Economy to take a beating for acute gas crisis

The severe gas crisis is increasing the cost of manufacturing of goods for both local and export markets, which may ultimately hit the pockets of consumers in the form of higher prices and the economy since overseas sales could see further slowdown.

Owing to lower generation of gas locally, factories in all sectors of the economy have long complained of inadequate energy supply. But the supply situation has worsened in the past two weeks.

At present, the government supplies 2,500 million cubic feet of gas per day (mmcfd), the lowest since April 2020, against a demand of 3,800 mmcfd, data from state-run Petrobangla showed.

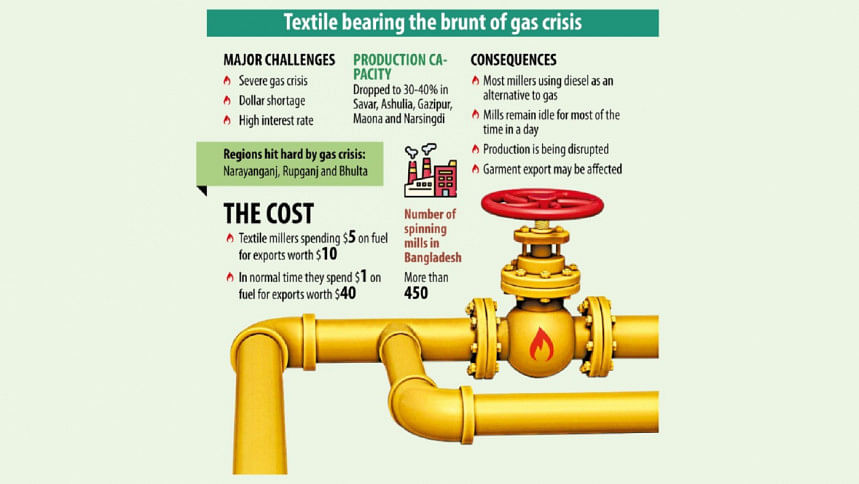

The acute gas crisis has crippled the textile and garment sectors, which may not bode well for the country as they account for 85 percent of Bangladesh's exports and have created millions of jobs, mainly for the poor.

With the onset of winter, the power sector's demand for gas has subsided, but that does not mean the other sectors are getting more gas because of a drop in local production and fewer imports.

The shortage has hit hard industrial belts such as Narayanganj, Rupganj and Bhulta, forcing many factories to either keep production shut for long hours or run operations with expensive diesel in order to retain customers.

Most of the textile mills, which are usually gas guzzlers, in Savar, Ashulia, Gazipur, Maona and Narsingdi are running at 30 to 40 percent capacity because of the gas crisis.

Currently, textile millers have to spend $1 on fuel in order to make export-bound goods worth $2. When the gas supply is normal, they would ship goods worth $40 with the same expenditure on energy, industry people say.

"Usually, I export $20 million worth of garment items a month but the production has fallen. This will bring down exports to $10 million," said a composite garment factory owner in Bhulta. The company produces finished garments from cotton.

At its peak, it can produce 160 tonnes of yarn per day. However, the output has plunged to 60 tonnes, he said.

Now, the factory can dye 90,000 metres of fabrics a day against a capacity of more than 2.5 lakh metres. Similarly, the output of the fabric mill has fallen to 90,000 metres against the capacity of 2.5 lakh metres.

"I am running my mills not to make any profits but to maintain the flow of work orders from international buyers," the owner said.

He said the yarn production capacity of the five largest textile mills in Bhulta and Gausia of Narayanganj is 1,000 tonnes per day. But they have been producing 300 tonnes daily for the last 15 days owing to a fall in gas supply.

Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association, said there is zero pressure of gas for several hours in some factories.

Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said the worst-affected industries are located in Narayanganj.

Nearly 500 garment factories in the industrial belt have almost zero output, said several owners.

The situation prompted the BKMEA to write to the prime minister on Sunday, calling for immediate steps to ride out the energy crunch.

The severity of the energy crisis has hit industries and businesses at a time when they are already weighed down by a sharp depreciation of the local currency, a shortage of US dollars needed to settle import payments, and a rising bank interest rate.

Owing to a significant fall in the foreign currency reserves, the taka has lost its value by about 30 percent against the US dollar in the past two years, which has made imports costlier.

Similarly, because of the withdrawal of the ceiling on lending rates in July, the cost of funds has gone up in the banking sector after remaining capped at 9 percent for more than three years.

"The cost of doing business has climbed due to the significant appreciation of the dollar," said Humayun Rashid, president of the International Business Forum of Bangladesh.

"We, the businessmen, are adopting various mechanisms to optimise efficiency to tackle the ongoing crisis."

Rashid, also the managing director of Energypac Power Generation Limited, said the dollar shortage, the gas crisis, and the increase in bank interest have affected businesses.

"One challenge is coming after another. As a result, businesses are finding it tough to survive."

Entrepreneurs in the leather footwear sector say although leather, the key raw material for the industry, can be sourced domestically, most of the chemicals and accessories needed to manufacture finished goods for both local and export markets need to be imported.

The packaging industry has seen an output decline of 25 percent.

"Demand has decreased like in other sectors," said Safius Sami Alamgir, president of the Bangladesh Flexible Packaging Industries Association.

Subir Kumar Ghose, chief executive officer of Partex Petro Ltd, said the overall import cost in the energy sector has increased by 10 to 12 percent due to the depreciation of the taka.

Md Fazlul Hoque, managing director of Maona-based Israq Textile Mills Ltd, said their yarn production fell to 70 tonnes a day against a capacity of 110 tonnes because of the lower gas pressure.

Hatem said the volatile exchange rate, the higher cost of financing, and the severe gas crisis are hitting the industries so badly that many owners may turn defaulters if they can't continue smooth production and export on time.

Industry people and analysts say a higher production cost will translate into higher prices of finished goods, meaning local consumers, who are grappling with an elevated level of inflation for the past 18 months, could see another spike in their cost-of-living.

If the prices are raised to absorb the higher cost of production, Bangladesh may also emerge as an unattractive supplier to global markets. As a result, sales may fall, both at home and abroad.

Exports grew at 0.84 percent in the first half of the current financial year. It rose 6.67 percent in the last financial year, which ended in June.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments