year.

Besides, continuous undue favour doled out to the large borrowers, which restructured their loans under a special restructuring package in 2015, squeezed the earnings of Janata Bank.

The bank requires to maintain a higher provision after the loans amounting to Tk 7,600 crore defaulted, Md Abdus Salam Azad, managing director of Janata Bank, said.

“High default loan eroded the profit of the bank,” he said.

The bank now plans to take provision forbearance from the central bank. If the BB exempts the bank from maintaining the provision, the loss will come down, he added.

“Otherwise, the loss will lead the bank to a huge capital shortfall of around Tk 6,000 crore in the final balance sheet,” Azad said. Despite the ailing health, the bank has continued to extend undue benefits to the large loan borrowers to keep their loan account regular at the expense of shrinking income.

Janata Bank extended its exceptional concession to Beximco Group by rescheduling its large loan and reducing the instalment size by almost half in December last year, after the conglomerate failed to repay two consecutive instalments.

The group's loan has doubled to Tk 3,619 crore from Tk 1,849 crore that was restructured, putting more pressure on Janata as the amount accounted for 75 percent of the lender's capital, also a breach of the ceiling set by the central bank.

This was a clear breach of the agreement related to the large loan restructuring, which was given to 11 companies in 2015. The facility was allowed by the BB on conditions that if the companies fail to repay even a single instalment, the loans will be dubbed as classified and will never be rescheduled.

Speaking about the concession made to the borrower, Azad said Beximco is the highest export earner in his bank.

“If we do not provide a breathing space to such a big client, the bank will weaken,” he said, adding that other state banks provided the same facility to Beximco.

Of the seven large loan borrowers, the loans of Beximco, Thermax and Jamuna groups are regular. Beximco and Thermax have managed it by cutting down the instalment size.

The bank has not been able to recover instalments from borrowers such as SA Group, AnonTex, Ratanpur and MR Group as they have filed writs with courts against their default status and secured stay orders, Azad said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments