Govt’s interest expenses jump 26% in 6 months as funds get costlier

The government's expenses on interest payments rose about 26 percent year-on-year in the first six months of the current fiscal year due to a spike in the cost of borrowing from both local and external sources, official figures showed.

In July-December of 2023-24, the government spent Tk 50,223 crore to repay interests against loans, up from Tk 39,925 crore a year prior, according to a finance division report.

The interest costs for domestic loans increased 13.58 percent to Tk 42,313 crore while the same for foreign credits surged 195.81 percent to Tk 7,910 crore.

The higher spending comes as the yield against the treasury bills climbed in the past one year amid the government's escalated borrowing from the banking system amid lower-than-expected revenue collections.

The cost of external funds has also gone up because global interest rates rose as central banks around the world raised benchmark lending rates sharply to make funds costlier with a view to taming higher inflation.

The government of Bangladesh has set aside Tk 94,376 crore to service interest payments for FY24. It spent 53.2 percent of the budget in July-December.

The interest payment may exceed Tk 1,00,000 crore in the current budget, according to a finance ministry official.

The subsidy expenditure stood at Tk 15,934 crore, accounting for 19 percent of the Tk 84,002 crore allocated.

The government's borrowing from the banking sector mainly takes place through the 91-day treasury bill.

The range of the yield of the 91-day treasury bills was 11.24-11.35 percent on March 25, up from 6.30-6.50 percent a year ago. The yield of the 182-day treasury bills rose to 11.28-11.40 percent from 7.04-7.10 percent during the same period, Bangladesh Bank data showed.

The government borrowed Tk 78,190 crore through treasury bills in the July-September quarter. Of the sum, Tk 34,656 crore was borrowed through the 91-day treasury bill, according to the finance division.

Another finance ministry report shows that the interest expenditures for the treasury bills surged 159 percent year-on-year in the quarter, while the interest cost of treasury bonds was up 24 percent.

The figure for the second quarter was not officially available, but an official of the ministry said the same trend was observed in October-December as well.

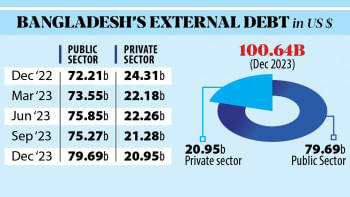

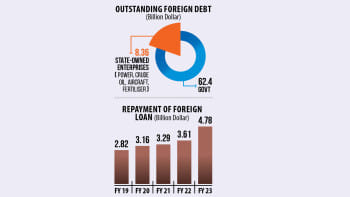

In recent times, the interest payment expenses have risen because of the hike in non-concessional loans from bilateral and multilateral partners.

In 2023, the government borrowed about $2.6 billion at market-based rates. In 2022, it was $3.42 billion.

The Secured Overnight Financing Rate (SOFR), the global benchmark interest rate, stands at more than 5 percent currently whereas it was less than 1 percent before the latest surge in the cost of funds. Some additional charges take the borrowing rate to 8 to 9 percent, finance ministry officials said.

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said since the treasury bill's yields have gone up, the government's interest expenses in the domestic sector increased.

Speaking about the implication of the higher interest outlays, he said the government would have to cut expenses in other areas in order to keep the budget deficit within the target.

"Otherwise, the deficit will widen and the government will have to borrow to finance the budget deficit."

As of September 30, the government's outstanding debt stock was Tk 16,55,156 crore: the domestic debt stock amounted to Tk 9,74,092 crore while the external debt stock totalled Tk 6,81,064 crore.

The government's borrowing cost through savings instruments fell 10 percent year-on-year in the first quarter of FY24.

Various reform initiatives such as the online issuance, an investment limit, the introduction of multiple interest rates, and higher inflation have contributed to the decline of the sales of the tools, the finance ministry report said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments