Decade of Grameenphone’s rise and Banglalink’s decline

Grameenphone’s market share edged up about two percentage points over the past decade, thanks to huge investment in network expansion that gave the mobile operator leverage to almost double its revenue.

The company has started the new decade with a 46.18 per cent share of total customers in the market, up from 42.80 per cent just five years back, according to a report of the Bangladesh Telecommunication Regulatory Commission.

The regulator yesterday published a report on active user in Bangladesh and found that Grameenphone’s active customer number was 7.64 crore at the end of December last year.

The country’s second largest operator, Robi, had 4.90 crore active connections, Banglalink 3.52 crore and state-run Teletalk 48.68 lakh.

All four operators added only 85.83 lakh active SIMs in 2019 as the market was somewhat slow because of the regulatory restrictions on top two players.

Grameenphone had a wonderful journey in the last two decades, which is why they were able to build a huge customer base, said BTRC Chairman Md Jahurul Haque.

“But along with a bigger market share, regulatory compliance also needs to be ensured.”

Though Grameenphone’s market share in terms of subscription is below 50 per cent, their share in revenue is more than 50 per cent, leading to an imbalance in the market.

“To enhance competition in the market, we are working to bring significant market power (SMP) regulations, which we think will give small operators some space to grow further,” Haque added.

The SMP is a regulation that imposes restrictions on an operator once it corners 40 percent of the subscribers, revenues and spectrum, according to the BTRC.

As per the parameter, the telecom regulator last year declared Grameenphone as an SMP operator but the restrictions imposed then did not come into being due to court orders.

However, BTRC officials said fresh restrictions are on way to contain influence of the operator, which currently has an annual revenue base of about Tk 14,000 crore.

The mobile operators’ combined revenue runs into Tk 26,000 crore now, which is almost double of what it enjoyed ten years back.

Grameenphone, however, said they have become “a customer-centric brand and logged the growth through continuous modernisation and expansion of 3G and 4G networks”.

“Our innovative products and digital services helped earn the trust of customers,” said Md Hasan, head of external communications at Grameenphone.

Five years ago, Bangladesh had six mobile operators and Banglalink was the second largest carrier in terms of customers with a 25.68 per cent market share.

Their market share was 26.45 per cent ten years back but fell to 21.28 per cent at the end of December last year.

Robi, which was the third largest carrier until it merged with Airtel in November 2016, controls 29.60 per cent of the market.

At the end of 2014, they had a 21.01 per cent share while Airtel had 6.24 per cent, according to the BTRC. Ten years ago, Robi had only 17.72 per cent share.

“Market share of a mobile operator is the direct representation of its strength,” said Shahed Alam, chief corporate and regulatory officer at Robi.

A company’s pricing strategy is highly influenced by its financial strength and market power, he said, adding that the regulator has effectively managed the competition in voice market but unfortunately data market remains unregulated.

As a result, the market is experiencing competitive distortion in terms of direct subsidy on customer acquisition and cross subsidisation of data service by earnings from voice, which is ultimately leading to predatory pricing, he said in a statement.

Market competition has been distorted to such a level that smaller operators risk extinction, Alam said, adding: “The only way to address this fundamental problem is to ensure immediate enforcement of competition regulations.”

State-run carrier Teletalk had a very nominal market share from the beginning: they now control only 2.94 per cent, a slight increase from 2.04 per cent in 2009.

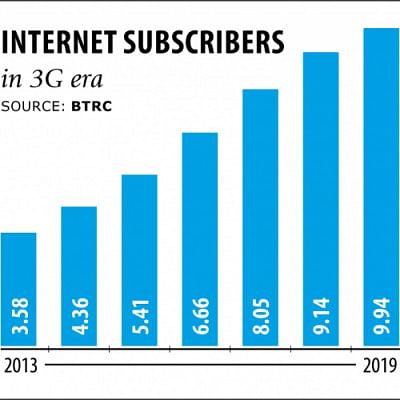

The internet started to dominate the telecom industry in the last decade with the advent of 3G and 4G technologies.

At the end of February 2012, the country had 3.11 crore active internet connections that reached 9.94 crore in December last year, with 94.22 per cent of the latest figure being mobile internet.

The preceding decade also witnessed the demise WiMax, a wireless broadband service: currently there are only 5,000 active connections.

At the end of December last year, fixed broadband number amounted to 57.42 lakh, up from 12.80 lakh in February 2012, according to the BTRC.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments