Duty exemptions surged 20% in FY23

Duty exemptions provided by the National Board of Revenue (NBR) have been increasing over the years despite Bangladesh's low tax-to-GDP ratio and the International Monetary Fund's (IMF) recommendation to rationalise such expenses.

According to NBR officials, these exemptions are provided to facilitate domestic industrialisation, facilitate exports, and keep the prices of essentials at tolerable levels.

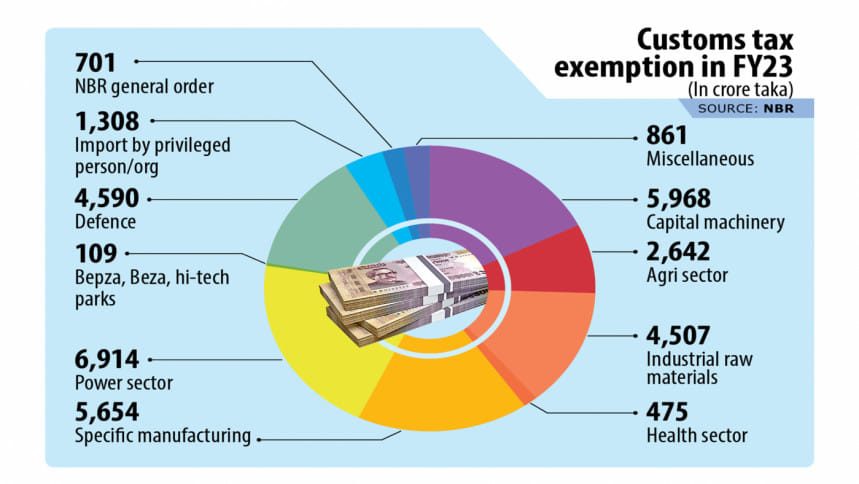

In fiscal year (FY) 2022-23, the tax administration allowed Tk 33,729 crore in duty exemptions, which is a part of indirect tax expenditure, to various sectors as well as industries and agricultural enterprises.

This was 20 percent higher compared to the year prior and almost 47 percent higher than the amount of duty exemptions provided in FY21.

The NBR revealed the information in its 'Customs Tax Expenditure Report 2022-23', released on August 9.

The tax authority took the initiative to publish the report for the first time in line with a recommendation from the IMF centring a $4.7 billion loan.

However, the multilateral lender's advice to rationalise tax exemptions in view of the country's status graduation from a least developed country in November 2026 had a negligible impact.

In FY23, Bangladesh's tax-GDP ratio was 7.30 percent, one of the lowest in the world.

The tax-GDP ratio of neighbouring India, which recently rationalised tax expenditures, is significantly higher at 11.7 percent.

However, if the total amount of exemptions provided is added to total tax collection, the nation's tax-GDP ratio would have increased by 0.76 percentage points in FY23, lowering the state's dependence on borrowing to finance expenses.

"Exemptions cannot be provided day after day," Towfiqul Islam Khan, an economist and a senior research fellow at the Centre for Policy Dialogue (CPD), told The Daily Star.

The tax authority must reshuffle its priorities to reduce the exemptions, he said.

Zaidi Sattar, chairman of the Policy Research Institute (PRI) of Bangladesh, echoed those sentiments.

There is plenty of scope to rationalise exemptions in manufacturing or other sectors where "end-user concessions" for industrial raw materials apply, he said.

The penchant to grant or extend tariff concessions on inputs or raw materials without adjustment of protective tariffs on finished goods has resulted in rising protectionism without an end in sight, Sattar added.

Consequently, numerous import substitutes with export potential end up losing out internationally due to price competitiveness, thus constraining any progress in export diversification, he explained.

However, Sattar said that all the customs duty exemptions should not be withdrawn.

For instance, if the customs tax expenditure in specific manufacturing sector includes zero-tariff on back-to-back LC imports of RMG sector, this tax expenditure is an absolute necessity to ensure world-priced inputs to this sector to create a level playing field for RMG exports in the world market.

At present, Bangladesh provides more tax and revenue exemptions than many developed countries.

According to the NBR's report, the power sector was the biggest beneficiary in FY23, securing nearly Tk 7,000 crore or 20.50 percent of the total share.

Exemptions provided for capital machinery imports accounted for the second largest share of duty exemptions at 17.69 percent, followed by the specific manufacturing and defence sectors.

The power sector got priority due to political preference, CPD's Khan added.

"There are many sectors in Bangladesh that are growing. So, a plan must be drawn up to eliminate the culture of mass exemptions," he suggested.

A senior NBR official, seeking anonymity, told The Daily Star: "The IMF has asked us to rationalise tax expenditures gradually, which means we should allow duty exemptions to sectors that actually need it.

"So, it should not matter whether the total amount is increasing or decreasing."

The government is looking to identify sectors which have been enjoying the duty exemptions for years on end, he said.

"We will focus on reducing exemptions in those sectors as well as to enhance revenue mobilisation and the tax-GDP ratio," the official added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments