Few banks thrived, others bled in 2024

For three banks, 2024 brought cause for celebration as they crossed the milestone of Tk 1,000 crore in annual profits for the first time. But for nine others, it was a year of reckoning, marked by mounting losses and a desperate fight for survival.

This stark divide followed sweeping reforms in the banking sector that were introduced following the July uprising last year. As political influence lost its grip on the industry, governance improved, and long-buried toxic assets began to surface.

The fault lines separating strong lenders from struggling institutions became clearer, bringing the governance issue to the forefront.

- Part 1 - Bond boom contributes half of bank income

- Part 3 - Depositors leave troubled banks for stronger rivals

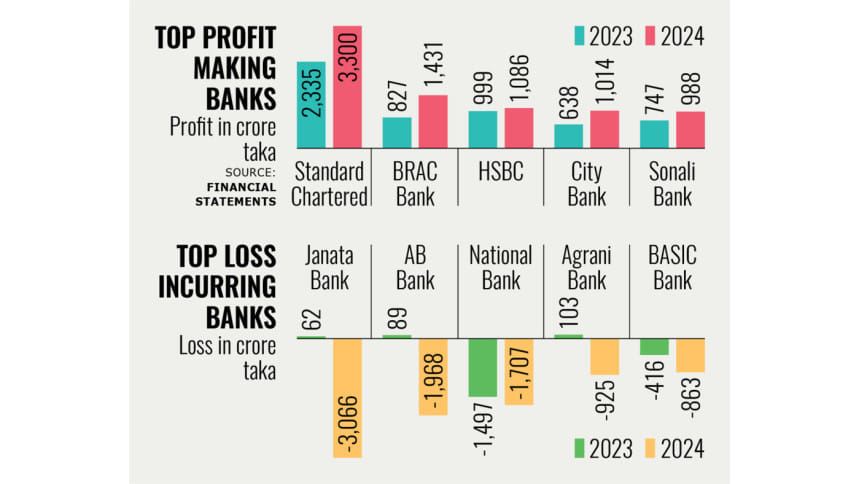

Leveraging good governance and capitalising on solid customer trust last year, three banks joined the Tk 1,000 crore profit club, while nine of their market peers posted a combined loss of Tk 9,500 crore, according to an analysis by The Daily Star.

The findings are based on the latest available financial statements of 50 banks. Islami Bank Bangladesh, the country's largest shariah-based lender, was not included in the review as it has yet to publish its report.

Islami Bank made headlines during the previous regime several times over allegations of loan irregularities and corruption. Had its data been available, the divide in fortunes would likely have appeared even more dramatic.

Standard Chartered Bank led the profit-makers, posting a record-breaking Tk 3,300 crore in profits last year, the highest annual profit ever recorded by a bank in Bangladesh. This marked a 41 percent jump from its 2023 figure of Tk 2,335 crore, shows the analysis.

BRAC Bank, HSBC Bangladesh, and City Bank also crossed the Tk 1,000 crore profit threshold for the first time. BRAC Bank's earnings surged by 73 percent year-on-year, while City Bank saw a 60 percent increase.

"The real game-changer here is governance," said Asif Khan, president of CFA Society Bangladesh, a platform for investment professionals.

He said that many banks were overwhelmed by bad loans, which dented public confidence. Depositors grew more cautious and began shifting their funds to well-managed banks, even if it meant accepting lower interest rates.

"As a result, stronger banks attracted deposits at relatively low costs while earning solid returns from treasury bonds. That translated into healthy profits," Khan said.

Meanwhile, troubled banks began to falter. With closer scrutiny and stricter regulations in place, they were forced to acknowledge long-concealed non-performing loans and set aside hefty provisions. The financial hit was swift and severe, according to the investment analyst.

According to the analysis, bad loans of the 50 banks increased by 158 percent year-on-year, reaching Tk 348,892 crore in 2024. The worst-affected banks were those plagued by questionable lending activities during the previous regime.

Janata Bank reported the highest loss at Tk 3,066 crore, followed by AB Bank at Tk 1,968 crore and National Bank at Tk 1,707 crore. Collectively, these three banks accounted for Tk 108,738 crore — nearly a third of the total bad loans across the banking sector.

Others in the red included First Security Islami Bank, Social Islami Bank, BASIC Bank, Agrani Bank, Bangladesh Commercial Bank, and IFIC Bank. Deposits at these nine banks shrank by 3.3 percent, or roughly Tk 15,000 crore, while deposits across the sector rose by 12 percent, or Tk 136,665 crore.

"These banks were not just inefficient, they were victims of systemic theft and loan scams under the previous regime," said Khan.

He commented that many banks had earlier painted an artificially healthy picture of their books, concealing the true extent of bad loans. "Now they are acknowledging reality. As they begin provisioning properly, profits are taking a hit, but this transparency is ultimately a step in the right direction."

Md Mazibur Rahman, managing director of Janata Bank, admitted that his bank's losses came from a reclassification of assets following the political changeover.

"Many of our assets, previously shown as regular, were classified. That wiped out expected income from those and dragged down our bottom line," he said.

Janata Bank's bad loans soared by 171 percent in 2024, reaching Tk 62,805 crore.

Rahman, however, said things have begun to improve. "Our cash recovery in the last six months has already surpassed the total recovery made in 2024. We are selling off defaulters' assets, and field-level collections are also up. It will take time, but we are on the road to recovery."

ZM Babar Khan, managing director and CEO (CC) of AB Bank, said over the past few years, they have faced significant challenges due mainly to non-performing loans.

As of December 2023, the bank's classified loan ratio stood at 30 percent, including deferred loans, which the bank hoped to recover within 2024.

"But due to political instability last year, many of our large corporate borrowers were unable to meet their commitments. As a result, we fully recognised the non-performing loans in our financial statements, which led to a substantial suspension of interest income," said Khan.

Khan said they are now pursuing a comprehensive recovery plan, and the bank has mobilised deposits totalling Tk 6,400 crore over the past six months.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments