Govt borrowing from banks rises as unrest hits tax collection

The government's net borrowing from the banking system rose in the first two and half months of the current fiscal year in the face of falling tax collection and surging foreign debt servicing costs, raising concerns of a crowding out effect on private credit.

The government's borrowing from banks increased by Tk 6,568 crore during July 1 to September 15 of fiscal year (FY) 2024-25. During the same period a year ago, the net borrowing from banks fell by Tk 8,939 crore, according to the Bangladesh Bank (BB) data.

The spike in borrowing took place at a time when high inflation, rising interest rates and import contraction have caused a slowdown in businesses and investment.

Bangladesh's economic activities ground to a near-halt in July amid deadly protests and a mass uprising, which led to the fall of the Sheikh Hasina-led government on August 5.

The spike in borrowing took place at a time when high inflation, rising interest rates and import contraction have caused a slowdown in businesses

The interim government took charge in the second week of August, the latter part of which saw devastating floods in the Eastern districts and crippled the Dhaka-Chattogram Highway, the key economic corridor which carries most of the country's export and import cargo.

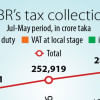

Tax collection by the National Board of Revenue (NBR), which collects more than 85 percent of total revenue, fell 6 percent year-on-year in the first quarter of FY25.

Disbursement of loans by bilateral and multilateral lenders fell by a third year-on-year to $846 million in the July-September period of FY25. At the same time, Bangladesh's foreign debt servicing shot up 29 percent year-on-year to $1,126 million.

In net terms, the country spent more to repay foreign loans than it received during the period.

"The ongoing political unrest has triggered a slowdown in revenue growth between July-September and Annual Development Programme implementation," said Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh.

"The resulting economic uncertainties that we have witnessed have also motivated development partners like the World Bank to reduce our growth forecast for the current year to 4 percent," he said.

"Moreover, the lack of coherence within the civil bureaucracy, and recurring strikes and unrest on various issues are keeping political uncertainties very much alive. As a result, the government is depending on commercial banks to meet its expenditure outlay.

"But this is unlikely to influence inflation as it does not involve the printing of high-powered money."

Central bank data showed that the government repaid Tk 29,272 crore from July 1 to September 15 this year, which was higher than the amount it repaid in the same period a year ago.

"Furthermore, given Bangladesh Bank has categorically stated that it is not willing to directly lend to the government through the creation of high-powered money, the inflationary pressure is expected to come down provided that the central bank remains committed to the tightened monetary regime," said Rahman.

However, Deen Islam, associate professor of economics at the University of Dhaka, was of a different opinion.

"Increased borrowing from the banking system often leads to higher liquidity in the market, which can contribute to inflationary pressures, especially when not offset by corresponding increases in productivity or supply," he said.

"With headline inflation already high, further borrowing by the government could worsen the inflationary environment. The increased availability of money in the economy, without a corresponding rise in the production of goods and services, can drive up prices, exacerbating inflation."

Additionally, the recent data on currency outside banks, which rose by 0.69 percent in August 2024, suggests that more money is circulating in the economy, potentially adding to inflationary pressures.

Islam said the net outstanding position of government borrowing from the banking sector, including the BB, rose 24 percent year-on-year to Tk 4.81 lakh crore as of September 14 this year.

"This is a significant increase, indicating the government's growing reliance on domestic bank financing to meet its fiscal demands," he said.

"While the government reduced its net borrowing from Bangladesh Bank itself, the broader banking sector has had to absorb a larger portion of the debt.

"Government borrowing from banks can lead to a crowding-out effect, where private businesses have less access to loans due to the government soaking up available funds," he said.

Islam added that the net credit to the private sector, which increased 0.09 percent in August 2024 compared to 9.84 percent in June 2024, suggests that credit expansion to the private sector is slowing, potentially due to the government's increased demand for funds.

Additionally, government borrowing can lead to higher interest rates as banks seek to compensate for the increased demand for funds.

"This might constrain private sector investment, which is crucial for stimulating economic growth."

He said the non-bank borrowing of the government increased in July this year by Tk 4,360 crore compared to Tk 996 crore taka a year ago.

"Revenue collection continues to be a concern. The slower growth in tax revenues further exacerbates the need for borrowing, putting additional strain on fiscal management."

Islam said the overall economy of Bangladesh is facing a slowdown, and the heavy government borrowing from the banking sector could exacerbate this issue.

Towfiqul Islam Khan, senior research fellow at the Centre for Policy Dialogue, said the government does not have much option beyond bank borrowing for budget deficit financing.

"External borrowing is tied to development project implications. Sales of national savings instruments has fallen due to drop in the disposable income of the middle class."

Khan said borrowing from commercial banks should not be very high.

The government should revise the budget at the earliest, keeping in view a realistic revenue mobilisation target and a budget deficit that the economy can absorb, he added.

The previous Awami League government framed a nearly Tk 8 lakh crore budget with plans to borrow over Tk 2.51 lakh crore for the FY25.

"Essentially, it will inform the likely scope for public expenditure. The government indeed will be required to prioritise its public expenditure. And it should prioritise the interest of marginalised people."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments