Idra seeks revival plans from six troubled life insurers

The Insurance Development and Regulatory Authority (Idra) has asked six troubled life insurance companies to submit their plans for addressing prolonged failures in settling claims as policyholders continue to suffer due to corruption and irregularities.

The regulator's move aims to ensure greater accountability and protect consumer rights in the sector.

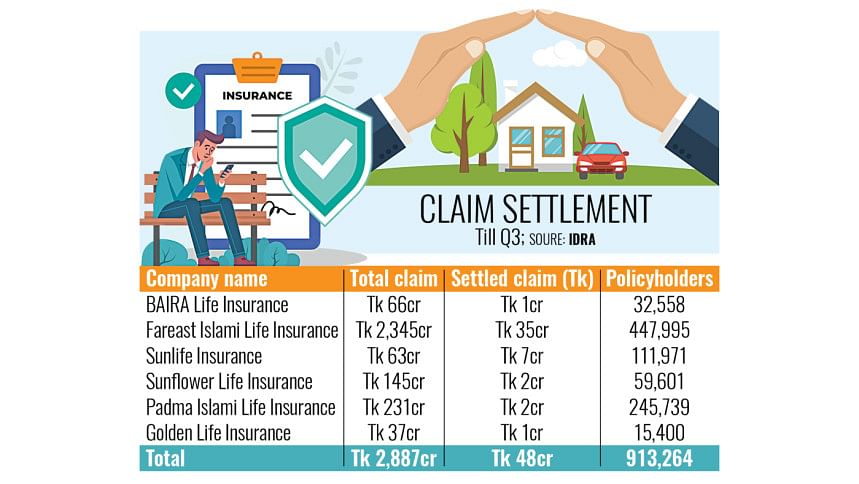

The companies facing regulatory scrutiny are Baira Life Insurance, Fareast Islami Life Insurance, Sunlife Insurance, Sunflower Life Insurance, Padma Islami Life Insurance, and Golden Life Insurance.

Meanwhile, Golden Life Insurance is in turmoil, with its headquarters currently shut down amid ongoing financial struggles.

Data from the Idra showed that six life insurers are required to settle more than 9 lakh policyholders' claims worth Tk 2,887 crore. The unsettled claims accumulated in five years until the third quarter of 2024 are 98.37 percent of the total claims in this period.

Md Solaiman, spokesperson of the Idra, told The Daily Star that the six companies have failed to comply with various regulatory parameters, particularly in settling policyholder claims.

He also added that prolonged corruption and irregularities within these companies have led to their ongoing challenges and the companies are in dire financial condition.

Therefore, the insurance regulator has held meetings with the chairpersons and chief executive officers of these companies recently, asking them to submit a three-month action plan by April 15, outlining how they intend to address the issue, he added.

According to the latest Idra data, except for Sunlife Insurance, the remaining five companies have a claim settlement ratio of less than 5 percent.

"If the insurers' proposed solutions are not satisfactory, the regulator will take maximum intervention to resolve the issue," Solaiman said.

Amzad Hossain Khan Chowdhury, chief executive officer of Golden Life Insurance, told The Daily Star that they have been trying to resolve the crisis.

The company, established in 1999, is now in turmoil, with its headquarters closed, many key officials absent and around 18,000 policyholders waiting for their dues.

The closure followed a confrontation between frustrated policyholders and company staff after the insurer failed to settle claims totalling Tk 34.95 crore.

Meanwhile, the board of directors of Padma Islami Life Insurance has decided to sell its property, particularly land, to settle claims from policyholders, the company said in a disclosure.

The Idra has already approved the sale, according to the disclosure posted on the Dhaka Stock Exchange website.

The 20-decimal land, located in Cumilla, would have a sale price of Tk 1.9 crore.

According to the latest data, Padma Islami Life Insurance received claims worth Tk 226 crore over the past five years, while approximately Tk 221 crore of these remain unsettled.

A top official of Sunlife Insurance said that, of the Tk 63 crore in claims, they have already paid Tk 33 crore. Currently, 19,000 policyholders are still owed Tk 30 crore.

It is possible to resolve the current issue by selling new policies and they will officially inform the regulator of this, the official added.

This reporter also tried to contact the top official of Padma Islami Life Insurance, Baira Life Insurance, Fareast Islami Life Insurance, and Sunflower Life Insurance. However, they did not respond by the time this report was filed.

Idra spokesperson Solaiman said the companies have been directed to sell assets, reduce staff, and inject funds to address the issue.

The regulator has offered them one final chance before resorting to any drastic measures, he said.

Also, they have been asked to provide a logical and practical plan as the companies are facing endless problems. It is not possible to resolve all the issues at once, he added.

Md Main Uddin, a professor of banking and insurance studies at the University of Dhaka, said addressing the prolonged claim settlement failures is crucial for restoring trust in the life insurance sector.

The regulator's intervention is a necessary step in ensuring that these companies adopt a clear and actionable plan to resolve outstanding claims, he said.

The mounting issues of corruption and irregularities need to be tackled head-on, and a transparent approach to policyholder compensation will be vital for both policyholder protection and the stability of the industry, he added.

However, he further said that it would have been better if the government had taken this regulatory measure earlier. Nevertheless, the fact that they have realised the importance of this issue, even if late, is still significant.

Meanwhile, those responsible for the current situation of the companies must face exemplary punishment, which will serve as a warning for many, Main Uddin added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments