DSE turnover crosses Tk 1,000cr after two months

Turnover at the Dhaka Stock Exchange (DSE) crossed the Tk 1,000-crore mark yesterday after two months as the shares extended a rally for the sixth consecutive day riding on gains of blue-chip stocks.

Blue-chip stocks such as Kohinoor Chemicals, BBS Cables, Best Holdings, Taufika Foods and Lovello Ice-cream, GPH Ispat, Fortune Shoes, along with Square Pharmaceuticals, Robi Axiata, Al-Arafah Islami Bank and City Bank fared well.

On the other hand, BAT Bangladesh, Grameenphone, Beacon Pharmaceuticals, Unilever Consumer Care, Pubali Bank, National Bank, Eastern Bank, and Shahjalal Islami Bank among large-cap companies displayed poor performance.

Turnover, which indicates the volume of the shares traded during the session, surged 14.69 percent to Tk 1,019 crore yesterday compared to the previous day.

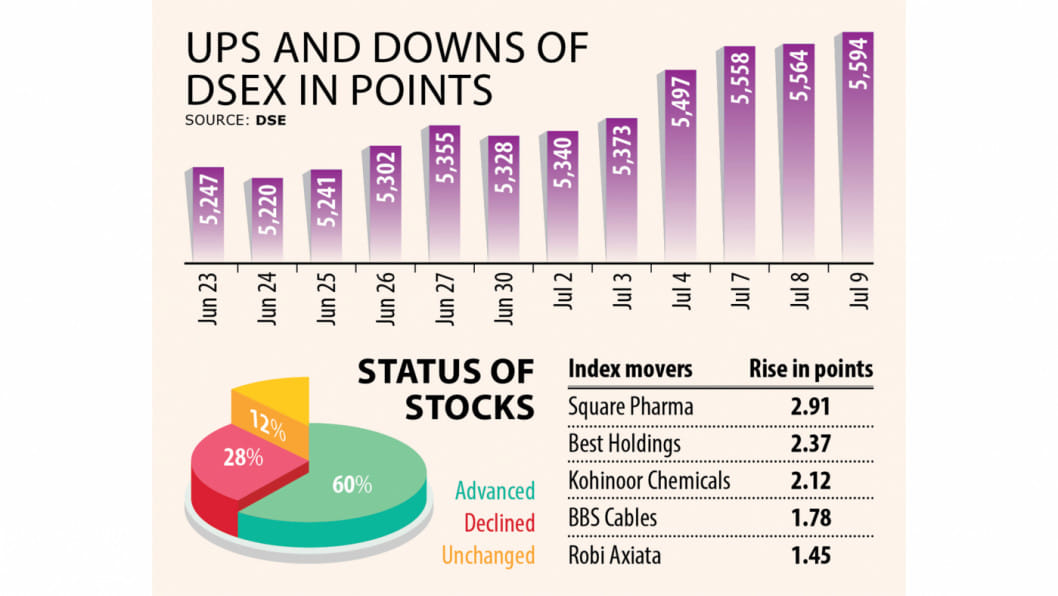

The broad index of the country's prime bourse, the DSEX, rose 30.01 points, or 0.54 percent, to close the day at 5,594.64.

Similarly, the DSES, the index that represents the shariah-compliant companies, edged up 8.18 points, or 0.67 percent, to 1,223.32 while the DS30, the index that composed of the best blue-chip firms, went up 4.63 points, or 0.24 percent, to 1,964.53.

Out of the 393 issues that changed hands on the DSE, 237 closed higher, 111 declined and 45 did not see any price movement.

Large-cap sectors posted mixed performance with fuel and power booking the highest gain of 0.77 percent, according to the daily market update by BRAC EPB Stock Brokerage.

Engineering sector logged a gain of 0.74 percent followed by pharmaceuticals with 0.31 percent.

Bank posted a loss of 0.14 percent, followed by telecom, non-bank financial institutions, and food & allied 0.41 percent, 0.44 percent and 0.75 percent respectively.

Block trades contributed 5.3 percent of the daily overall market's turnover.

Sea Pearl Beach Resort & Spa was the most traded share with a turnover of Tk 53.6 crore.

In its daily market update, UCB Stock Brokerage said the market closed on a positive note with an increase in turnover.

Sector-wise, ceramics, services and real estate and information technology were the top three sectors to close in the positive territory while food and allied, life insurance and NBFI sectors closed in the red.

The pharmaceuticals sector dominated the turnover chart covering 14.37 percent of the day's turnover.

Salvo Chemical Industry topped the gainers' chart with a rise of 10 percent.

Kattali Textile, Beach Hatchery, HR Textile and Deshbandhu Polymer all made gains of more than 9 percent.

The Peninsula Chittagong, BBS Cables, Bangladesh Industrial Finance Company and Republic Insurance Company also chalked up gains.

Rupali Life Insurance Company shed the worst, losing 2.99 percent.

National Life Insurance Company, Shyampur Sugar Mills, Zeal Bangla Sugar Mills, and ICB Islamic Bank suffered losses.

Unilever Consumer Care, Sea Pearl Beach Resort & Spa, Shahjalal Islami Bank and ADN Telecom were also on the losers' chart.

Market movement was driven by positive changes in the market cap of travel and leisure, tannery industries, and fuel and power scrips amid negative changes in the market cap of paper and printing, life insurance, and food and allied scrips, according to the daily market update by Shanta Securities.

Sea Pearl topped the turnover list with a 2.71 percent gain, followed by Capitec Asset Management (2.03 percent), Beach Hatchery (9.89 percent), and Salvo Chemical Industries (10 percent).

The Chittagong Stock Exchange also rose with the Caspi, the premier index of the bourse in the port city, jumping 94.96 points, or 0.60 percent, to settle at 15,889.62.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments