Exports hit $50b in 2024

Bangladesh's exports hit $50 billion in 2024, buoyed by a sharp December spike, providing the much-anticipated breather for an economy facing multiple headwinds, including external account pressures.

Exports grew 8.3 percent year-on-year in the past year, according to data from the Export Promotion Bureau (EPB) released yesterday -- just a day after cheering record-high remittances of $26.9 billion in 2024.

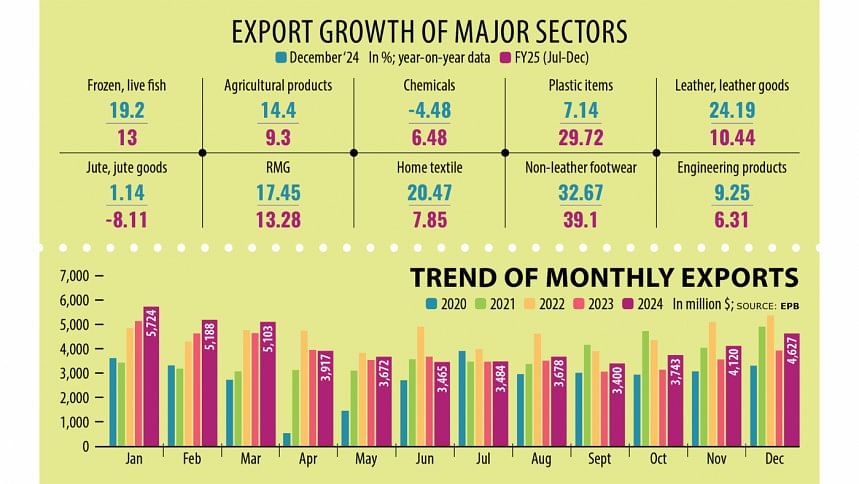

Of the total $50 billion, exporters earned $4.62 billion in December alone, an 18 percent increase compared to the same month in the previous year.

The growth is largely attributed to the strong performance of the readymade garment (RMG) industry -- the backbone of the country's economy.

December's export receipts were the highest since March 2024, when the country earned over $5 billion.

In the first six months of the current fiscal year 2024-25, exports rose by 12.84 percent to $24.53 billion.

During the July-December period, garment shipments, the top export earner, increased by 13.28 percent to $19.88 billion.

Of the total garment exports in July-December, $10.83 billion came from knitwear exports -- a 13.01 percent year-over-year increase.

Exports from the woven segment contributed $9.05 billion -- up 13.60 percent year-over-year.

Leather and leather goods exports grew 10.44 percent to $577.29 million in the last six months. Cotton and cotton product exports increased 16.32 percent to $319.06 million.

According to EPB data, home textile exports increased 7.85 percent to $410.81 million in July-December, while non-leather footwear exports surged 39.10 percent to $273.89 million.

Frozen and live fish exports grew 13.01 percent to $245.71 million and agricultural product shipments increased 9.31 percent to $595.51 million, data showed.

Plastic goods shipments went up 29.72 percent to $157.94 million in July-December.

However, some traditional export items, such as jute and jute goods, saw a decline in merchandise shipment during the July-December period. Jute and jute goods exports fell 8.11 percent to $417.39 million.

"As you've seen, our textile and apparel sectors are enjoying positive growth despite political and financial challenges," said David Hasanat, chairman of apparel exporter Viyellatex Group.

Hasanat, also the president of Bangladesh Independent Power Producers' Association, said, "Our remittance flows are increasing significantly and I believe they will continue to grow in the coming year."

"If we can ensure political stability, businesses will see great momentum from mid-2025," he added.

Shams Mahmud, managing director of Shasha Denims Ltd, another big exporter, said that overall garment exports have increased, driven by large factories with strong financial positions and reliable energy supplies.

"However, SMEs (small and medium enterprises) are struggling. So, the export growth doesn't necessarily indicate strong performance across the industry. Smaller factories are not doing well, and this could cause problems in the long run," he said.

Faruque Hassan, a former president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), termed the rebound in exports as a very positive sign.

According to Hassan, there is a bright outlook for Bangladeshi businesses in the near future as inflationary pressures in major Western markets like Europe and the US have started to ease.

Bangladesh's garment exports are poised for growth in the near future due to increased exports to new markets and higher exports of value-added garment items such as suits, lingerie, and jackets, Hassan further said.

Besides, the unit price of Bangladeshi garments has increased over the past few years.

The former BGMEA chief said the growth, achieved even amid repeated flooding, labour unrest, inflationary pressures and nationwide movements, shows the strong confidence that international clothing retailers and brands have in Bangladesh.

The leather industry has also experienced significant growth, with exports increasing by over 30 percent in the first half of the year, according to Nasir Khan, chairman and managing director of Jennys Shoes.

Exporters thanked the timely shipment of winter goods, especially in preparation for Christmas, for the growth.

Khan said exporters received bulk orders for winter leather footwear, which played a key role in driving the industry's seasonal growth.

"This growth mainly comes from Europe and Japan, where demand for quality leather products peaks during the winter season," he added.

Businesses hope that 2025 will bring stability as normalcy begins to be restored in businesses after turbulent times both domestically and internationally.

Local businesses have been severely affected by various internal and external issues over the past few years.

For them, just-past 2024 was a challenging year as firms now hope to avoid a recurrence of the adverse incidents that affected their trade.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments