Inflation falls to three-year low

Consumer prices eased to their lowest level in nearly three years in June, according to official data, offering tentative signs of economic stabilisation after months of monetary tightening by the central bank.

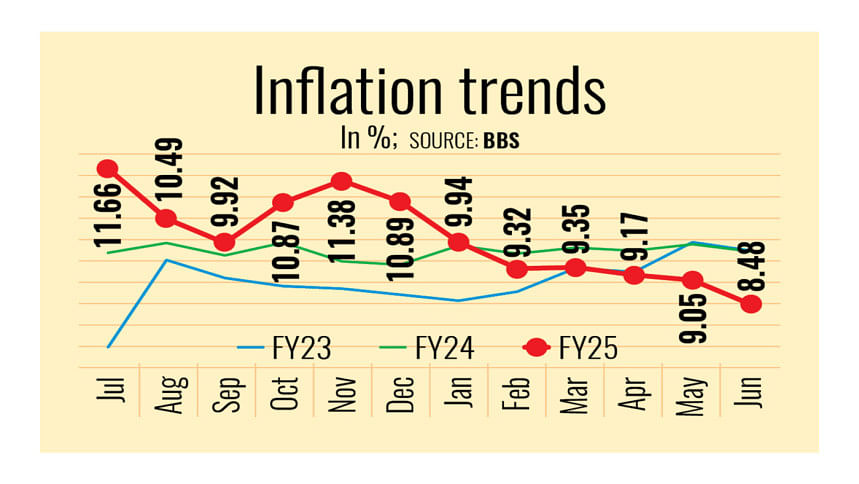

Overall inflation dropped to 8.48 percent in June, down from 9.05 percent in May, according to data released by the Bangladesh Bureau of Statistics (BBS) yesterday.

This marks the lowest reading in 35 months and the first time since March 2023 that inflation has fallen below 9 percent.

The decline was driven by a fall in both food and non-food prices. Economists say this suggests early signs of improvement in the country's macroeconomic situation.

Food inflation fell to 7.39 percent in June, compared with 8.59 percent the previous month, bringing relief to families struggling with the rising cost of essentials.

Non-food inflation also inched down, to 9.37 percent from 9.42 percent in May.

"This is an early sign of economic stabilisation," said Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh (PRI), a local think tank.

"This downward movement underscores that the Bangladesh Bank's commitment to a tight monetary policy is beginning to yield results," he added.

The central bank has kept the policy rate unchanged at 10 percent since October last year. The current rate now sits above inflation, creating a positive real interest rate that helps ease pressure on prices and the exchange rate, Rahman said.

He also mentioned that greater stability in the balance of payments has supported a measured recovery in commodity imports, easing earlier supply chain bottlenecks caused by forex reserve pressure.

"The move towards a more liberalised import regime has played a key role in smoothing out price dynamics," said the economist.

According to him, these developments point to a broader shift in economic management from a control-driven approach to a more market-based strategy.

This change, he said, has not only helped cool inflation but has also contributed to stabilising foreign currency reserves, strengthening the country's overall macroeconomic resilience.

Chief Adviser's Press Secretary Shafiqul Alam wrote in a Facebook post yesterday, "Due to the well-considered policy strategies of the interim government, inflation is decreasing rapidly."

"Food inflation has declined significantly to 7.39 percent, the lowest in two years. Non-food inflation has also begun to decrease, and it is expected to fall further in the coming days," he added.

Despite the recent easing, the government missed its target for the fiscal year 2024-25, which had aimed for average inflation of 6.9 percent.

BBS figures show that average inflation over the year, from July 2024 to June 2025, stood at 10.03 percent.

Month-on-month moving average inflation has remained at or above 10 percent for nine consecutive months, though it has been on a gradual decline since February.

In a recent interview with The Daily Star, Bangladesh Bank (BB) Governor Ahsan H Mansur said the central bank is unlikely to cut the policy or repo rate in the second half of the year, as inflation remains stubbornly high.

The BB raised the rate to 10 percent in October 2024, the 11th hike since May 2022, in a bid to tame inflation by making borrowing more expensive.

It left the rate unchanged in its monetary policy statement for the January–June period of this year.

"There is no such reason for reducing the interest rate," Mansur said.

"But there will be indications of whether it is possible for the rate to be brought down soon, when we can expect the policy rate to fall, or how many days we may have to wait for it to go down," said the governor.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments