31 listed banks see a surge in interest income

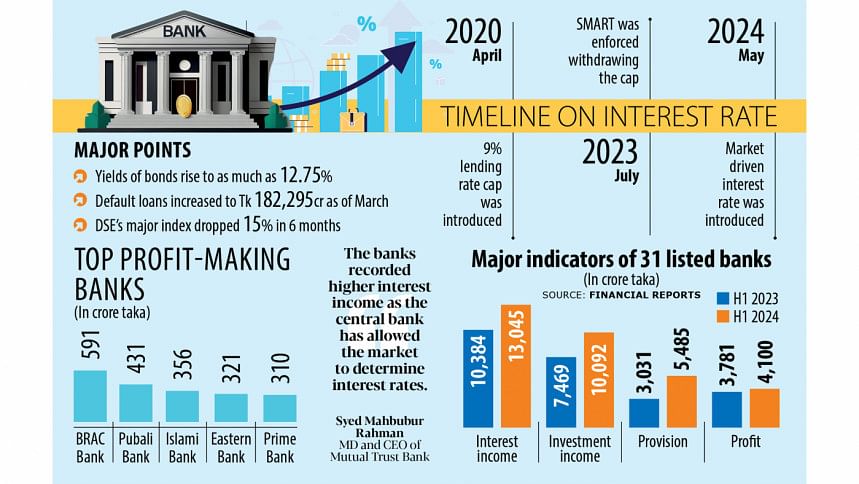

Banks listed in the stock market logged Tk 2,700 crore higher interest income in the first half of this calendar year as lending rates rose after Bangladesh Bank eased its grip on the sector.

Besides, increasing yields from treasury bonds helped the banks post more profit even though they had to keep hefty provisions against investments in stocks and default loans.

Default loans in the banking sector have hit an all-time high of Tk 182,000 crore, according to the central bank.

As per the recently published financial statements of 31 out of 36 listed lenders in the country, their combined interest income soared 26 percent year-on-year to Tk 13,045 crore in the January-June period.

Of this amount, their income from investments, mostly in government bills and bonds, jumped 35 percent year-on-year to Tk 10,092 crore.

"The banks recorded higher interest income as the central bank has allowed the market to determine interest rates," said Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank.

In May earlier this year, Bangladesh Bank returned to the market-driven interest rate regime after a gap of about four years by scrapping the Six-month Moving Average Rate of Treasury Bills (SMART).

In July last year, the central bank withdrew the 9 percent cap on lending and introduced the SMART formula as prescribed by the International Monetary Fund for securing a $4.7 billion loan.

Now though, it is going for a more market-based system to determine interest rates, effectively removing the caps imposed since April 2020.

However, private sector demand for credit slowed as the cost of borrowing rose. Against this backdrop, many banks chose to invest in treasury bonds and bills to reap the benefits of rising yields amid the government's continued borrowing.

"This enabled us to post higher returns from investment," added Rahman.

On the other hand, the banks are seeing sluggish profit growth as they had to maintain higher provisions against loans. The banks' combined profits grew 8 percent year-on-year to Tk 4,100 crore in the January-June period.

The banks' provisioning surged 81 percent year-on-year to Tk 5,485 crore at the time, their financial statements showed.

Regarding the higher provisioning, Rahman said they had to do it as default loans were rising and they suffered losses from investments in stocks.

"But if the banks keep higher provisions, it will be helpful for them in the future," added Rahman, also a former chairman of the Association of Bankers, Bangladesh.

Default loans in the banking sector amounted to 11.10 percent of the total outstanding loans by the end of March this year.

Meanwhile, the DSEX, the benchmark index of Dhaka Stock Exchange, lost 14 percent to reach 5,328 points by the end of June this year.

Another top official of a leading bank said several banks shifted their focus to treasury bonds instead of lending as the yields were comparatively more lucrative.

"It is a smart decision [to invest in treasury bonds] as these are safe and offer high income," he said while citing how such investments carry no risk of default and therefore do not require provisioning.

"On the other hand, banks have to take the risk of default if they lend to any sector. So, banks need to keep a minimum provision on unclassified loans too," he added.

The annual yield from treasury bills of different tenures currently ranges from 11.64 percent to 11.95 percent. Similarly, the rate for treasury bonds with different maturity periods ranges from 12.30 percent to 12.75 percent, as per central bank data.

The official said banks do not need to assess the risk when investing in government bills and bonds while the process is easy and carries almost no cost.

However, lending to any sector carries risks and processing costs while a credit team is needed to work on issuing disbursals subject to various conditions and also need to communicate with borrowers.

"So, smart banks preferred investing in treasury bills and bonds and have reaped the benefits," he said.

For instance, BRAC Bank's investment income doubled to Tk 1,191 crore in the first half of 2024. This was the highest investment income among all the 31 listed banks.

Powered by high investment income, BRAC Bank's profit surged 77 percent year-on-year to Tk 591 crore, the company said in its financial statement.

Pubali Bank, another private bank, was the second highest profit-making company during the six-month period ending in June. Its earnings rose to Tk 431 crore during the period.

National Bank incurred the highest loss of Tk 1,066 crore in the January-June period while ICB Islamic Bank saw losses of Tk 28 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments