IMF suggests raising repo rate by 50 basis points by Dec

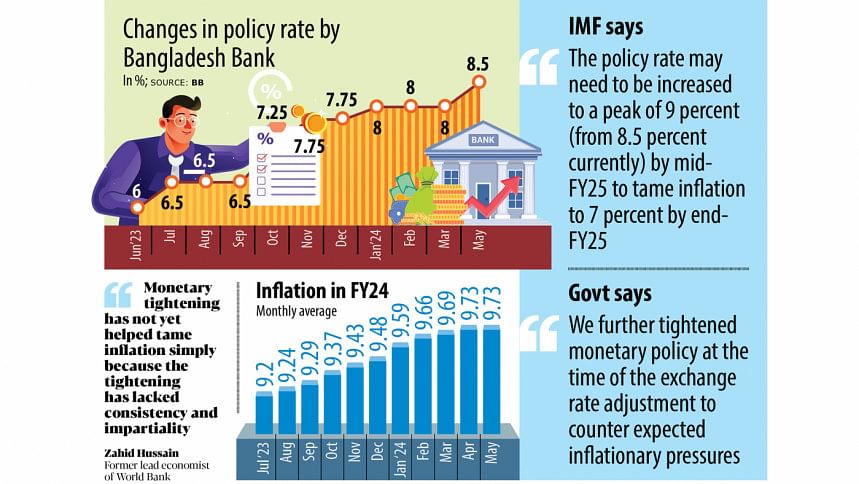

The International Monetary Fund (IMF) has suggested the central bank raise the policy rate by 50 basis points by December this year since its monetary tightening is yet to rein in inflation.

The lender came up with the recommendation as the Bangladesh Bank is set to announce its next monetary policy in July.

The central bank has been struggling to contain inflation for the past two years despite making funds costlier by increasing the benchmark policy rate to unprecedented levels.

Zahid Hussain, a noted economist, however, said the monetary tightening has not yet helped tame inflation simply because it lacked consistency and impartiality.

The BB has lifted the policy rate, better known as repo rate, by more than 400 basis points in two years to 8.5 percent, but inflation shows no signs of cooling.

The Consumer Price Index surged to a 12-year high of 9.02 percent in the last financial year, way higher than the historical average. The trend has continued into the ongoing financial year, and it has stayed above 9.5 percent, hurting the poor and low-income groups hard because their purchasing power has witnessed significant erosion.

The IMF has also urged the central bank to take the initiative to amend the Bangladesh Bank Order in light of the modern monetary policy framework and international best practices.

The suggestions were cited in its programme document as the lender approved $1.15 billion in the third tranche of the $4.7 billion loan to Bangladesh on Monday.

It said inflation is still elevated, and inflation expectations will require continued monetary policy tightening until inflation consistently slows down to BB's medium-term target range of 5-6 percent.

"The policy rate may need to increase to a peak of 9 percent by the middle of 2024-25 to tame inflation to 7 percent by the end of the fiscal year and bring it close to 5.5 percent by end-FY26," the IMF said.

The government has assured the IMF that it would tighten the monetary policy further, the document said.

The IMF also stressed the need for improvements in decision-making and communications to support the transition to the modernised policy framework.

To this end, the BB is committed to publishing the schedule of regular Monetary Policy Committee (MPC) meetings starting from FY25 and aims to start publishing a quarterly monetary policy report before the IMF-supported programme ends.

"Also, the central bank should continue revamping its legal framework to strengthen the foundation of the emerging modern policy framework," the global lender said.

The BB has agreed to share the draft amendments of the Bangladesh Bank Order for the IMF's review by December to affirm its alignment with international best practices.

The government has also assured the IMF that it would continue building analytical and forecasting capacities and improve the decision-making processes of the BB by developing a model-based forecasting and policy analysis system.

Hussain, a former lead economist of the World Bank's Dhaka office, said the BB has been financing the growing fiscal deficit indirectly by providing liquidity to banks against their holdings of Treasury bills and bonds.

The latter has increased as the government borrowed heavily from the banking system. In addition, the BB has continued supporting cash-starved insolvent banks without subjecting them to take immediate corrective actions, he said.

On May 8, the central bank loosened its age-old grip on the taka in order to shore up the foreign currency reserves, and now follows a flexible exchange rate system. It also made lending rates fully market-based.

Hussain said the foreign exchange constraint has not eased.

Forex reserves have shown some signs of stabilising recently after remittances picked up and development partners have started to disburse budgetary support.

"But it has not been enough to allow easing of import compression measures," Hussain said.

Forex reserves stood at $19.47 billion on Wednesday, central bank data showed, down from $41.7 billion in August 2021.

"Under the circumstances, the topmost priority for the forthcoming monetary policy is to enhance the transmission of monetary tightening and increase the functionality of the interest rate corridor in the money markets," Hussain said.

He called for widening the Tk 117 per dollar midpoint exchange rate by Tk 1 and providing a specific time-bound roadmap on the implementation of the Prompt Corrective Action Framework for insolvent banks.

The economist said the BB has of late slipped on data updates on its websites.

"This has fogged the transparency of the conduct of monetary and exchange rate policies and muddied BB's otherwise enviable reputation on data sharing."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments