Unused foreign loans swell to $48.44b: not a good sign

Unused foreign loans in the government's pipeline surged to $48.44 billion in November from $44.7 billion in June. That's not necessarily a good omen as it highlights the country's inability to use up cheaper funds available for projects.

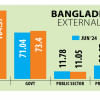

The ballooning of the aid under its disposals has prompted the government to set a 27 percent higher foreign loan disbursement goal at $11.78 billion for the current fiscal year, according to the annual report of the Economic Relations Division (ERD) for 2022-2023.

The higher target came despite a slow disbursement of external loans in the first five months of 2023-24: the government utilised $2.12 billion between July and November, down 14 percent year-on-year.

In the entire FY23, $9.27 billion in foreign loans was disbursed.

If the low utilisation persists, the loan in the pipeline might exceed $50 billion in the ongoing financial year, which ends in June.

A finance ministry official said although the flow of foreign loans accelerated in recent times, the utilisation capacity of ministries and divisions has not improved accordingly.

Some $48.11 billion has been added to the foreign loan commitment pipeline in the five years to FY23, according to the ERD report, on the back of the funds from development partners that accelerated the lending to help Bangladesh overcome the crisis stemmed from the coronavirus pandemic.

The funds are supposed to be disbursed within the next five to six years. However, the release is directly linked to the implementation of projects.

The ERD report says it continuously takes initiatives to ensure the maximum use of project assistance allocated under the development projects.

In the past few years, quarterly meetings at the wing level were held with ministries, divisions and development partners, it said, adding that slow-moving projects are identified during the signing of loan agreements.

Additionally, the progress of project execution is monitored through a series of inspections in order to detect the problems that may arise during their implementation.

An ERD official said foreign loans in the pipeline crossed $50 billion a few years ago. But thanks to initiatives taken by the division, the loan size came down.

As a new government takes over within a few days, more focus will be put on using foreign loans, he said.

For FY24, the government has increased the debt servicing repayment target by 26 percent to $3.37 billion. It repaid $2.67 billion in the past financial year.

According to the thresholds of the International Monetary Fund and the World Bank, the risk of external debt distress has remained low for Bangladesh. The ERD report, however, cited some risks confronting the country.

It says additional investment demand has been created to achieve the target of turning Bangladesh into a smart nation by 2041.

"On the other hand, due to the slowdown in the global economy, the complexity of Europe-centric debt, and the changing geopolitical context, the sources of flexible debt have shrunk."

In addition, as state-owned enterprises and autonomous bodies are taking non-concessional loans against government guarantees, the risk of foreign debts is increasing steadily, it added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments