Bangladesh’s credit rating depends on political stability: Moody’s

Bangladesh's credit rating will depend on maintaining political stability and the interim government committing to structural reforms, said US ratings agency Moody's.

The agency said credit ratings might worsen if prolonged political or social unrest derails progress on structural reforms and dampens growth or if the interim government deviates from its commitments to structural reforms.

The observation was issued on August 8, when an interim government led by Nobel laureate Prof Muhammad Yunus was sworn in after a mass uprising toppled the Sheikh Hasina-led government.

"It is unclear whether the political and social unrest will subside following Hasina's departure and questions remain over the formation of the interim government headed by Yunus, an economist who founded microfinance institution Grameen Bank," Moody's said.

"We expect short-term disruptions in remittance and financial flows as risk-averse individuals, investors, and companies pause in repatriating or investing their capital in Bangladesh amid the heightened political uncertainty, weakening the government's external position," it added.

It said a reduction in remittances would in turn reduce banks' foreign currency liquidity, which accounts for a significant portion of banks' liquid assets.

The Moody's views come more than a week after S&P Global downgraded Bangladesh's long-term sovereign rating from BB- to B+ amid deadly protests over the quota-based hiring system for government jobs.

Some 551 people, including students, died as of August 7 amid clashes that saw law enforcers open fire on protesters.

Moody's said Bangladesh's economy may grow 5.5 percent to 6 percent in FY25. But inflationary pressure since mid-2022 persists, which has led to a curb in domestic consumption and a decline in real wages, it added.

Prolonged social unrest could continue to weigh on domestic consumption, which accounted for about 66 percent of the country's GDP in the past five years.

However, a modest recovery in merchandise exports would balance this risk in the second half of 2024.

Moody's said a prolonged shutdown of businesses would weigh on their and individuals' ability to repay loans, increasing the risk of non-performing loans (NPLs).

"A loss of confidence among retail depositors, prompting them to withdraw their deposits as a safeguard against potential bank failures or economic downturns, could also strain banks' liquidity."

It said a reversal of bank reforms on tightening loan classifications to accelerate NPL recognition from 2024 or reduced reform momentum to strengthen the banking sector would be credit negative for Bangladesh's banking system.

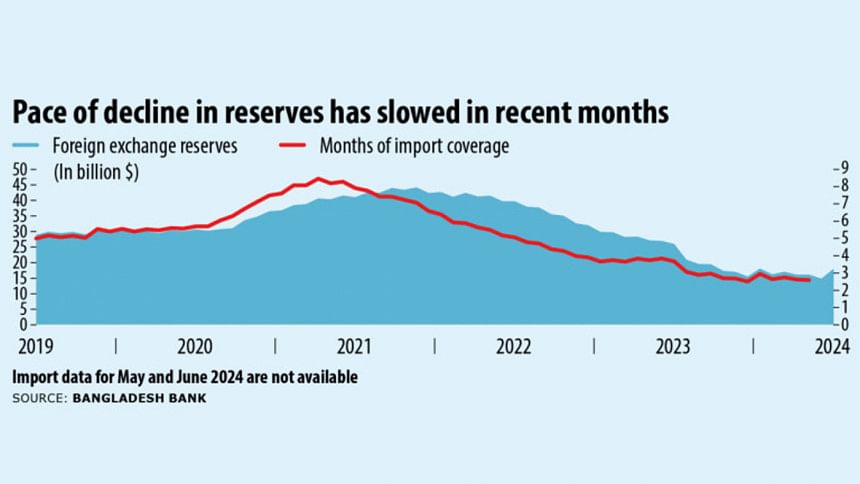

Moody's said the government has made progress over the past year on structural reforms to address external vulnerabilities and liquidity risks despite a structurally weaker external position than before the pandemic, with lower reserve buffers as well as high inflation and youth unemployment.

Citing the disbursement of the third tranche of a $4.7 billion loan by International Monetary Fund (IMF) in June this year, it said Bangladesh's progress included the implementation of a formula-based fuel price adjustment mechanism for petroleum products, liberalisation of the reference lending rate, tightening of banks' overdue loan classifications and the introduction of a crawling peg regime.

"The crawling peg regime is a transitional step towards greater exchange-rate flexibility to restore external resilience," it said, adding that the Bangladeshi taka lost 6.3 percent of its value against the US dollar following the introduction of the crawling peg in May this year, narrowing the gap between the official and black-market rates.

"While the country's external position and liquidity pressures were high before the protests, some metrics have been improving marginally," said Moody's, adding that monthly remittances rose since the beginning of this year, amounting to more than $2 billion each month from January to June 2024 from $1.3 billion in September 2023.

The US ratings agency also said the monthly current account balance went into a surplus since the beginning of the year because of import restrictions.

"The national financial account remains in deficit because of lower trade credit inflows amid reluctance in repatriation of export earnings and taka depreciation pressures," it said, adding that the pace of decline in reserves slowed in recent months.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments