BB to adopt more flexible exchange rate to meet IMF conditions

After a months-long stalemate, the Bangladesh Bank (BB) is finally set to adopt a more flexible exchange rate regime to fulfil conditions tied to a $4.7 billion International Monetary Fund (IMF) loan programme, which will likely enable Bangladesh to receive $1.3 billion in the fourth and fifth tranches.

The central bank is likely to issue a circular in this regard today.

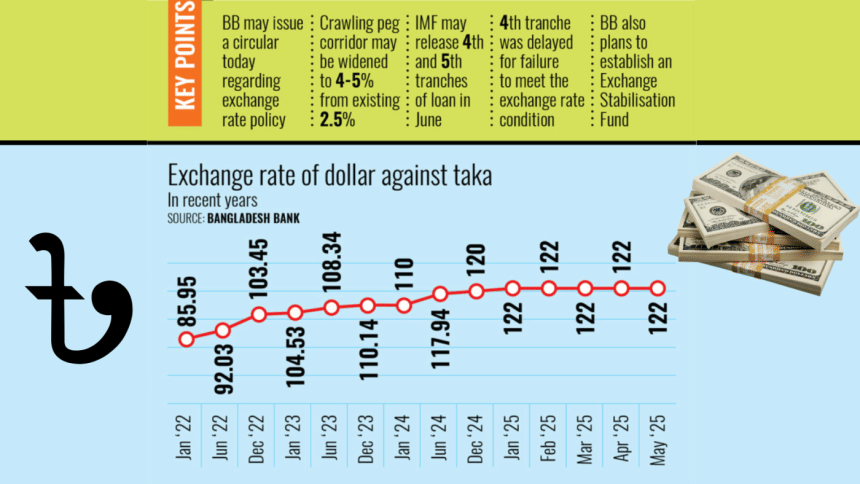

Currently, banks in Bangladesh are following a crawling peg rate system for spot purchases and sales of US dollars, where the mid-rate is set at Tk 119 with a 2.5 percent corridor per greenback.

The banking regulator may increase the corridor to 4 or 5 percent as part of its initiative to bring more flexibility to the foreign exchange market, The Daily Star learned from central bank officials.

As a result, banks will be able to quote 4 to 5 percent higher or lower than the mid-rate for spot purchases and sales of US dollars.

Central bank Governor Ahsan H Mansur is expected to address the issue during a virtual press briefing from Dubai at 2pm today, where he may share further details about the flexible exchange rate and IMF loan programme.

He is also likely to discuss the Exchange Stabilisation Fund (ESF), an emergency reserve account that can be used to mitigate instability in various financial sectors, including foreign exchange markets, which will be formed by the central bank.

A senior central bank official, seeking anonymity, told The Daily Star that the IMF agreed to release the expected funds in recent meetings as Bangladesh is going to bring greater flexibility to the forex market.

"After declaring the flexible exchange rate on Wednesday, the IMF will inform us about the staff-level agreement, and then they will place the loan issue in its board meeting in June and they are likely to approve it," the official said.

The $4.7 billion loan programme was agreed upon in early 2023. So far, Bangladesh has received $2.3 billion in three instalments under the Extended Fund Facility, Extended Credit Facility, and Resilience and Sustainability Facility.

The fourth tranche, originally slated for March, was delayed over concerns that the central bank had not moved decisively enough to unify the multiple exchange rates used across different transactions.

The IMF has long pressed for the country to abandon its tightly managed currency regime in favour of greater flexibility, a shift seen as crucial to easing pressure on dwindling foreign exchange reserves and restoring investor confidence.

In February of this year, the BB governor said the central bank was not moving away from the crawling peg mechanism to a free-floating exchange rate regime to "avoid any speculative role" by foreign currency market aggregators.

The central bank also fears that a free-floating exchange rate may fuel inflationary pressure, especially as inflation in Bangladesh has remained above 9 percent for the past 26 months.

However, businesspeople, especially exporters, have consistently urged the central bank to let the market determine the exchange rate.

The foreign exchange market in Bangladesh has been volatile for more than three years, but it has stabilised in recent months due to high foreign currency inflows created by export earnings and remittance inflows.

Economic experts have said that the central bank should meet the IMF conditions to release the remaining instalments of its $4.7 billion loan programme.

Mohammad Abdur Razzaque, economist and chairman of local think tank Research and Policy Integration for Development, recently said that IMF loans are necessary now because failure to secure IMF funds might raise questions about the government's policy credibility.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments