Four state banks asked to submit work plan to improve health

Bangladesh Bank (BB) has asked four state-run banks to submit a work plan for the next three years to improve their financial health, which had turned fragile during the Awami League-led government's regime due to political interference and irregularities.

The banking regulator recently sent letters to state-run Agrani Bank, Sonali Bank, Janata Bank, and Rupali Bank, instructing them to submit the work plan.

A senior official of the central bank, seeking anonymity, told The Daily Star that these banks have to submit a three-year work plan to improve their financial indicators.

The indicators include the reduction of non-performing loans (NPLs), provision and capital shortfalls, and credit concentration; closing loss-making branches; and bringing loans of large borrowers within the exposure limit.

Previously, the central bank used to set biannual performance improvement targets for the four state-run banks, but they were not able to meet their targets. That is why the BB has now asked them to submit a work plan and targets for the next three years, said the BB official.

Since 2007, the BB has been setting biannual performance improvement targets such as cash recovery from defaulters, bringing down the defaulted loan ratio, improving the capital base, credit growth, profitability, and so on for the four state-owned commercial banks to restore their financial health.

Despite close monitoring by the central bank, the financial health of the state-run lenders continued to worsen during the previous government's regime.

After the political changeover on August 5 of last year, the actual fragile scenario of the state-run banks came to light.

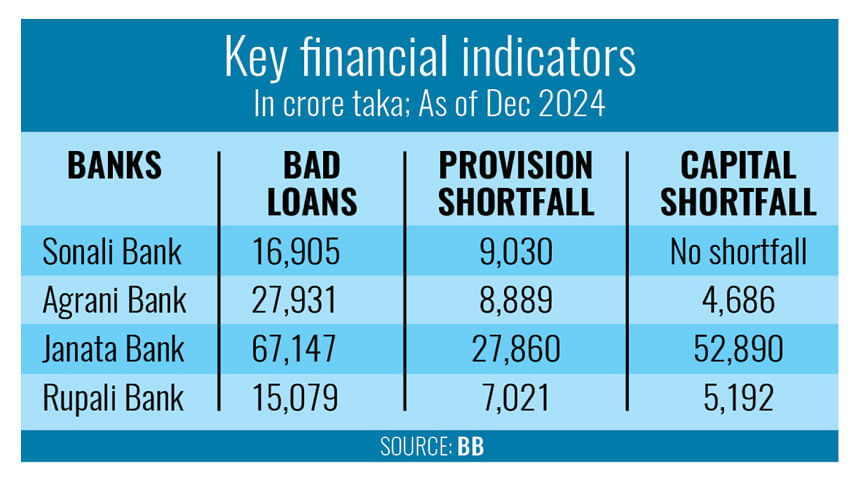

At the end of last year, the six state-run commercial banks' bad loans stood at Tk 136,618.60 crore, and of them, Tk 127,062 crore were held by the four state-run banks, central bank data showed.

The four banks also faced a combined Tk 52,800 crore provision shortfall, and except for Sonali Bank, they faced a Tk 62,768 crore capital shortfall, the data showed.

Janata Bank saw the highest capital shortfall, which swelled to Tk 52,890 crore by the end of 2024, driven by Tk 67,148 crore in bad loans—72 percent of its disbursed portfolio.

Major defaulters include Anontex, Crescent, Beximco, Thermax, and S Alam Group, who collectively owe over Tk 45,000 crore, according to BB data.

The majority of the state-run banks have now become unable to disburse large loans due to their worsening capital base, industry insiders said.

At the end of December last year, state-run banks posted a CRAR (capital to risk-weighted assets ratio) of negative 8.42 percent, far below the 10 percent minimum required under the Basel III framework, an international set of reforms.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments