Drug sales grow at slowest pace in five years

Despite the price hike, sales of medicines in Bangladesh grew at the slowest pace in at least five years in 2023 driven by a lower purchase of non-life-saving drugs and vitamins.

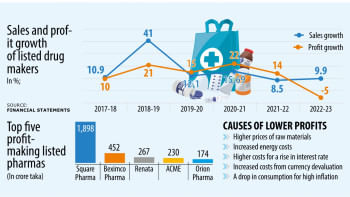

Last year, drug sales grew 2 percent to Tk 30,059 crore, far lower than the four-year average of 8.5 percent in 2022, according to a report of IQVIA, a global provider of advanced analytics, technology solutions, and clinical research services to the life sciences industry.

Experts and industry people blame higher inflationary pressure confronting a larger section of the population, especially low-income households, since May 2022, for the slower growth since their purchasing power has eroded significantly.

Shahidul Islam, chief executive officer of VIPB Asset Management Company, which invests in listed and non-listed companies, argues that since the prices of almost all types of medicines rose, the sales growth was supposed to be higher even if consumption remained the same.

"But that did not happen. It indicates sales volume or consumption dropped mainly due to the reduced purchasing power amid higher inflation."

Islam says the demand for non-life-saving medicines usually remains elastic when people face tight financial conditions and are forced to put food expenditures over everything else.

Since the buying capacity of many households has been squeezed, many have delayed treatment for non-fatal illnesses, thereby taking in fewer medicines, he said.

Square Pharmaceuticals retained its position as the largest seller although turnover dropped 8.5 percent year-on-year to Tk 5,039 crore in 2023, according to IQVIA. It holds a 16.8 percent share of the market.

Zahangir Alam, chief financial officer of Square Pharmaceuticals, however, contradicted the findings.

"We have not seen any negative growth yet," he said, adding that their sales grew around 10 percent in 2022-23.

Incepta Pharma was the second-highest drug seller and sales rose 3 percent to Tk 3,575 crore. The company owns 11.9 percent of the market share. Third-placed Beximco Pharmaceuticals' sales were up 1.8 percent to Tk 2,867 crore and the market share was 9.5 percent.

Prof Mujibur Rahman, a former head of medicine at Dhaka Medical College Hospital, said patient arrivals at hospitals and chambers dropped in 2023 compared to a year earlier.

"It may be because of the higher price level. People only go to doctors when it is urgent."

Prof Rahman says the presence of patients who have no serious symptoms but try to find out the disease through diagnosis, is now rare.

"Doctors are cautious as well in prescribing not-so-important medicines."

Some people may strike off one or two medicines from the prescriptions without consulting with doctors in order to cut costs. This is being seen in the rural areas, the noted physician added.

Sales of Healthcare, Renata and Opsonin stood at Tk 2,181 crore, Tk 1,504 crore, and Tk 1,391 crore, respectively.

"The consumption of medicines has slowed due mainly to higher inflationary pressure," said M Mohibuz Zaman, chief operating officer of ACI Health Care Division.

The overall inflation in Bangladesh was 9.67 percent in February and it has been above 9 percent since March last year, according to the Bangladesh Bureau of Statistics.

"This is a bitter example that if inflation rises, people can even cut back on their medicine intake. Last year, people's pockets were tight," Zaman said.

Two companies – Eskayef Pharmaceuticals and ACME Laboratories – moved up in the list of the top drug sellers.

Owned by Transcom Group, Eskayef is now the seventh-largest drug manufacturer in Bangladesh. Its sales rose 7.8 percent to Tk 1,265 crore in 2023. Eighth-placed Aristopharma posted sales of Tk 1,211 crore.

ACME Laboratories was in the ninth place with sales amounting to Tk 1,150 crore, leaving Radiant Pharma, whose sales were Tk 1,134 crore, in the 10th, the IQVIA report showed.

Md Jubayer Alam, company secretary of Renata, said the revenue of the industry grew by around 2 percent because of the price spike of drugs.

"It is clear that sales volume did not grow in 2022."

The senior official of the fifth-largest medicine manufacturer attributed the higher prices of raw materials, the energy costs and the shortage of dollars to the upward adjustments of prices.

"However, companies did not pass on the entire cost to consumers," he said, adding that people avoided consuming the medicines that can be obviated.

"For instance, if a doctor had prescribed antibiotics and vitamins, people might have chosen to drop the latter."

Both VIPB's Islam and ACI's Zaman said if inflation pressure does not ease, the situation of drug sales will not improve, which might impact public health in the long run.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments