Gas crisis leaves households, industry on edge

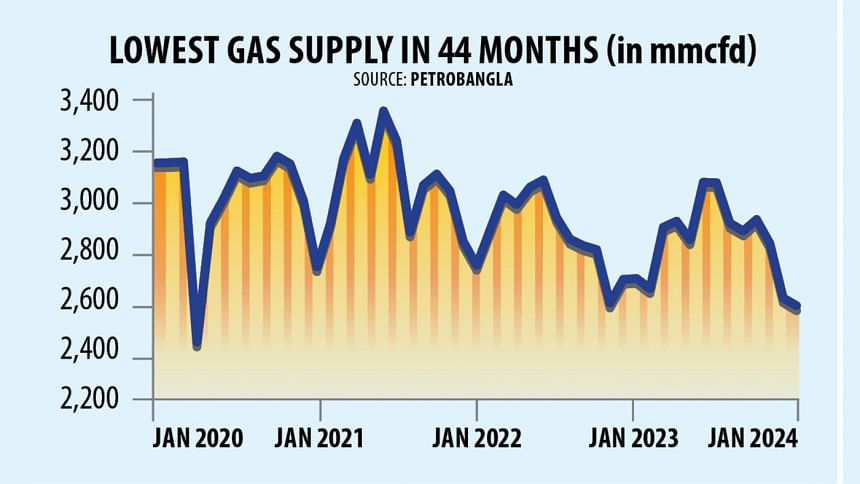

The gas supply now is the lowest since April 2020, shows data from Petrobangla -- in a development that informs the acute crisis plaguing the industrial sector as well as households.

At present, the gas supply is about 2,500 million standard cubic feet per day (mmcfd) against the demand of 3,800 mmcfd.

This is lower than in the last quarter of 2021, when the government suspended the purchase of liquefied natural gas from the international spot market following record-high prices and a dollar crunch.

With the onset of winter, the power sector's demand for gas has subsided, but that does not mean the other sectors are getting more gas because of a drop in local production and fewer imports, according to Petrobangla officials informed with the proceedings.

The situation is unlikely to see a drastic improvement anytime soon: the supply will only increase in the latter half of February, but then the demand will also tick up.

For now, patience of both households and industries is wearing thin over the constricted gas supply.

Take the case of Total Fashion, an export-oriented textile manufacturer in Narayanganj. The factory gets adequate gas supply only on Fridays, according to its officials.

"We don't get gas on the other days of the week, so our production has dropped dramatically. We need gas to keep our boilers running for dyeing and printing fabrics," said one of the officials asking not to be named as he is not authorised to speak with the media.

BSRM Group, the country's leading steel manufacturer, saw its production costs balloon for the gas shortage as they are meeting the fuel demand with diesel, said Tapan Sengupta, its deputy managing director.

The production cost per tonne of rod has increased by Tk 1,000-1,200.

"For now, we are absorbing the higher production cost. But if it continues this way, we will have to hike the prices," he added.

The ceramics industry is particularly suffering from the inadequate gas supply.

"We need a minimum 10 psi (Pounds per square inch) gas pressure, but during the daytime, the pressure is between two to four psi," said Irfan Uddin, managing director of FARR Ceramics, whose factory is located in the Bhabanipur area of Gazipur.

As a result, the quality of products is deteriorating.

The inadequate gas pressure means the factory has to halt production for hours on end, which adds to the production costs.

"If the pressure drops when we are in the middle of production, the entire batch is ruined. We have to count losses for all the raw materials that went into that batch," he added.

Households too are counting additional expenses for the unreliable gas supply.

Take the case of Jahangir Hossain Babu, a pharmacy owner in the Hosne Dalan area of Bakshibazar, who has to stay up till 3 in the morning to cook.

"We are paying bills every month, but we are not getting enough gas. Though many of our areas have gas connections, they are using bottled LPG. I can't afford that, so I have to wait till 3-3:30 am as that is when the gas pressure is usable," he added.

For Mohammad Hasan's tenants at his two-storied building at Uttarkhan's Madarbari, it is back to the olden times of cooking with firewood in an earthen stove on the roof as they do not get gas at decent hours.

Around 2,050 families in the Bhasantek BRP area have started using firewood or LPG depending on their means as they get gas from 1.30am to 4.30am.

"We need to stay awake till midnight to cook but we are paying bills for the piped gas for all hours of the day," said Hasna Banu, who pays Tk 7,500 as rent for her two-bedroom flat in the area.

Sohel Rana, a private employee in Azimpur, used to come home for lunch every day. Now, he has to eat out as his wife can't cook for want of gas during the day.

"I can't afford to eat out like this for long," said an exasperated Rana.

The gas crisis was found during multiple visits in Kamrangichar, Demra, Purba Dogair, Hazinagar, Kolatia, East Shewrapara, Mirpur, Shyamoli, Pallobi, Banasree, maximum areas of Puran Dhaka including Gendaria, Nababganj, Narinda, Mohammadpur and Bhasantek.

Their suffering is unlikely to recede soon, according to Petrobangla officials who spoke on the condition of anonymity to speak candidly on the situation.

Gas production will increase slightly once operation resumes in one of the two floating storage and regasification units (FSRU) resume production on January 14, said Md. Kamruzzaman Khan, director of Petrobangla's operation and mines department.

The FSRU has been under maintenance since November 1 last year. The two FSRUs supply 850 mmcfd of gas a day; now, the lone operational FSRU is supplying about 500 mmcfd.

Supply will increase by about 200mmcfd, which will not be enough to meet the demand, said another Petrobangla top official.

Local gas production also is declining, including the Bibiyana gas field, which is the most prolific producer.

Petrobangla Chairman Zanendra Nath Sarker acknowledged the drop in production in the local gas fields.

"But we are working to increase production. We have a plan to add about 618mmcfd of gas by 2026. Of the amount, we have already added around 70 mmcfd."

To meet the immediate gas crisis, there is no alternative to ramping up LNG imports, Sarker added.

Given the acute strain on the dollar stockpile, it is unlikely that the government would be able to ramp up imports much.

As of January 10, foreign currency reserves stood at $20.2 billion, enough to meet a little over three months' import bills, according to the latest published data by the Bangladesh Bank.

In the World Economic Forum's Global Risks Report 2024, the 70 Bangladeshi businesses that participated in the study cited energy supply shortage as their number one threat to the economy and their business.

In 2024, the government plans to import 24 LNG cargoes from the spot market, according to officials of the Rupantarita Prakritik Gas Company, the state-owned entity that purchases from the global spot market.

Between February and December last year, a total of 23 cargoes was purchased from the spot market.

Bangladesh also imports LNG through a 10-year import deal with Oman and a 15-year import deal with Qatar. Last year, a total of 56 LNG cargoes arrived from the two countries, which is the same as in 2022. In 2021, 64 LNG cargoes arrived.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments