Deep uncertainty stalls businesses

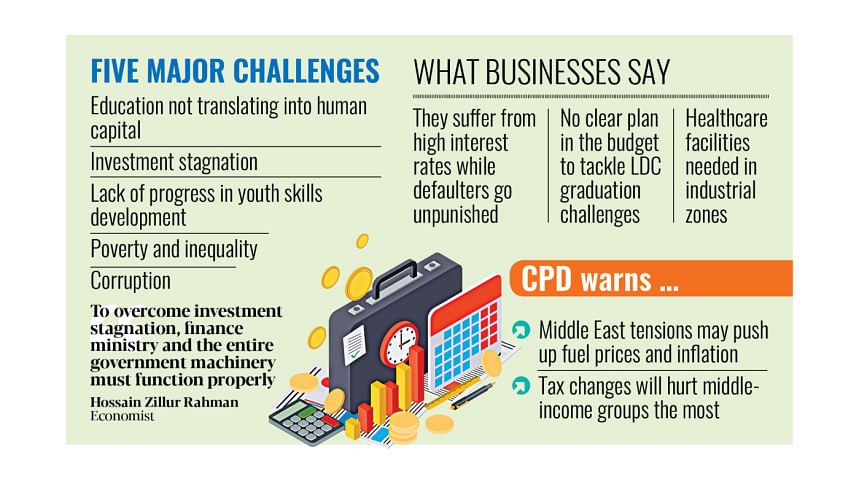

The country's business climate is weighed down by a deep shadow of uncertainty, economist Hossain Zillur Rahman said yesterday, warning that the stagnation is slowing economic progress.

"We have draped the society under a blanket of suspicion. In such conditions, people are left idle and suffer," Rahman said at a post-budget dialogue organised by the Centre for Policy Dialogue (CPD) in Dhaka.

He explained this suspicion as distrust directed at many because of the actions of a few. Rahman blamed this on false or fabricated cases filed after the Awami League government was ousted in a mass uprising in August last year.

He said overcoming investment stagnation would require the entire government machinery to function properly. "If ministries, from home affairs to the judiciary, fail to perform their duties, the problem will remain unresolved," he said.

The economist called for what he termed "sacred anger" to push for change. "There is a peculiar syndrome in this government. They listen but do not respond."

He pointed to other major challenges, including a shortage of skilled workers, corruption, poor progress in youth skills, an education system failing to build human capital, and widespread corruption.

Rahman also said political will is needed for bold budget decisions.

"Many ask why the budget is so conventional despite four economists in the advisory council. Even if all its members were economists, nothing exceptional would happen without political courage," he commented.

Business leaders at the programme echoed similar concerns.

Showkat Aziz Russell, president of the Bangladesh Textile Mills Association, said firms are in a painful situation as they are going through a very uncomfortable time under high interest rates.

"We see beautiful economic models being prepared, but when someone loots money, we are the ones who compensate for it. Those of us who do business with honesty have to bear the burden of high interest rates," Russell added.

"Identify those who looted public money and punish them. No bank official has faced jail so far," he added.

"The government cannot increase interest rates to subsidise the stolen money. That is unacceptable," commented the business leader. "Previous governments distorted facts and misled the public in various ways. The current government seems to be heading in the same direction."

Inamul Haq Khan, senior vice-president of the Bangladesh Garment Manufacturers and Exporters Association, said the budget offers no guidance on coping with challenges after graduation from the least developed country club next year.

He also criticised the lack of talks with businesses on recent US tariffs.

"The government has not held any discussions with us regarding it, and the business situation will worsen if we fail to handle the inflated duties to the American market," he mentioned.

Khan also said that simply increasing labour wages will not solve all the problems amid high inflation.

"The government could build a hospital in the Ashulia-Gazipur industrial belt for the workers. This would allow them to receive healthcare services at affordable costs," he added.

Barrister Rumeen Farhana, a former lawmaker and BNP's assistant secretary for international affairs, said the budget for the upcoming fiscal year shows no fresh ideas despite input from respected economists.

"This is extremely unfortunate," she added.

Fahmida Khatun, executive director of the CPD, warned of rising inflation due to the Middle East conflict, which is likely to drive up fuel prices and import costs.

She also criticised the changes to the income tax threshold.

"This will disproportionately raise the burden on low- and middle-income earners over the next two fiscal years, while taxpayers in higher income brackets will face a relatively modest increase," said Khatun.

The economist said this goes against the principle of equitable tax treatment and fairness.

According to CPD estimates, tax liabilities for individuals earning Tk 6 lakh, Tk 10 lakh, and Tk 15 lakh annually will rise by 12.5 percent, 16.7 percent, and 16.7 percent, respectively, over FY27 and FY28.

Meanwhile, those earning Tk 30 lakh a year or more will see their tax burden increase by only 7.6 percent.

In the new budget, the annual tax-free income threshold for general taxpayers has been raised to Tk 3.75 lakh for FY27 and FY28.

"It's a positive step. But the concern is that it won't take effect until FY2026–27. That raises questions, especially since the previous threshold was set back in FY24," she added.

Prof Mustafizur Rahman, a distinguished fellow of the CPD, conducted the dialogue.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments