Distressed loans soar to a record Tk 4.75 lakh cr

Distressed loans at banks totalled over Tk 4.75 lakh crore at the end of 2023 – a revelation that makes for a sobering read of the actual health of this vital sector of the economy.

The amount is the sum of non-performing loans (NPLs), rescheduled loans and restructured write-offs, all of which were disclosed in the latest edition of the Bangladesh Bank's Financial Stability Report yesterday.

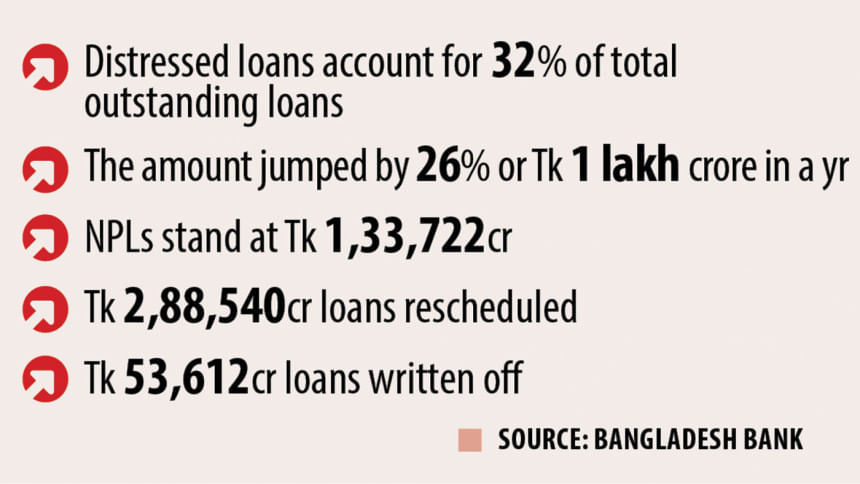

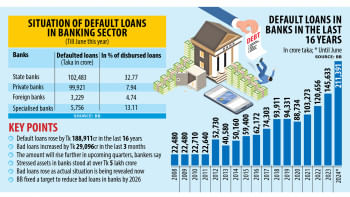

The distressed loans amounted to almost 32 percent of the total outstanding loans of about Tk 15 lakh crore as of December 2023. The sum is a nearly Tk 1 lakh crore or 26 percent jump from a year earlier and close to the operating expenditure of the 2023-24 national budget.

Zahid Hussain, former lead economist at the World Bank's Dhaka office, blamed political or business influences in disbursing credit for the rise in distressed loans.

"This was because of bad governance as the banking regulator has given support and on the other hand, the big borrowers have taken the loan facilities using their influences through various political channels," he said.

At the end of 2023, the banking sector's NPLs stood at Tk 133,722 crore, rescheduled loans at Tk 2,88,540 crore and written-off loans Tk 53,612 crore.

The breakdown of distressed assets has been revealed as part of the conditions agreed with the International Monetary Fund for the $4.7 billion loan programme, which was launched last year.

As per international best practices, distressed assets are reported alongside NPLs to reflect the true state of the banking sector's stressed assets.

"The asset quality of the banking sector might have deteriorated partly due to a lack of oversight on regular and rescheduled or restructured loans and advances as well as slow progress in NPL recovery," the report said.

External issues like the ongoing Russia-Ukraine war, Israel-Palestine conflict, and other global and domestic challenges may have impaired the borrowers' repayment capacity, which in turn might have translated into the deteriorated asset quality of the overall banking sector, it added.

In recent times, a huge amount of loans has been rescheduled. About Tk 63,720 crore loans were rescheduled in 2022. The amount of rescheduled loans in 2023 was Tk 91,221 crore.

The report said the Bangladesh Bank introduced a temporary and somewhat lenient policy in 2022, allowing banks to reschedule loans by taking reduced down payments and granting a relatively longer tenure to the borrower for repayment.

"Banks were also allowed to frame their own policy to reschedule loans based on the parameters set by the Bangladesh Bank earlier. The stated policy might have contributed to the increase in rescheduling of loans in 2023. Furthermore, banks were allowed to reschedule loans of particular sectors (such as ship building and cold storage related loan) for longer tenure," it said.

Professor Selim Raihan, executive director of the South Asian Network on Economic Modeling (SANEM), said irregularities and extreme deterioration of good governance in the banking sector led distressed loans to increase.

Disbursing loans indiscriminately, and rescheduling loans on political considerations over the past years worsened the situation further, he said.

"I think the actual situation is more horrible if the money taken away by the directors of many banks is taken into consideration.

"This shows how the banking system has turned into a looting ground and influential people have taken away money from banks by using connections. I am afraid that a large part of these loans are not recoverable. This is the biggest concern," Prof Selim said.

However, the Dhaka University teacher is optimistic that the current authorities will be able to find a way out of the problem because an expert like Ahsan H Mansur has been appointed as the governor of the Bangladesh Bank.

Zahid Hussain said distressed loans would have been bigger had the defaulted loans, which were not calculated due to court's stay orders, been taken into consideration.

However, it is too early to say that the initiatives of the interim government in this regard will be successful, he said. "More time is needed to see the result."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments