Golden Life Insurance in trouble as customers owed Tk 35cr

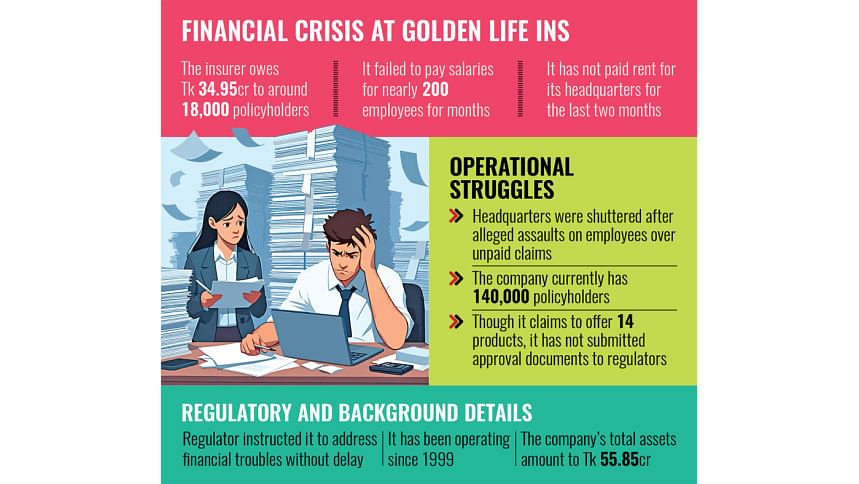

Private insurer Golden Life Insurance Limited is in crisis as it struggles with a severe cash crunch, unpaid claims and operational breakdowns.

The company, established in 1999, is now in turmoil, with its headquarters closed, many key officials absent and around 18,000 policyholders waiting for their dues.

After the political changeover in August last year, the insurer's troubles have deepened, as its head office at Ambon Complex in Mohakhali area of Dhaka remains shut for more than a month.

The closure followed a confrontation between frustrated policyholders and company staff after the insurer failed to settle claims totalling Tk 34.95 crore.

Amzad Hossain Khan Chowdhury, chief executive officer of Golden Life Insurance, admitted the severity of the situation.

"The head office has remained closed for the past 20 days in a row. We are making our best efforts to resolve the current problem," he said.

While Chowdhury claimed that branch offices are functioning "as usual," the company's inability to pay salaries to nearly 200 employees or clear overdue rent for its headquarters throws light on its financial distress.

YEARS OF MISMANAGEMENT

The current crisis of the insurer originated from years of operational mismanagement and governance failures.

Chowdhury pointed to irregularities between 2011 and 2014, including unreported policies and unsubmitted money receipts by field-level employees, which created a backlog of liabilities.

"When these clients claimed their funds, the money went pending," said the CEO.

He added that after the political changeover in August, funding for operations stopped abruptly, leading to a halt in claim settlements from September and a suspension of staff salaries.

A recent visit to the company's head office found locked doors on the 3rd and 5th floors of Ambon Complex.

"The office is currently closed," a notice at the building entrance read. "A strike is underway due to the board's failure to provide promised funds on time. We kindly ask customers for their patience."

A senior official of the building's management told The Daily Star that Golden Life has not paid rent, electricity or water bills for two months.

However, the insurer has reportedly promised to settle the dues after upcoming Eid-ul-Fitr and vacate the premises.

The crisis at the headquarters has also affected Golden Life's regional offices.

A visit to its Chattogram divisional office on March 16 found only one official present, with the office head's room locked and no other staff in sight.

'A COMPANY CAN'T OPERATE LIKE THIS'

Amid the crisis at Golden Life, the Insurance Development and Regulatory Authority (Idra) has intervened.

The company's managing director, head of accounts and company secretary were summoned by Idra last week for updates.

Yesterday was the deadline set by the insurance regulator for resolving the issue, but the company failed to meet it and requested more time.

The regulator granted the request, setting the next meeting for March 20.

Md Apel Mahmud, Idra's member for life insurance, said, "A company cannot operate like this. They also do not have the authority to shut down a company's head office in this manner. There are certain systems and rules in place."

Meanwhile, AKM Azizur Rahman, chairman of Golden Life Insurance, assured Idra in a letter yesterday that all outstanding urgent claims would be settled within the next 30 days.

Golden Life's troubles are not new.

A special audit by Idra in 2022 uncovered massive irregularities, resulting in a Tk 22 lakh fine, which remains unpaid.

Besides, the company has failed to provide approval documents for its 14 insurance products, raising further concerns about its compliance and governance.

Golden Life's total assets stand at Tk 55.85 crore, with 140,000 policyholders.

Preferring anonymity, a chartered accountant and life insurance expert with over 20 years of experience in both multinational and local firms said that the breakdown stemmed from weak governance within the company as well as regulatory lapses.

He warned that similar problems could affect other life insurance companies if the regulator takes drastic actions against them, ultimately eroding public confidence in the insurance sector.

Bangladesh has 82 insurance companies, 36 in the life insurance sector and 46 in the non-life sector.

[Md Nazrul Islam from Chattogram contributed to this report]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments