Allocation for interest payments to rise 38%

The allocation for interest payments of domestic and foreign loans will likely increase by 38 percent to Tk 129,000 crore in the upcoming budget due to a significant hike in the cost of borrowing from both sources.

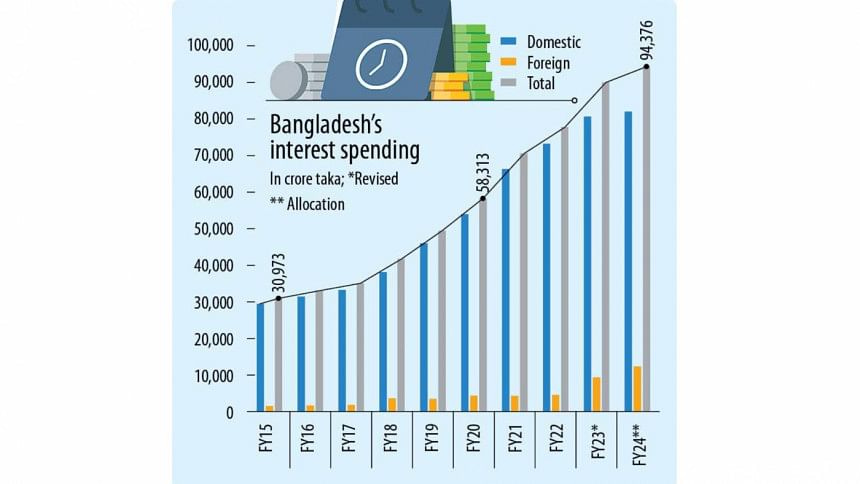

At the start of the current fiscal year, the government allocated Tk 94,376 crore towards interest payments, which crossed the Tk 100,000 crore mark for the first time after the budget was revised.

A finance ministry official, wishing anonymity, said the allocation for interest payments of domestic loans may increase by 33 percent to Tk 109,000 crore in FY25 compared to the original allocation for FY24.

Similarly, the allocation for interest payments of foreign loans are projected to rise by 61 percent year-on-year to Tk 20,000 crore next fiscal.

The increase in the government's treasury bond interest rate and the taka's depreciation could further drive up the allocation for interest payments when next year's budget is revised, the official said.

Finance ministry data shows that in the July-January period of FY24, interest payments totalled Tk 60,555 crore, a year-on-year increase of 26 percent.

The payment on the domestic front rose 15 percent to Tk 51,213 crore while interest payments for foreign loans went up threefold.

According to the latest data from the Economic Relations Division, interest payments for foreign loans jumped 125 percent to Tk 12,626 crore in the first 10 months of the current fiscal compared to FY23.

However, the total allocation was Tk 12,376 crore, meaning that the entire year's allocation was surpassed in only 10 months.

In dollar terms, it rose 101.5 percent to 1.15 billion.

As the taka depreciated against the US dollar in the past two years, payments through the local currency increased significantly compared to payments in dollars.

An ERD official said the average exchange rate rose to Tk 110 per dollar during the current fiscal, up from Tk 100 last fiscal.

As the Bangladesh Bank has recently hiked the price of each dollar to Tk 117, interest payments for foreign loans will rise significantly next fiscal.

The government's foreign loan utilisation has also been increasing in recent times, with $10 billion of foreign loans spent during each of the last two fiscal years.

Interest payments commence once the loan is utilised, thereby increasing the overall interest expenditure.

At the same time, interest rates of market-based loans have increased. Prior to the pandemic, interest rates of such loans were below 1 percent. But they have swelled to up to 9 percent in line with the international market.

The cost of funds mobilised through the sale of treasury bonds has also been on the rise, leading to further increases in interest expenditure.

The interest rate of treasury bonds has gone past 12 percent at present from 8 percent in June 2023, according to Bangladesh Bank data.

The interest rate for 5-year treasury bonds rose to 12.5 percent in May this year from 7.91 percent in December 2022. It was 10.3 percent in December 2023.

Though sales of instruments such as national savings certificates are currently low and interest rates against them have fallen, many schemes have matured. This means the government's expenses in this segment have also gone up.

As of December 31, the government's outstanding debt stock was Tk 1,659,334 crore, according to the finance ministry's quarterly debt bulletin. Of that, domestic debt stock was Tk 953,814 crore while foreign loan stock stood at Tk 705,520 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments