Half of remittances came thru Islamic banking in Dec

Nearly half of the total remittances in December last year came to Bangladesh through Islamic banking channels, according to the Bangladesh Bank.

Migrant workers sent home Tk 10,619 crore in remittances in December last year through Islamic banks, which accounted for 48.41 percent of the total Tk 21,934 crore received through all types of banking channels that month, showed data from the "Islamic Banking and Finance Statistics" of the central bank.

The Bangladesh Bank released the monthly statistics on Islamic banking for the first time.

Total receipts during December last year were 8.36 percent higher than the Tk 8,571 crore received in November of 2022.

Among remittance earnings via Islamic banking channels, 10 full-fledged Islamic banks received Tk 10,475 crore in the last month of 2023, up Tk 2,049 crore compared to the Tk 8,425 crore channelled through Islamic banks in November of 2022.

However, remittance receipts through Islamic banking branches of conventional banks dropped to Tk 78 crore in December last year from Tk 82 crore in November 2022.

Besides, Tk 67 crore remittance was received through Islamic banking windows of conventional banks in December 2023 compared to Tk 63 crore in November 2022.

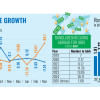

According to the latest data, a total of $2,043.06 million was received in remittances through all banking channels in April this year.

The remittance inflow was $1,997.07 million in March.

In April, among full-fledged Islamic banks, Islami Bank Bangladesh received $541.25 million, Social Islami Bank $148.23 million, Al Arafah Islami Bank $59.45 million, Standard Bank Ltd $40.54 million, First Security Islami Bank $10.39 million and EXIM Bank $3.34 million.

Industry insiders said remittance inflows through banking channels are increasing as banks are buying US dollars for more than the official rates to encourage remitters.

Currently, the official rate of the US dollar is Tk 110-115 along with a 2.5 percent incentive.

About the Islamic Banking and Finance Statistics, the Bangladesh Bank said the review would be beneficial in helping policymakers understand the necessity of framing separate acts to grow the Islamic banking industry.

"After all, we do believe the Islamic banking sector will be the predominant sector in the entire banking industry," the central bank said in its concluding remarks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments