How much per capita debt does Bangladesh have?

It is a great news for Bangladesh to see its per capita income rising gradually. But did we ever think about how much per capita debt we have at present and how much is the government spending per head?

The government has to take a huge amount of loan every year from different sources to bear the development and non-development expenditure.

At the beginning of a fiscal year, the government comes up with a list of works that are needed to be done to ensure economic growth and development of the country and to keep the promises made to the general mass during the election.

Then the government starts finding out where it can generate revenue from and how it can earn more tax and non-tax revenue to finance the list of areas of spending it had made, which is called annual financial statement or national budget.

Despite collecting lakhs of crores of taka in revenue, every time the government falls short of fund to finance the whole budget and has to take crores of taka in loan from local and foreign sources.

The burden of the loans falls on the shoulder of the general mass, as these are cleared with the money paid by the taxpayers.

Bangladesh's total loan stood at Tk 1,006,202 crore at the end of 2019-20 fiscal year and Tk 1,144,297 crore in the next fiscal year, according to the September 2021 edition of the Debt Bulletin released by the finance ministry.

In 2019-20, Bangladesh's per capita national debt stood at Tk 59,822 when the country had a population of 16.82 crore, according to data of the Bangladesh Bureau of Statistics.

The next year, the per capita debt rose by 14 per cent to Tk 68,031.

Now let's see where does the government get the loans from and how much per capita debt other south Asian nations have?

The two-thirds of Bangladesh's loan taken in 2020-21 fiscal year came from local sources and the rest from foreign countries and global lenders.

The government takes the highest amount of local loan from savings certificates, uses the fund and in exchange gives interests in different amounts.

Treasury bills, treasury bonds and Sukuk are the other sources of local loans.

The major portion of the foreign loans Bangladesh took in 2020-21 fiscal year came from World Bank, the Asian Development Bank, Japan, Russia, China and India.

It is a must here to mention that it is easier for the government to clear foreign loans, which come with longer repayment periods and low interest rates.

On the other hand, the interest the government pays to the public for savings certificates is much higher than the interest payment for foreign loans.

Now let's focus on the per capita debt of the neighbouring countries of Bangladesh.

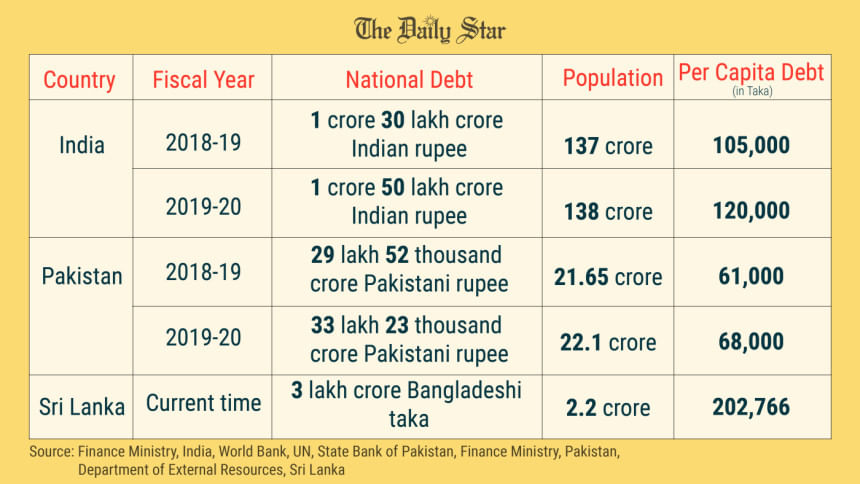

India, the largest economy in South Asia, had a per capita debt of over Rs 105,000 in 2019, which crossed Rs 120,000 in 2020, according to data of the Indian finance ministry, the World Bank and the United Nations.

Pakistan's per capita debt was Rs 68,000 at the beginning of the current financial year, up from Rs 61,000 in the previous year, according to data of the State Bank of Pakistan, the Pakistani finance ministry and the World Bank.

And the per capita debt of Sri Lanka—which is currently going through a severe economic crisis—exceeds 2 lakh rupees if the country's foreign loan alone is taken into consideration, according to the Department of External Resources of Sri Lanka and the World Bank.

Now the question is how much did the government of Bangladesh spend per capita in 2020-21 fiscal year?

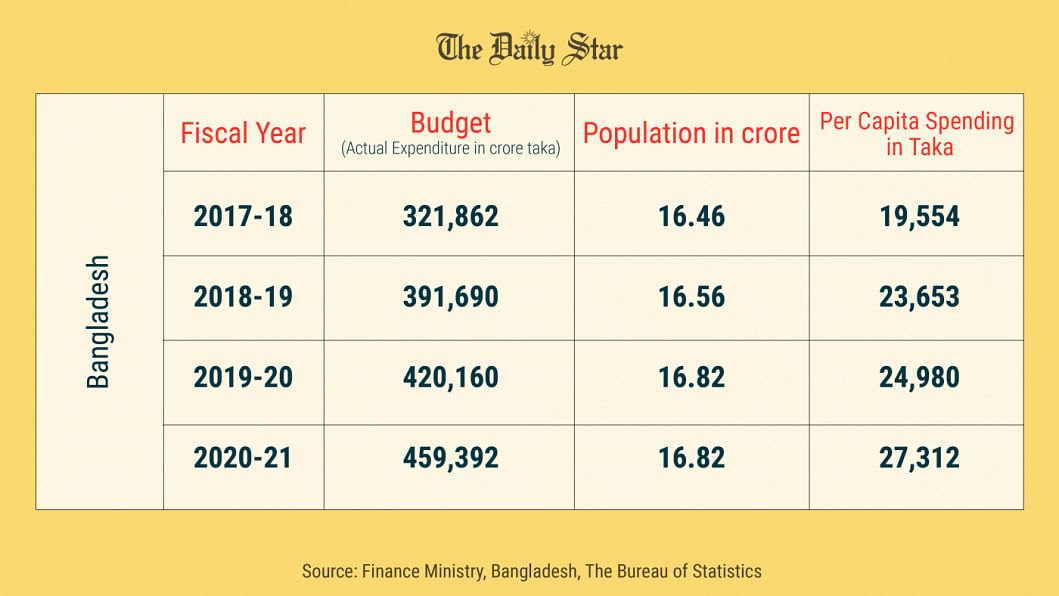

The per capita expenditure of the government through the budget has increased every year. In 2017-18 fiscal year, the government spent Tk 19,554 per capita through the budget.

The very next year, the amount was increased by more than 20 per cent. In the next two years, the spending rose and hit Tk 27,312 in 2020-21.

It is important to note here that this per capita debt is calculated based on the amount of money borrowed by the government so far. And the country does not need to repay the loans at a time and every year the government sets aside a part of the national budget to pay interest of the loans.

However, it is also worth mentioning here that Bangladesh's loan repayment record has always been and is still good.

Moreover, prominent economist Wahiduddin Mahmud in an article published recently said the pressure on Bangladesh to repay the loans may have increased now because of the arrival of the coronavirus pandemic and the debts of the mega projects.

"But there is nothing to be worried about Bangladesh's debt right now," the economist said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments