Bourse braces for its biggest IPO yet

Robi is set to come up with the country's biggest-ever initial public offering yet within a couple of months, in what can be viewed as finally some good news for the depressed bourse.

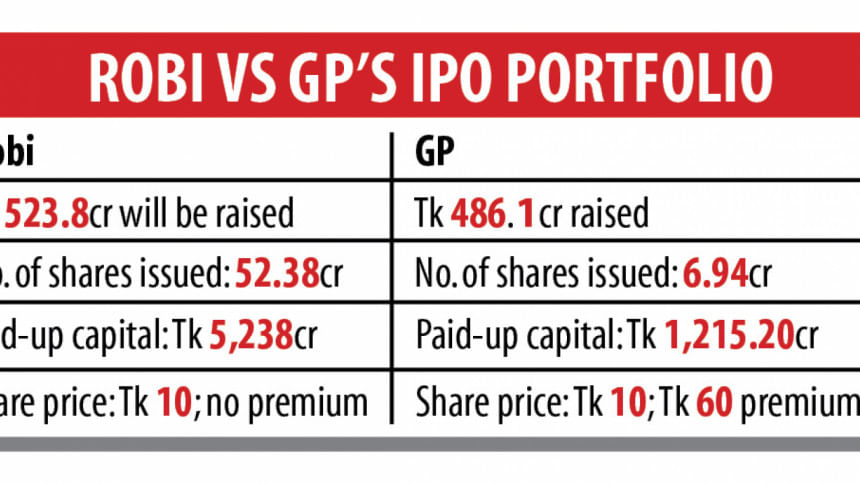

The second-largest mobile phone carrier intends to raise Tk 523.79 crore from the market.

The Bangladesh Securities and Exchange Commission (BSEC) has almost completed the scrutiny of the floatation proposal and is planning to approve the listing proposal within the next couple of months.

Some 10 per cent, or about 52.38 crore, shares would be offloaded, according to the application, which was submitted on March 2. The face-value will be Tk 10 and there will be no premium.

Prof Shibli Rubayat Ul Islam, the newly appointed chairman of the BSEC, said though the previous commission scrutinised Robi's application it was quite easy for the new commission to give its seal of approval.

"But the new commission has decided to go for a second scrutiny. We are very positive about Robi's enrolment and hope to accept it within the next couple of months," he said.

Robi's listing would help bring the market to a lucrative shape, he said.

Md Nafeez Al Tarik, chief executive officer of Asian Tiger Capital Partners Asset Management, said the company is coming at a face-value.

"This is a good sign and it will impact the stock market positively. Investors may come to the market to buy the stocks which we saw when Grameenphone went public," he said.

Robi, a sister concern of Axiata Group of Malaysia and a multinational venture, is very compliant and the market has not seen the entry of such a good company in the last eight to 10 years, according to Tarik.

"The government should introduce such good companies to the market."

As Robi is coming at the face-value, investors would gain in the long run as it is yet to see a higher growth in its balance sheet following the merger of Airtel, said a merchant banker.

Investors would get the share at Tk 10 that has the assets of Tk 12.64, he said, adding that the share price compared to earnings before interest, tax, depreciation and amortisation (EBITDA) is very lucrative.

The price of telecom shares normally ranges between 6 and 8 per cent of EBITDA globally, but it is 3.35 per cent in case of Robi, he said.

So, the company's entry may give a leg up to the ailing stock market, especially during the coronavirus pandemic as most of the companies have failed to make profits because of the collapse in demand, except those operating in the pharmaceuticals and telecom sectors, the merchant banker added.

The DSEX, the benchmark index of the Dhaka Stock Exchange, dropped to 3,603 points on March 18, the lowest in seven years.

As the market had been falling because of the fear over earnings falls amid the raging pandemic, the stock market regulator set floor prices for all stocks to prevent the freefall.

Now, the index is hovering between 3,800 and 4,000 points.

According to an industry calculation, if the carrier's share is sold at the face-value of Tk 10, the market capital would increase by more than 1.65 per cent. If the share price rises to Tk 50, the market capitalisation would expand by 7.74 per cent.

The DSE's current market capitalisation is about Tk 311,125 crore.

In the application, Robi requested the government to bring down the corporate tax rate to 35 per cent and withdraw 2 per cent minimum income tax.

Grameenphone had received the corporate tax benefit when it got listed in 2009. The government withdrew the benefit a few years ago.

About the demands of Robi, the BSEC chairman said he learned about the issues but the commission has nothing to do about them.

"Both issues are related with the National Board of Revenue and we could write to the NBR but it is up to the revenue board whether it would do it or not," Islam told The Daily Star on Saturday.

However, Islam said the operator should get some extra benefits for the listing.

"We are waiting for the approval from the BSEC," said Shahed Alam, chief corporate and regulatory affairs officer of Robi.

"As of now, we are happy with the development in this regard. We are hopeful that we will soon get the nod from the commission."

Robi has allocated 13.61 crore shares to its employees and collected Tk 136.10 crore, a top-placed source at the carrier said.

Talks of Robi's listing have been going on since 2013. The government has requested the operator on several occasions to go public, but Robi did not entertain it on grounds of not logging in profits consistently.

It raked in Tk 240.23 crore in profits in 2015 after two years of losses. The operator returned to profitability in 2018. In 2019, Robi's profit stood at Tk 16.91 crore, down 92.12 per cent from the previous year.

Its earnings per share were Tk 0.46 in 2018 but it came down to Tk 0.04 at the end of 2019.

The carrier started its journey in 1997 under the brand name of Aktel. On May 28, 2009, the name of the company changed to Axiata (Bangladesh) and it assumed its present name on August 19, 2010.

Robi's authorised capital is Tk 6,000 crore and paid-up capital Tk 4,714 crore. Net asset value per share was Tk 12.64 in 2019, down from Tk 12.85 a year earlier.

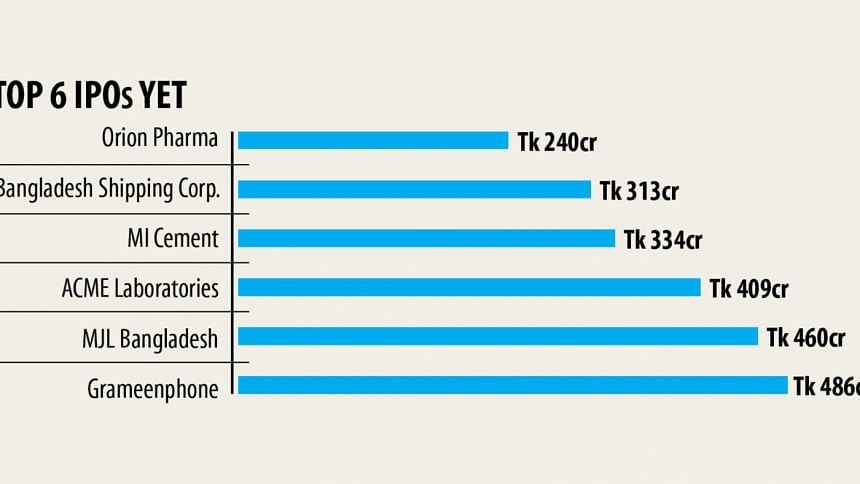

In 2009, Grameenphone became the first mobile carrier in Bangladesh when it made its debut on the twin bourses. It raised Tk 486.07 crore by issuing 6.94 crore shares.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments