BRAC Bank emitted 1,477,468 tonnes of carbon dioxide equivalent in 2024

BRAC Bank has released its Sustainability and Impact Report 2024, where it reported emitting a total of 1,477,468 tonnes of carbon dioxide equivalent (tCO₂e) across direct, energy-related, and value chain activities in 2024.

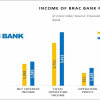

Under Scope 1—which includes direct emissions from sources owned or controlled by the bank, such as diesel generators, refrigerants, and fleet fuel—the bank reported 1,630 tCO₂e.

For Scope 2, covering indirect emissions from purchased electricity, the figure stood at 16,671 tCO₂e.

Scope 3 emissions, which encompass indirect impacts across the value chain, amounted to 1,459,167 tCO₂e.

Of this, 1,423,479 tCO₂e came from Category 15 financed activities—emissions generated by the businesses and sectors the bank supports. These alone represent over 96 percent of BRAC Bank's total reported carbon footprint.

The remaining Scope 3 emissions, totaling 35,687 tCO₂e, were linked to business travel, waste, procurement, and employee commuting.

The bank has publicly disclosed its greenhouse gas (GHG) emissions data, covering the full spectrum from internal operations to emissions generated through its financing activities.

In the report, the bank said it had completed a full-scale carbon accounting exercise.

It considers the release of the report a significant step toward environmental transparency in the financial sector.

"This positions BRAC Bank as a national frontrunner in South Asia among financial institutions voluntarily reporting Category 15 emissions under Scope 3, as defined by the GHG Protocol," the bank said in a statement.

The GHG Protocol is considered the most complex and material aspect of a bank's climate impact, with quantification based on the globally recognized Partnership for Carbon Accounting Financials (PCAF) standard.

Additionally, 18,112 tonnes of emissions were avoided through the bank's clean energy investments and solar infrastructure, leading to a net climate impact of 1,459,356 tCO₂e for 2024.

The exercise revealed key insights: three sectors—petroleum and chemicals, food and beverage, and metal manufacturing—were responsible for 61.5 percent of these emissions, despite comprising only 21 percent of the loan book.

These findings are now shaping the bank's transition finance strategy, enabling the redirection of capital to climate-smart sectors while supporting high-emitting industries to decarbonize.

To ensure accuracy, the bank aligned its methodology with global frameworks including the GHG Protocol, Global Reporting Initiative (GRI) Standards, and International Financial Reporting Standards (IFRS) S1 and S2 under the International Sustainability Standards Board (ISSB).

It also used internal sustainability risk tools such as sectoral carbon intensity metrics and Climate Vulnerability Indexes (CVI) to assess portfolio risks.

Beyond the data, this marks a shift in the bank's operating philosophy, the bank said.

BRAC Bank has embedded emissions intensity and sectoral indicators into its credit risk framework, enabling real-time monitoring.

This lays the foundation for sustainability-linked loans, climate-tied credit products, and preferential terms for clients undertaking measurable transitions.

"The move strengthens Bangladesh's standing in the global green finance space. Full transparency, particularly of financed emissions, positions BRAC Bank to engage with international development finance institutions, green, social and sustainability bond markets, and global ESG investors on a firmer footing," the statement said.

Importantly, BRAC Bank's climate roadmap now includes developing sector-specific glide paths for high-emitting clients, setting reduction targets, and onboarding borrowers to carbon literacy tools.

The bank is also expanding climate-aligned project finance, with recent investments including a 68 MW grid-tied solar plant projected to offset over 70,000 tonnes of CO₂ annually, and Tk 5,335.7 crore disbursed in support of low-carbon technologies.

"This landmark declaration sets a new benchmark. BRAC Bank proves financial institutions can play a catalytic role in economic decarbonization through data-backed, forward-thinking action.

By accounting for its entire GHG footprint, the bank has elevated the standard of climate leadership in Bangladesh's financial sector, offering a blueprint for future-proof, purpose-led banking—and paving the way for policy reform, sectoral collaboration, and meaningful investor engagement."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments