Grameenphone can’t stop raking in profits

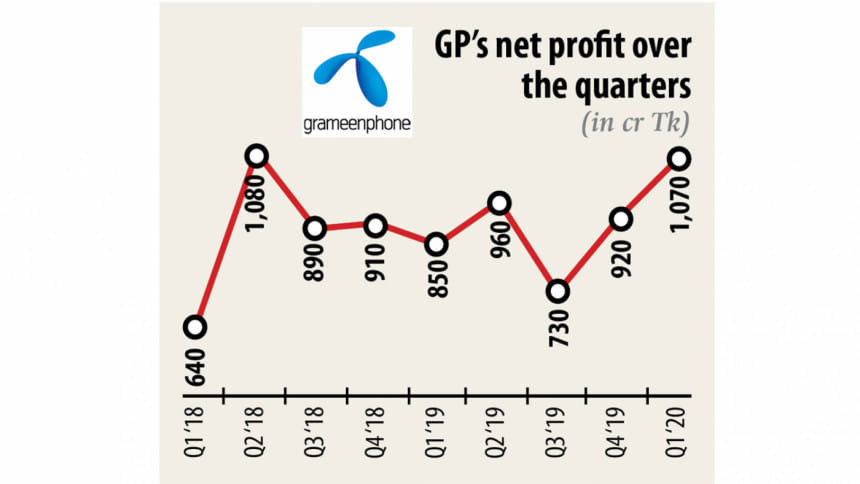

Grameenphone's net profits soared 25.8 per cent year-on-year to Tk 1,070 crore in the first quarter of the year driven by data revenue and cost-efficient programmes despite operating an increasingly challenging environment.

The carrier's profit margin was 29.6 per cent in January to March, the highest in recent times, according to the company's quarterly financial statement, which was published yesterday.

Earnings per share of the country's largest-listed company stood at Tk 7.92, up from Tk 6.92 in the same quarter a year earlier.

Grameenphone reported Tk 3,620 crore in revenue, registering 3.7 per cent year-on-year growth. It earned Tk 850 crore from the data segment, which posted 24.6 per cent growth, according to the report.

A huge 4G conversion took place in the quarter pushing up data revenue growth, said a company official. In the quarter, 23 lakh internet users who were using 3G service converted to 4G.

The operator though continued to face challenges in the quarter, GP said.

The challenge is related to the Bangladesh Telecommunication Regulatory Commission's audit claim of Tk 12,580 crore.

"The restrictions placed on us by our regulator by not issuing NOCs (approvals) lasted until March, which impacted our planned investment in the country," said Yasir Azman, chief executive officer of Grameenphone, in a statement.

Additionally, the company faced scarcity of numbers from the beginning of the quarter that negatively impacted the subscriber base, he said.

"Despite the challenges, our focus remained on market execution and maintaining our network leadership," said Azman, adding that the operator's drive on 4G conversion led to 1.42 crore 4G users at the end of the quarter.

The operator faced several challenges from the BTRC, centring the audit claims and its refusal to give approvals, even for network expansion and maintenance.

Despite the restrictions, the leading operator invested Tk 40 crore for network coverage and added 197 new 4G sites to its network.

"Grameenphone is a well-performing company, so its good performance was expected," said Ershad Hossain, managing director of City Bank Capital.

As the novel coronavirus is spreading, the use of telecom service is also rising.

As a result, the company will perform better in the coming days, he said, adding that had there been no audit-related disputes with the government, its share prices could be Tk 500.

"GP's competitors are still far behind."

The company's share was traded at Tk 238 on March 25, the last trading day before the country was placed on lockdown. The market has not opened since.

"Good performance of a stock is a good sign for the market and its higher profits will positively impact the market," Hossain added.

The profit growth of the company is impressive despite losing about 6 lakh subscribers during the quarter due to the government's restrictions on the issuance of new connections, said Md Moniruzzaman, managing director of IDLC Investments.

The company witnessed negative growth in voice revenue but managed to grow data revenue and had and improvement in operating efficiency, which contributed to the bottom line remarkably.

The company's income is yet to take a hit from the payment of Tk 1,000 crore to the government against the audit claim as per court order, he said.

However, the challenges remain on whether it will be able to get in the government's good books and settle unresolved court cases quickly.

The telecom company has the potential to grow faster but it has to pay huge attention to its dispute with the government rather than to its competitors, said a stockbroker preferring anonymity.

The government should emphasise on ensuring that the operator provides better services at competitive rates, he added.

Grameenphone's total number of active connections stands at 7.53 crore, 4.04 crore of which are using the internet.

Its users consume 2,225 megabytes of data every month on an average, up from 1,418 MB a year ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments