Tax collection falls short of IMF loan condition

The government has fallen Tk 17,946 crore short of the revenue it was to collect in the form of taxes last fiscal year as per one of International Monetary Fund's (IMF) conditions for a $4.7 billion loan.

The target was to collect Tk 345,630 crore between July 2022 and June 2023.

But the government finally collected Tk 327,664 crore in total tax revenue last fiscal year, according to a Finance Division report.

An IMF delegation visited Dhaka in October to review the progress made in meeting the conditions for the release of the loan's second tranche of about $681 million.

A finance ministry official said they had already informed the delegation of the government's inability to fulfil two conditions involving the tax collection and foreign currency reserves.

The government also explained the reasons behind its shortcomings, said the official.

However, the government is hopeful of getting the second tranche, he added.

The loan proposal is expected to be placed at an IMF board meeting on December 11 or 12 for approval, said the official.

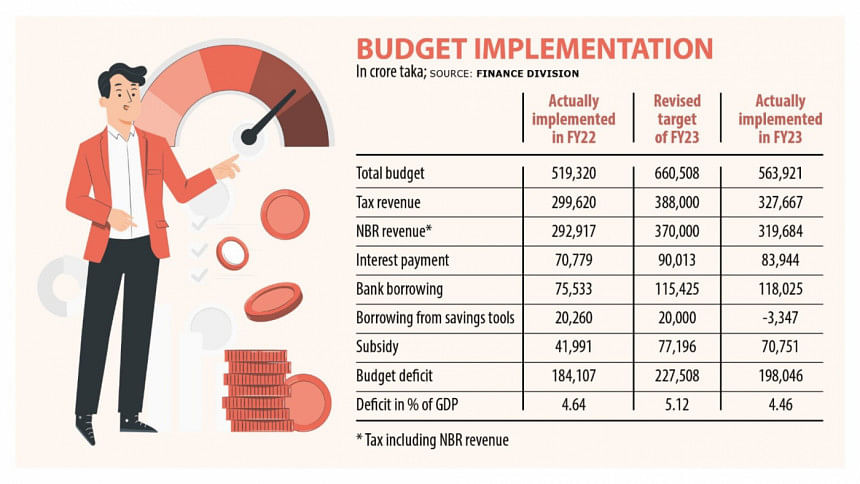

The finance division on Tuesday published its budget implementation report for last fiscal year.

The government's total revenue collection, meaning from the National Board of Revenue (NBR) tax, non-NBR tax and revenue, stood at Tk 365,862 crore whereas its target was Tk 432,999 crore.

However, the NBR's revenue collection increased 9.13 percent year-on-year to Tk 319,684 crore.

The NBR's revised revenue collection target was Tk 370,000 crore.

The government had to restrict imports to stabilise the country's foreign currency reserves in the aftermath of the Russia-Ukraine war, said the finance ministry official.

As a result, revenue collection fell short of the target, said the official.

Another IMF loan condition for the second tranche was that the budget deficit for last fiscal year could not be more than Tk 168,640 crore.

However, the country's budget deficit last fiscal year stood at Tk 198,046 crore.

The official said the IMF would review the budget deficit condition deducting interest payment and grants.

Last fiscal year the government made interest payments of Tk 83,944 crore and received Tk 2,749 crore in foreign grants.

The government's actual budget last fiscal year was nearly Tk 700,000 crore, which came to stand at Tk 660,508 crore in the revised budget.

Finally, the government could implement Tk 563,921 crore from the revised budget.

By reducing its expenditure, the government was relieved from maintaining its budget deficit.

The IMF's recommended target is to keep budget deficits within 5 percent of the GDP.

In the revised budget, Bangladesh's budget deficit target was 5.12 percent of the GDP. However, the budget deficit finally came to stand at 4.46 percent of the GDP.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments