IMF eases forex reserves target

Thanks to bold reform measures taken by the authorities, the IMF has drastically slashed the Net International Reserves (NIR) requirement for Bangladesh for the fourth tranche of the $4.7 billion loans.

The Washington-based multilateral lender had given the country a target to maintain $20.11 billion at the end of June this year. But after its 15-day review mission in Dhaka, it has reduced the NIR threshold for the central bank to $14.76 billion, according to a document of the IMF.

This is yet another relaxation on the NIR since the lender approved the loan for Bangladesh in January 2023 to tackle its economic challenges stemming from the global economic crisis and other factors.

Bangladesh Bank could not maintain the NIR goal, for until June 2023, set by the IMF after its first review. It also failed to hit the mark set for until December 2023.

Until that December, the central bank was supposed to maintain an NIR of $17.78 billion. It fell short by more than a billion.

Despite the failures to maintain the NIR, Bangladesh is going to get $1.15 billion as the third tranche of the loan, way above the programmed amount for the period.

"It appears that the IMF has relaxed the NIR target for us given the major reforms we have implemented on the exchange rate and interest rate and in consideration of the current reality," said a senior official of the BB.

Responding to a question on reserves at a press conference yesterday, Chris Papageorgiou, who led the 15-day mission to review the progress on the implementations of IMF-prescribed reforms and Bangladesh's economic health, said, "We have been seeing the reserves declining for some months now.

"We have all been concerned. Pre-pandemic reserves were pretty high. But we have seen a steady decline. Why is that the case?"

He said, "The most important one [reason] is external shocks -- real confluence of external shocks -- which hit Bangladesh."

He said the shocks include the war in Ukraine, the effects of the global financial tightening, and the volatility in commodity prices that affected all countries in the region.

As Bangladesh is primarily an importing country of food and commodities, the high prices trickled down to the economy more quickly than other economies, he added.

"So that raised inflation. And that's the inflation I think you have been seeing in the country for some time and has been persistent," said Papageorgiou.

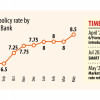

He said that since then, the authorities have taken some actions, including increasing the policy rates by 150 basis points.

"But inflation has been pretty stuck. At the same time, unfortunately, that pressure on reserves has continued."

He said the authorities have now taken bold actions, which are really a package of reforms.

He said they see Bangladesh coming out of these challenges and the challenging times.

The country had requested the IMF to cut the revenue collection target, which the lender refused. It kept the revenue collection target for the government at Tk 3,94,500 crore for June this year.

The IMF official said an increase in tax revenues is necessary.

He said for decades, Bangladesh has had one of the lowest tax revenue to GDP ratios. "So, we think that there is room for improvement there."

Tax revenues could be raised by 2.5 percent of GDP every year with measures like the removal of tax exemptions, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments