Highest income tax rate stays unchanged at 25%

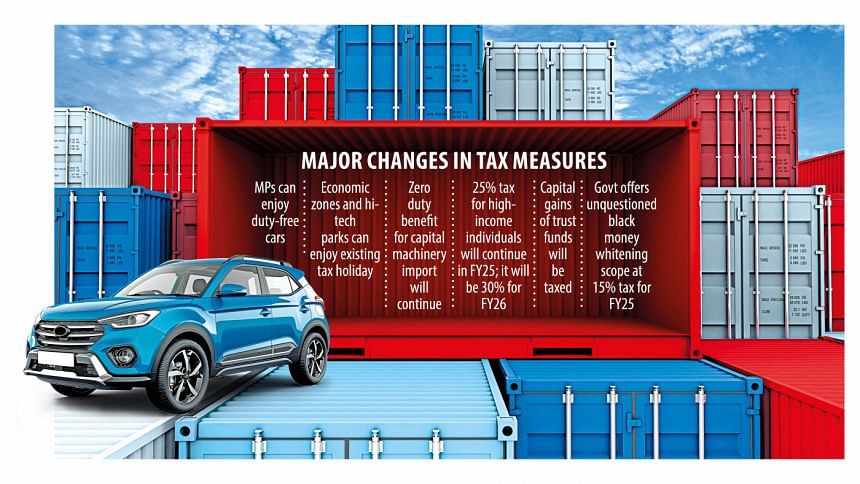

The government has moved away from its decision to raise the highest income tax rate to 30 percent and end tax holidays for investors in economic zones and hi-tech parks.

However, the proposal aimed at granting amnesty for whitening the black money has been approved while the plan to levy duties for the first time on the cars imported by lawmakers has been scrapped – developments that upset the opposition.

Yesterday, lawmakers passed the Finance Act 2024 with several amendments after Finance Minister Abul Hassan Mahmood Ali placed the bill in parliament.

When he unveiled the budget for 2024-25 on June 6, the finance minister proposed to elevate the highest slab of the tax rate to 30 percent applicable to annual incomes of more than Tk 38.50 lakh that high-income earners can generate.

The government has retained it at 25 percent "to ease the tax burden" on taxpayers, according to the amended Finance Act. The highest tax rate would be 30 percent from 2025-26, it said.

The government has extended the existing 10-year holiday for investors in private economic zones and hi-tech parks and continued the zero-duty benefit on the imports of capital machinery, components and construction materials. The finance minister had proposed a 1 percent duty.

Ignoring widespread condemnation from economists, watchdogs and businesspeople, the scope to allow individuals and businesses to legalise black money without facing any question and by paying a 15 percent tax was passed.

According to the new provision, no authority can question if a taxpayer pays tax at fixed rates for immovable properties such as flats and land, and a 15 percent tax on other assets, including cash, securities, bank deposits, and savings schemes.

Yesterday, several lawmakers including GM Quader, also the opposition leader, and Hamidul Haque opposed the amnesty.

"It is double standards on the part of the government because it has committed to eliminate corruption. It should be stopped," Haque, the lawmaker of Kurigram-2, told parliament.

After the budget was unveiled, the finance minister was praised for his plan to amend the Member of Parliament (MPs) Order 1973 in order to withdraw the duty-free vehicle import facility for lawmakers. A 25 percent import duty, along with other taxes, was scheduled to be in place in FY25.

Since no amendment was proposed yesterday, lawmakers will keep enjoying the benefit.

Currently, vehicles are considered luxury goods in Bangladesh and are subject to a maximum of 500 percent supplementary duty. In some cases, it goes up to 800 percent. Also, there are other duties and taxes that regular importers must cough up. In contrast, MPs have been exempted from paying any customs duties since 1988.

Officials of the finance ministry and the National Board of Revenue (NBR) who were involved with the budget preparation said the change in plan comes as the initiative contradicts the MPs (Remuneration and Allowances) Order, 1973 (President's Order).

NBR data showed that of the 572 cars imported by the MPs since 2009, at least 563 were brought in from Japan. Brands included Toyota Land Cruisers, Range Rovers, and Mitsubishi Pajero.

The finance minister also backtracked on his decision to impose an environmental surcharge on the vehicles owned by government authorities, departments and private companies. The surcharge on the second vehicle has been retained.

According to the Finance Act, trusts will have to pay a 15 percent capital gains tax similar to companies. Previously, trusts were excluded.

The capital gains up to Tk 50 lakh in the share market will continue to qualify for the tax exemption.

For individual investors, the gains tax would be 15 percent if they hold securities for at least five years. If they make the sales in less than five years, the capital gains will be considered as other incomes, and the regular income tax rate will be applicable.

The government has eased the rules on showing proof of submission of returns linked to renting community and convention centres for weddings and other events.

Under the new provision, proof of income tax filing will be required only for using such venues in eight city corporations.

Speaking in parliament, Abul Hassan Mahmood Ali said inflation would come down to 6.5 percent in the next fiscal year thanks to steps and strategies initiated by the government.

He also said the budget for FY25 has been framed to strike a balance between attaining economic stability and retaining the growth trend, the goals that apparently contradict each other.

The finance minister is hopeful that the country will return to a higher growth trajectory soon.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments