External debt rises slightly

Although Bangladesh's foreign debt slightly increased in the first quarter of the current fiscal year 2024-25, the debt of private sector and public sector corporations decreased due to a lack of confidence in the banking sector and payment delays.

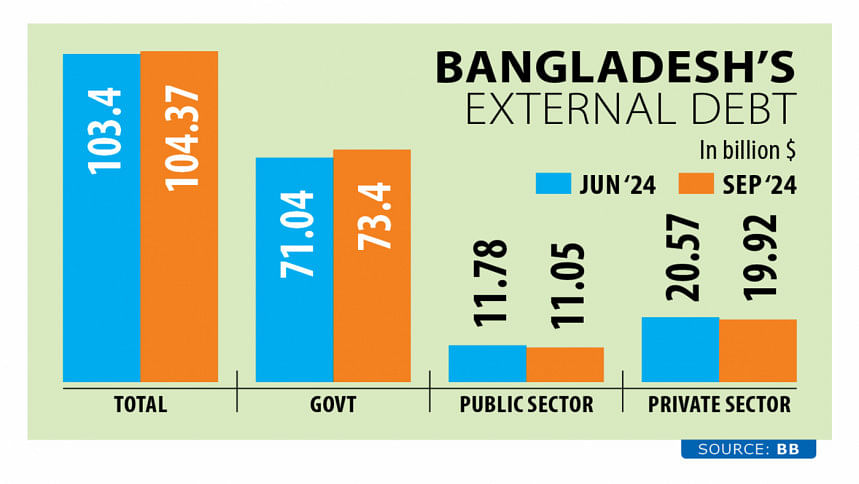

The country's gross external debt grew by 0.93 percent to $104.36 billion in September, compared to $103.40 billion in June 2024, according to Bangladesh Bank data released yesterday.

In the same period, the debt of public sector corporations fell by 6.23 percent to $11.05 billion, while private sector loans decreased by 3.18 percent to $10.73 billion.

However, government loans rose by 3.31 percent to $73.4 billion, the data showed. The government usually takes these loans from development partners, including the World Bank and the Asian Development Bank.

Development partners commit to providing these types of loans and disburse them as the projects are implemented. All these debts are long-term loans.

Public sector corporations, however, usually take both short-term and long-term loans. Over the past year, short-term loans fell, while long-term loans rose slightly.

Private sector credit dropped as short-term trade-related debt could not be rolled over amid a lack of confidence, said Zahid Hussain, former lead economist of the World Bank's Dhaka office.

The lack of confidence stemmed from problems in the banking sector, payment delays, letter of credit (LC) settlement delays, and deferrals. It was difficult to secure new loans, he said.

As a result, private sector loan growth had been declining even before the political turmoil began, he added, mentioning that repayments were higher than the new loans they received.

Due to lower creditworthiness, they could not secure loans. Specifically, loan rollovers were almost halted, leading government corporations to experience the same trend.

On the other hand, government loans rose due to an increase in project loans, he added.

At the end of September, short-term loans fell to $1.9 billion, compared to $2.8 billion in June of the previous year. However, long-term loans rose to $9.2 billion, up from $8.99 billion three months earlier.

At the same time, private sector short-term loans decreased to $10.73 billion from $11.4 billion in June. However, long-term private sector loans remained almost unchanged at $9.19 billion in September.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments