Budget goals not backed by measures: CPD

The positive objectives laid out in the proposed national budget for fiscal 2025–26 are not backed by measures, said the Centre for Policy Dialogue.

"The budget focused on several things like reducing inequality, overall development and human capital, which is good. Unfortunately, these are not supported by steps," said CPD Executive Director Fahmida Khatun at a media briefing on the think-tank's analysis of the national budget for the upcoming fiscal year.

While there are several positive initiatives such as tax relief for several sectors, allocations and incentives for some sectors and higher taxation for tobacco producers, the proposed budget fails to address the ongoing economic challenges holistically.

Some fiscal measures, including allowing black money, contradict the theme of the budget, which is 'building an equitable and sustainable economic system', she said.

Though the tax rate for legalising undisclosed income has been raised significantly, keeping this provision will send the wrong signal to the public and is against the spirit of July, according to the CPD.

This provision creates a disincentive for honest taxpayers and creates inequality as the huge supply of funds raises the apartment prices beyond the reach of honest taxpayers and middle-income people.

The overall budget is compatible with assumptions but it is disappointing in terms of expectations, said Mustafizur Rahman, a distinguished fellow of the CPD.

About the 1 percent turnover tax on all firms, he said the move was in preparation for graduation from the least-developed country bracket in 2026 and must be accepted.

"The government tried to reduce the anti-export bias and protection for local firms."

However, there is no indication of measures that can raise the firms' competitiveness. Such steps could include a single window for all services, a reduction in bank interest rates and reducing the cost of doing business, he said.

Although the government came through the July uprising, it was expected that there would be specific steps for the unemployed youth.

"But this was not done. So, job creation will have to come through investment. But, protection has been reduced for local firms, so it would be a challenge to create more jobs."

As the tax-to-GDP ratio is low, the government is limited in its ability to reduce inequality.

Moreover, out of the total revenue collection, two-thirds come from indirect tax, which comes from the general public too. So, it is difficult to reduce inequality with the existing tax system, Rahman added.

The budget shows that provisional GDP growth for this fiscal year would be 5 percent, whereas the Bangladesh Bureau of Statistics estimated it would be around 4 percent.

So, how it would rise is not clear, the CPD said.

It is also not clear how the 5.5 percent GDP growth target for next fiscal year would be achieved, Fahmida said.

Inflation is expected to fall drastically to 6.5 percent next fiscal year, while average inflation was 10.1 percent as of May.

"The inflation projection seems ambitious."

The government may not have considered the actual progress on revenue collection for this fiscal year when it set fiscal 2025-26's collection target.

"It looks high," she said.

The slash in allocation for the agriculture sector from next fiscal year's development budget is a troubling development at a time when ensuring food security remains a high priority.

The share of projects with symbolic allocation has increased substantially, which is an objectionable development and a move in the wrong direction.

Meanwhile, the pace of implementation of mega projects remains a concern. Even if maximum utilisation of resources is ensured, none of the eight mega projects scheduled for completion in fiscal 2025-26 will be wrapped up.

Regarding private investment, the CPD said the government has targeted to increase the private investment-to-GDP ratio to 24.3 percent.

"Whether it is possible in the current political climate remains a question."

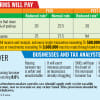

The moves to reinstate the highest tax slab of 30 percent and fix a minimum tax of Tk 1,000 for new taxpayers are both welcome.

The tax burden on relatively low-income groups and middle-income people will be higher due to the change in the tax rate of several tax slabs.

For those with annual incomes of Tk 6 lakh, Tk 10 lakh and Tk 15 lakh, the total tax liability will rise by 12.5 percent, 16.7 percent and 16.7 percent respectively.

In contrast, for those earning Tk 30 lakh, the rise will be comparatively lower at 7.6 percent.

This goes against the principle of equitable tax burden and fairness, and such types of fiscal measures will not be able to reduce inequality, the CPD said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments