Four lenders get Tk 945 crore liquidity support from five other banks

Four crisis hit banks -- First Security Islami, Social Islami, Global Islami and National – have received a total of Tk 945 crore as liquidity support from five other banks.

First Security Islami Bank received Tk 200 crore from City Bank, Tk 50 crore from Mutual Trust Bank and Tk 50 crore from Dutch-Bangla Bank, according to the central bank data.

Social Islami Bank received Tk 300 crore from City Bank and Tk 50 crore from Mutual Trust Bank.

Global Islami Bank received Tk 25 crore from Eastern Bank while National Bank received Tk 200 crore from City Bank, Tk 50 crore from Mutual Trust Bank and Tk 20 crore from Bengal Commercial Bank, as per BB data.

Bangladesh Bank Executive Director and Spokesperson Husne Ara Shikha confirmed the news today and said some banks are still preparing required documents to support those lenders.

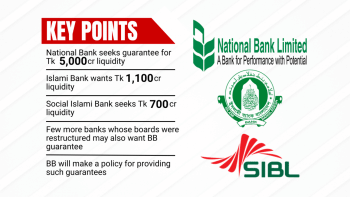

Before the move, five crisis-hit banks -- First Security, Global Islami, Social Islami, Union and National -- last month obtained a Bangladesh Bank (BB) guarantee to avail liquidity support from the inter-bank money market.

Following the installation of an interim government in August, all five commercial lenders saw their boards of directors reconstituted.

The central bank imposed nine conditions in the agreements with the five commercial lenders.

According to the terms, the banks will have to pay a 0.25 percent guarantee fee on the guaranteed amount.

The guarantee covers a period of three months on a case-to-case basis, while the loans will have to be paid back with profit after maturity.

Under the agreement, once the loans are repaid, the lenders will be able to take loans for another three months and the total tenure of this rollover will be one year.

In case of a failure to repay by the crisis-hit banks, the liquidity provider banks can create 90 days' tenure of forced loans in the name of the borrowing banks.

Against the liquidity support, the profits or interest will be imposed at the existing special liquidity facility (SLF) rate.

The BB will be able to deduct funds from the concerned lenders' current accounts with the central bank in case of failure to repay the loans on time, as per the agreement.

An additional 2 percent interest or profit will be imposed on the SLF rate if the loans are not repaid on time, it said.

If the BB fails to recover funds from the borrowers' current accounts, it will recover cash by selling the bank's permanent assets, bonds and other securities.

The banks will have to provide information and required documents to the central bank if needed and the BB can change the guidelines of the guarantee, as per the agreement.

The BB governor had said the central bank would not provide liquidity support by printing money like it did in the past but would instead create the scope for lenders to seek support from the inter-bank money market.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments